/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)

Jefferies describes it as “SaaSapocalypse” as fears around software companies losing their relevance gain more traction by the day. The idea is that leading AI companies such as ChatGPT-parent OpenAI and Anthropic's Claude will replace the work done by software companies eventually.

The jury may still be out on the perceived demise of the software industry, and the reality is actually much more nuanced than this. However, sentiments have turned against the sector, and investors are heading just one way: exit. Panic-induced selling in the software stocks has resulted in the shares of the world's largest ETF by AUM—the North American Tech-Software iShares ETF (IGV)—covering the sector declining by 24.6% on a YTD basis.

Yet, the words of a familiar friend may act as a savior for the industry.

Ives to the Rescue

Popular global head of technology research at Wedbush Securities, Dan Ives, along with his band of analysts, believes the current selloff is overdone and the fears around the sector, overblown. Making a case for the software sector, the firm's analysts remarked:

"We believe the market is baking in a doomsday scenario for software companies in the near-term, which we believe is extremely overblown, as many customers won’t be willing to put their data at risk to capitalize on AI implementation strategies until there is less risk with these migration projects. Is AI a headwind in the near-term for software? YES!...however, the magnitude of this software sell-off is a major head scratcher and is factoring in an Armageddon scenario for the sector that is far from reality in our view."

Ives's bullishness about the software sector has been longstanding. Yet, it is not for all the names. Which ones, then? Here are the five names that Ives and his team believe have it in them to navigate the present challenges and emerge as winners.

Software Stock #1: Palantir (PLTR)

Starting with an Ives favorite in Palantir (PLTR). Dubbed as the “Messi of AI” by Ives, Palantir is a software company specializing in data integration, analytics, and AI-driven decision platforms for governments and enterprises worldwide. Palantir builds mission-critical software platforms that unify disparate data sources and apply analytics/AI to produce insights and operational decisions.

Valued at a market cap of $332.6 billion, the PLTR stock is up 20% over the past year.

Notably, Palantir reported another quarter of beating Street estimates on both the revenue and earnings fronts. For Q4 2025, the company reported total revenues of $1.4 billion, which marked an annual growth rate of 70.5%. EPS went up by an even sharper 78.6% in the same period to $0.25, while also surpassing the consensus estimate of $0.23. This was the ninth consecutive quarter of earnings beat from the company.

Net cash from operations increased by 69% from the previous year to $777.3 million, as the company ended the year with a cash balance of $1.4 billion. This was much ahead of its short-term debt levels of $45.9 million.

