While headlines scream about tech volatility and artificial intelligence (AI) disruption, the tape is telling a different story. In this clip from Friday’s Market on Close livestream, Senior Market Strategist John Rowland, CMT, points out something most investors are missing:

Weakness in tech leaders doesn’t mean the market isn’t collapsing. But it does mean that capital is rotating. And lately, it’s rotating hard.

The Software Exodus and the Physical Pivot

As of mid-February 2026, the narrative has been dominated by what some are calling a “software Armageddon.” AI tools like Anthropic’s Claude Cowork plugins have forced a repricing of subscription software models. That means investors are questioning:

- Seat-based SaaS valuations

- AI-driven margin compression

- Capital spending intensity in hyperscale tech

Capital doesn’t disappear during these shifts. It moves. And where it’s moving is telling.

The Numbers Don’t Lie

Year-to-date performance tells the story clearly:

- Energy (XLE): +22% YTD

- Materials (XLB): +17% YTD

- Consumer Staples (XLP): +15% YTD, new all-time highs above $88

- Nasdaq: roughly flat and occasionally negative (~1% YTD)

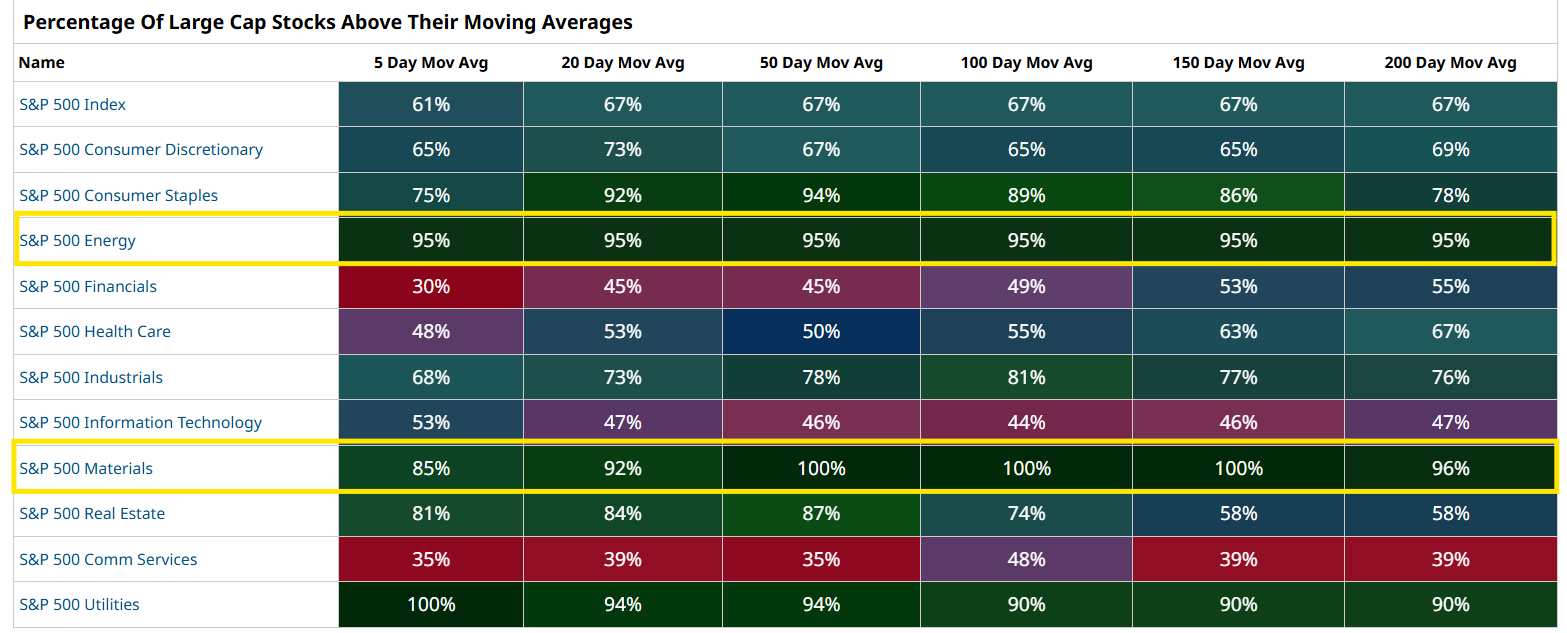

That divergence isn’t random. And John highlights something even more powerful than price performance. Currently, over 90% of Energy and Materials stocks are trading above their 20-, 50-, and 100-day moving averages.

That’s not normal participation. That’s breadth confirmation for the secular sector rotation.

What These 3 Sectors Have in Common

When John asks what Energy, Materials, and Staples share, the answer is simple: They’re physical.

- AI can’t manufacture oil.

- AI can’t mine copper.

- AI can’t brush your teeth.

And in a market questioning tech growth multiples, investors are gravitating toward:

- Tangible assets

- Cash-flow durability

- Dividend yields

- Pricing power

Consumer staples giants like PepsiCo (PEP) and Coca-Cola (KO) are yielding in the mid-3 to 4% range — attractive in a market where growth valuations are under pressure. Energy names like ExxonMobil (XOM) and Chevron (CVX) are generating massive free cash flow, with ConocoPhillips (COP) returning record capital to shareholders. And Materials leaders like Freeport-McMoRan (FCX) and Nucor (NUE) are benefiting from industrial reshoring and the copper-heavy demands of AI infrastructure.

This isn’t simply defensive positioning, it’s strategic capital reallocation.

The “Tale of the Tape”

John calls this reading the “tale of the tape.”

- When Tech is red but Energy is green…

- When headlines scream panic but Staples are making all-time highs…

- When 100% participation exists inside a sector…

That’s not a crash, it’s a rotation. And historically, at late-stage bull market phases, we often see:

- Basic Materials strengthening

- Energy outperforming

- Consumer Staples catching bids

These sectors tend to become active when leadership narrows and investors seek stability, yield, and tangible exposure.

Actionable Takeaway

This is what investors can do right now:

- Track sector participation using moving average screeners.

- Compare relative performance of XLE, XLB, and XLP versus QQQ.

- Monitor whether sector breadth remains above key moving averages.

This isn’t about abandoning tech altogether, but it is about understanding where alpha is flowing today. And right now, the flow is moving toward the physical economy.

Watch this quick clip to see John’s sector analysis:

- Learn how to screen for stocks using Moving Average filters

- Turn on notifications to catch the next Market on Close livestream

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)