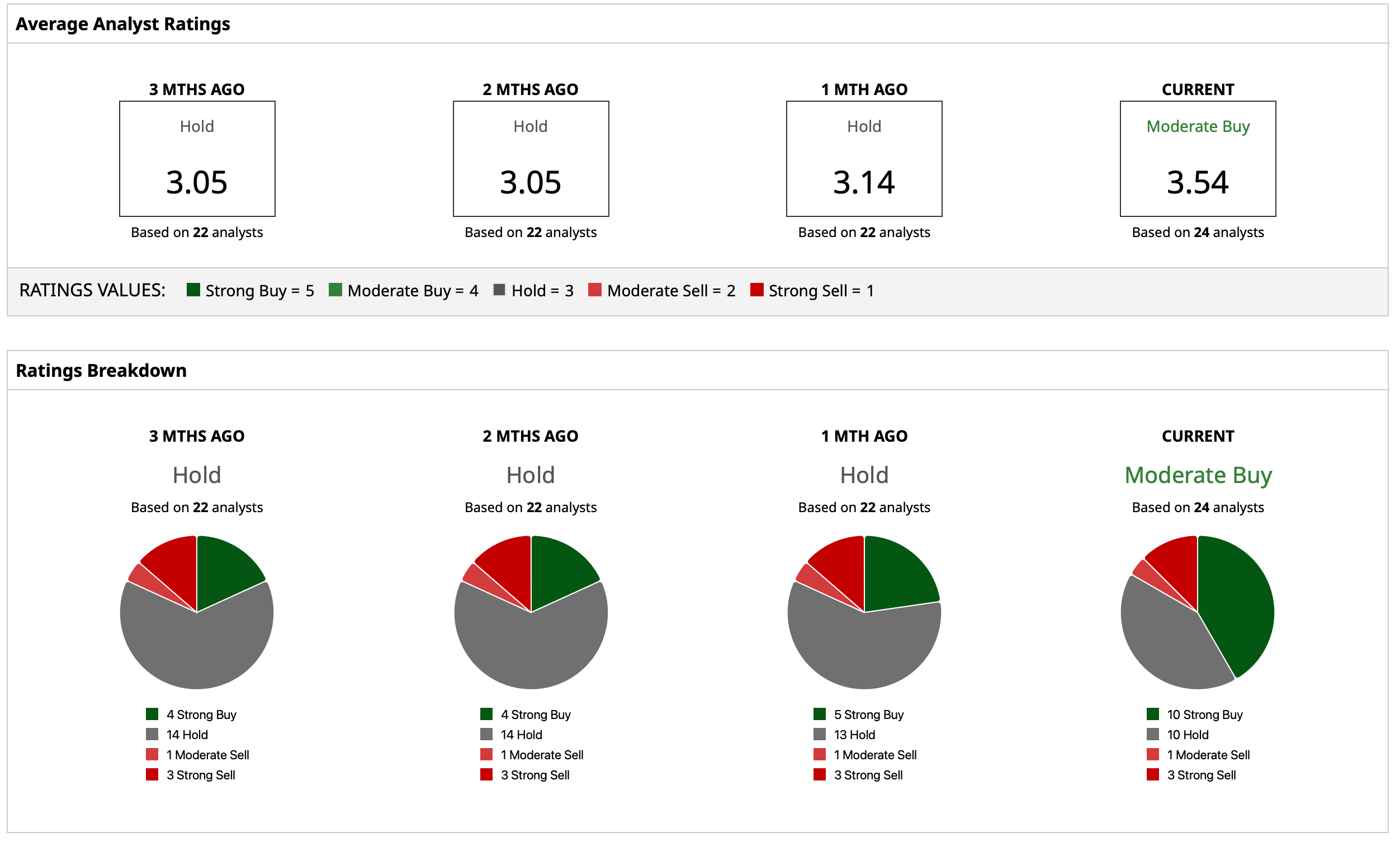

Overall, analysts have deemed PLTR stock a “Moderate Buy” with a mean target price of $198.28, which denotes an upside potential of about 52.5% from current levels. Out of 24 analysts covering the stock, 10 have a “Strong Buy” rating, 10 have a “Hold” rating, one has a “Moderate Sell” rating, and three have a “Strong Sell” rating.

Software Stock #2: Microsoft (MSFT)

If Palantir is the relatively new kid on the block in the software trade, Microsoft (MSFT) was the one who started it. Founded in 1975 by Bill Gates and his friends, Microsoft is one of the largest and most diversified technology companies globally, with instantly recognizable names such as Microsoft 365, Azure, and Xbox in its stable. Microsoft also invests heavily in AI (Copilot services, Azure AI), cybersecurity tools, and developer platforms.

Valued at a staggering $3.1 trillion, Microsoft is one of the most valuable companies in the world. However, its stock is down 5% over the past year, while offering a modest dividend yield of 0.89%.

One of the early investors in OpenAI, Microsoft has seen its revenue and earnings grow at CAGRs of 13.24% and 26.12% over the past 10 years, respectively. Notably, the results for the most recent quarter were impressive as well, with revenue and earnings both surpassing estimates.

For the quarter ended Dec. 31, 2025, Microsoft's revenues stood at $81.3 billion, up 16.7% from the prior year. The critical cloud business continued to grow at a healthy pace, rising by 26% on a year-over-year (YoY) basis to report revenues of $51.5 billion in the quarter. Meanwhile, earnings went up by 28.2% in the same period to $4.14 per share, easily outpacing the consensus estimate of an EPS of $3.91. This was the ninth straight quarter of earnings beat from the company.

Net cash from operations jumped by 60.5% from the previous year to $35.8 billion, with the company closing the quarter with a cash balance of $24.3 billion, higher compared to its short-term debt levels of $4.8 billion.

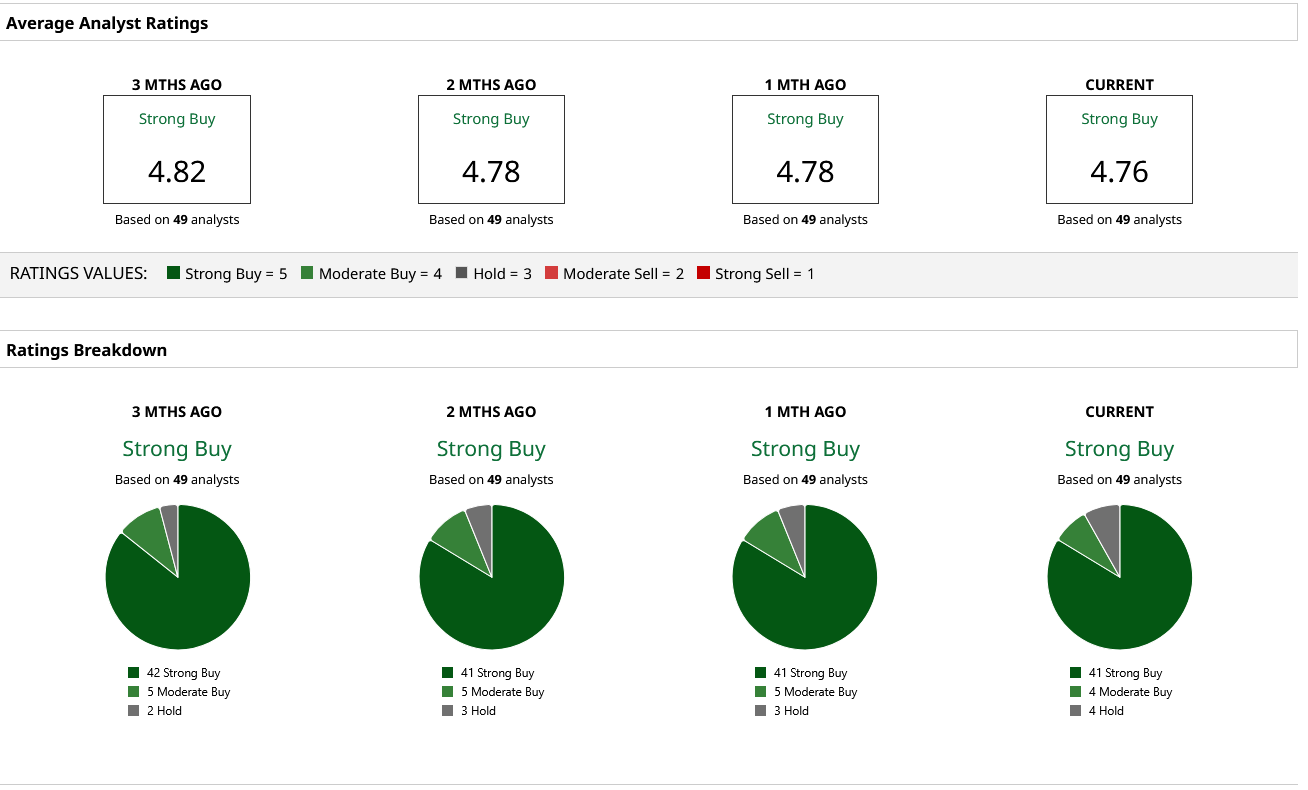

Thus, analysts have attributed a rating of “Strong Buy” for MSFT stock, with a mean target price of $602.57, which indicates an upside potential of roughly 53% from current levels. Out of 49 analysts covering the stock, 41 have a “Strong Buy” rating, four have a “Moderate Buy” rating, and four have a “Hold” rating.

Software Stock #3: CrowdStrike (CRWD)

Another arena where Ives is particularly bullish is cybersecurity, and one of his favorite names in the domain is CrowdStrike (CRWD). Founded in 2011 and based out of Austin, Texas, CrowdStrike is a leading cybersecurity technology company best known for its cloud-native security platform that protects endpoints, cloud workloads, identities, and data using AI-driven threat detection and response.

Its shares are down 10% over the past year, and its current market cap stands at $104.7 billion.

CrowdStrike's latest results for the third quarter saw the company reporting a beat on both revenue and earnings. Revenues for the quarter came in at $1.23 billion, up 22% from the previous year. However, earnings grew by a modest 3.2% in the same period to $0.96 per share, coming in just ahead of the consensus estimate of $0.94 per share. Notably, this was the ninth time in the past nine quarters that the company's EPS has beaten Street expectations.

For the nine months ended Oct. 31, 2025, CrowdStrike's net cash from operations was $1.1 billion, reflecting an annual growth rate of 6.7%. Overall, the company closed the quarter with a cash balance of $4.8 billion, with short-term debt of just $15.9 million on its books.

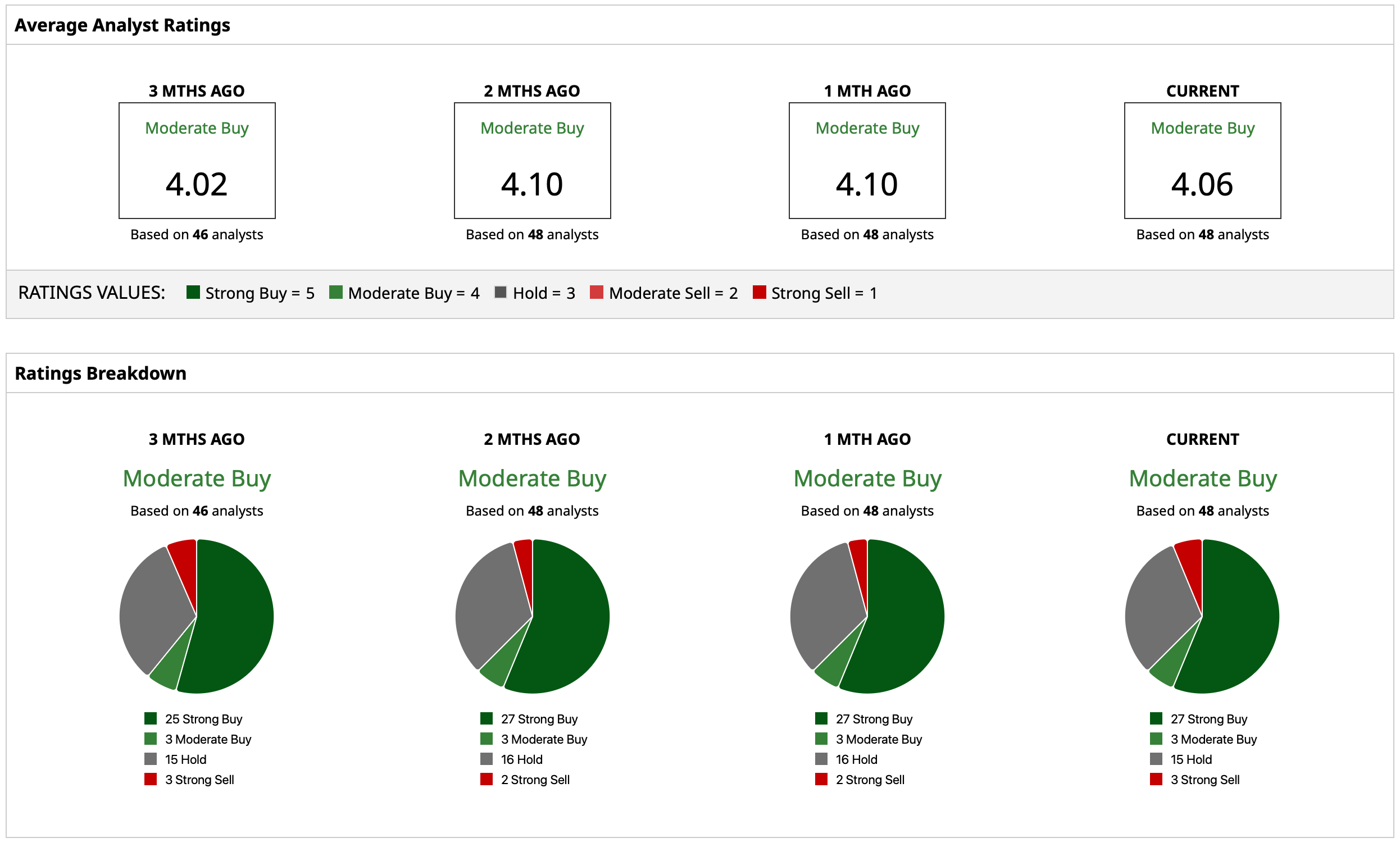

Overall, analysts have deemed CRWD stock a “Moderate Buy,” with a mean target price of $559.21. This denotes an upside potential of about 48% from current levels. Out of 48 analysts covering the stock, 27 have a “Strong Buy,” three have a “Moderate Buy” rating, 15 have a “Hold” rating, and three have a “Strong Sell” rating.

Software Stock #4: Snowflake (SNOW)

We continue with Wedbush's list of favorite software stocks with Snowflake (SNOW). Founded in 2012, Snowflake operates a cloud-based data platform (often called the Snowflake Data Cloud), which supports data warehousing, data lakes, data engineering, analytics, and data sharing across multiple clouds, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

Valued at a market cap of $56.6 billion, the SNOW stock is down 13% over the past year.

And like its peers above, Snowflake's results for the most recent quarter exceeded Street expectations as well. Notably, in Q3 2025, the company's revenues stood at $1.21 billion, which denoted an annual growth of 28.5%. Within this, revenues from the core product segment saw a YoY growth rate of 29% to $1.16 billion. In the same period, the company registered earnings of $0.35 per share, up a whopping 75% from the previous year and also above the consensus estimate of an EPS of $0.31. Notably, this was the sixth consecutive quarter of earnings beat from the company.

Net cash flow from operating activities rose by 35.2% from the previous year to $137.5 million, with the company closing the quarter with a cash balance of $1.9 billion. This was way above its short-term debt levels of $40.2 million.

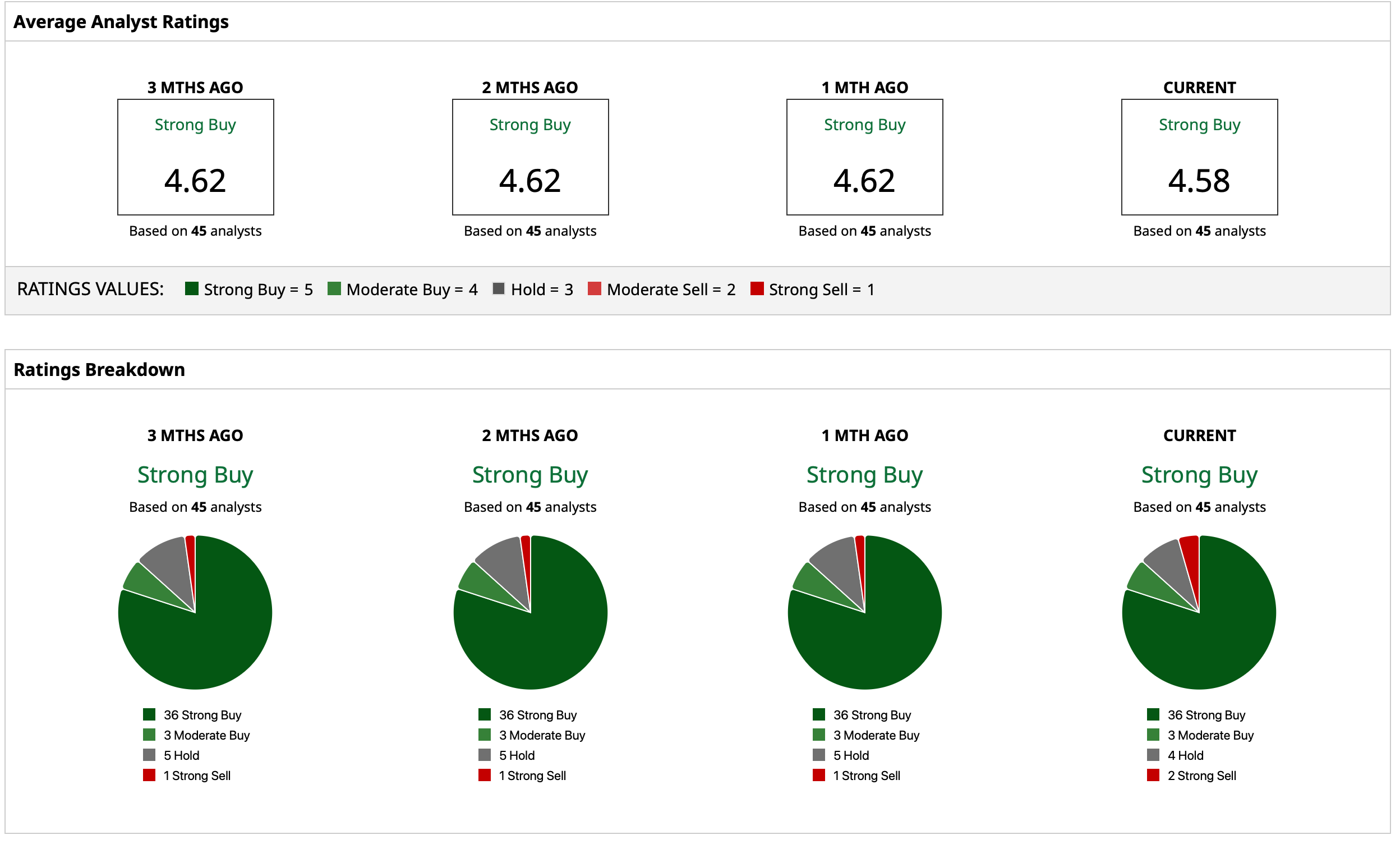

Considering this, analysts have earmarked an overall rating of “Strong Buy” for SNOW stock, with a mean target price of $277.07, which denotes an upside potential of about 77% from current levels. Out of 45 analysts covering the stock, 36 have a “Strong Buy” rating, three have a “Moderate Buy” rating, four have a “Hold” rating, and two have a “Strong Sell” rating.

Software Stock #5: Salesforce (CRM)

Now, concluding the list with the name that many attribute to as the one where this selloff in software stocks started: Salesforce (CRM). Founded in 1999, Salesforce pioneered enterprise cloud-based customer relationship management (CRM) software at a time when most applications were still on-premises, helping launch the SaaS revolution. Presently, it is a cloud software company that builds and sells tools to help organizations manage customer relationships, sales, marketing, service, analytics, and digital experiences.

With a market cap of 4186.9 billion, the CRM stock is down a considerable 43% over the past year. The stock also pays a modest dividend yield of 0.85%.

Salesforce's results for the most recent quarter were a mixed bag, with earnings surpassing but revenue missing estimates. For the third quarter of fiscal year 2026, Salesforce's revenue stood at $10.3 billion, up 9% on an annual basis. Whereas earnings grew by an even sharper 34.9% in the same period to $3.25 per share, outpacing the consensus estimate of $2.86 per share. This was the fourth consecutive quarter of earnings beat from the company.

Net cash from operating activities for the quarter ended Oct. 31, 2025, was $2.3 billion. This marked an annual growth of 17.2% as the company ended the quarter with a cash balance of about $9 billion, which was much above its short-term debt levels of $564 million.

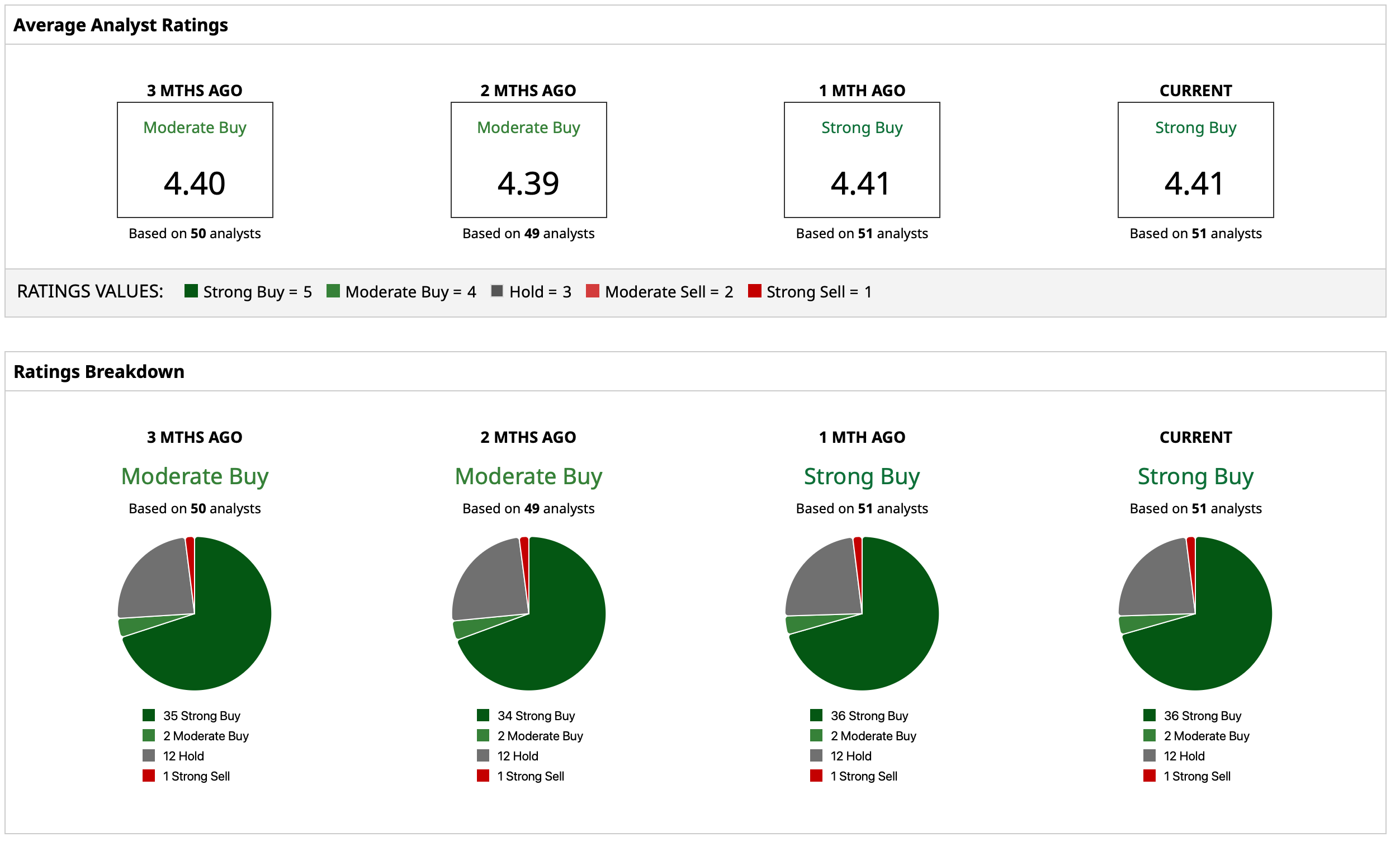

Taking all of this into account, analysts have assigned a consensus rating of “Strong Buy” for the stock, with a mean target price of $329.27. This denotes an upside potential of about 73% from current levels. Out of 51 analysts covering CRM stock, 36 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 12 have a “Hold” rating, and one has a “Strong Sell” rating.

Final Take

To conclude the piece, I would quote Ives when he said that even a “New York City cab driver was bearish on Google to start the year…” in 2025. We all know what happened with the Alphabet (GOOG) (GOOGL) stock in the year, as the stock went parabolic. Similarly, obituaries being written about the software companies are also far-fetched. These companies have proven operators at the helm with robust balance sheets and steady growth in revenue and earnings. Thus, the current downturn can be an opportunity for investors to load up on these names for the long haul.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)