/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

The broad-based S&P 500 Index ($SPX) is hovering near record highs, and the 30-share Dow Jones Industrial Average Index ($DOWI) closed above 50,000 for the first time earlier this week. However, tech stocks, particularly the Magnificent 7, that pretty much led the rally from the front since the March 2020 lows, tell a different tale.

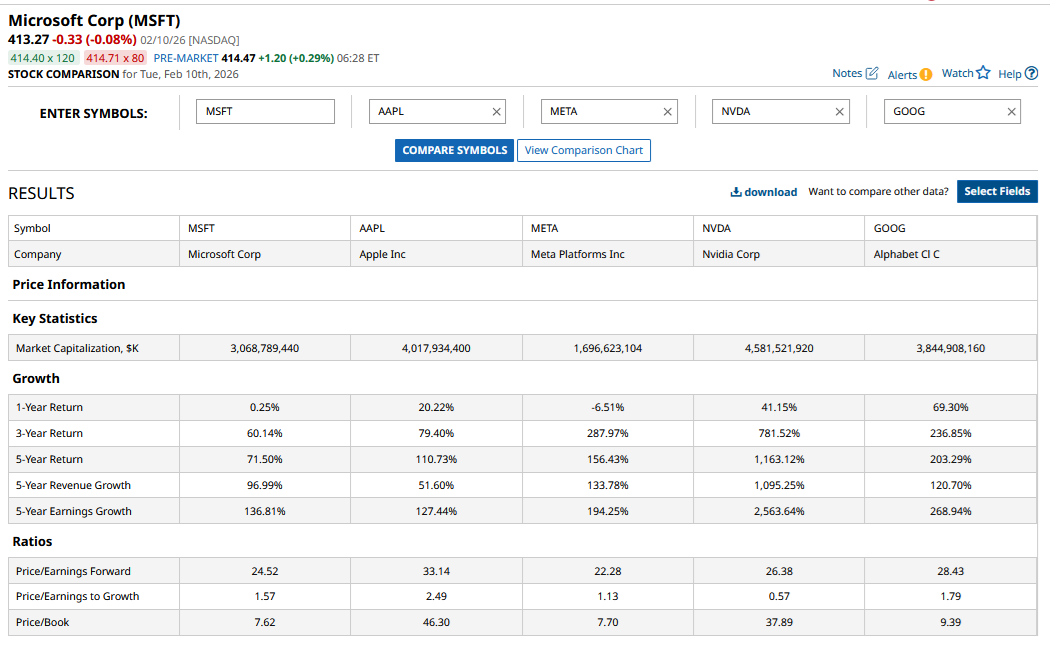

Apple (AAPL) has been somewhat of an outlier, down only about 5% from its all-time highs—but it also never really participated in the artificial intelligence (AI) rally, so it's not surprising to see it sit pretty amid the selloff. Alphabet (GOOG) (GOOGL), which was the best-performing of the lot last year, has fared the second-best and is down 9% from its record highs. All the other Magnificent 7 constituents are down double digits from their peaks, with Microsoft (MSFT) leading the pack with a 25% drawdown. Let's explore what's pulling down tech stocks and whether they can rebound from the lows.

Tech Stocks Have Fallen Amid AI Spending Spree

Hyperscalers’ capex is expected to hit $700 billion this year, and markets are now getting increasingly worried about tech companies’ burgeoning capex, which is draining cash flows and putting pressure on their once-impeccable balance sheets.

Tech giants, which not long back were splurging money on buybacks, are now raising debt capital to fund their capex, with Alphabet being the latest to raise over $30 billion. As part of the global bond sale, the Google parent issued a 100-year bond, marking the first time since the dot-com days that a tech company sold a bond of that duration.

Meanwhile, while tech stocks have rebounded from their lows, UBS is not sold on their outlook and downgraded the sector to “Neutral” from “Attractive,” listing three reasons to support its rationale. These are

- An expected slowdown in hyperscaler capex.

- AI-led disruption in the software industry.

- Stretched valuations of tech hardware plays.

UBS, however, did not use the “AI bubble” or the feared “B” word and instead seems optimistic about the AI opportunity, expecting it to lead to efficiencies for companies, particularly in healthcare and financial sectors. Its note talks about “diversifying toward other preferred areas of the market, including banks, health care, utilities, communication services, and consumer discretionary.”

Should You Sell Tech Stocks?

I believe it is a bit late to sell tech stocks, as much of the damage has always been done. From a valuation perspective, there are two ways to look at tech stocks. The forward price-to-earnings multiples don’t look that bad and, in some cases, particularly for Amazon (AMZN) and Microsoft, look quite attractive.

The P/E-to-growth (PEG) multiples look a bit concerning for most, given the near-term earnings compression from higher depreciation expenses. For the next few years, tech companies’ earnings might not grow at the pace we saw in the previous two years as their depreciation expenses swell further amid soaring capex.

The real concern, however, boils down to cash flows, with Amazon being a case in point. The e-commerce giant used to be a free cash flow powerhouse, even as its GAAP earnings were low. Tables have turned now, and while the company is now posting healthy operating income, its free cash flows are expected to turn negative this year.

I maintain that AI is a generational opportunity like the internet, and the technology is set to disrupt several industries. However, there are growing signs of euphoria that are bordering on bubble in some pockets.

The message from the market is loud and clear, and investors are unforgiving of companies pouring money into building AI infrastructure without showing tangible current returns or a clear path to future profitability, which would help them generate adequate return on their investments.

Sooner rather than later, managements would have to listen to the market just as they did between 2022 and 2023 and tighten their belts. Somewhere down the line, tech companies might need to be more capital-efficient in their AI initiatives while also showing tangible breakthroughs, as incremental gains won’t cut ice with markets, given the massive spending.

Incidentally, Zuckerberg termed 2023 as the “year of efficiency,” and the company went on a relentless cost-cutting spree that received a thumbs-up from the markets. We could hear such namesakes for AI investments, as capital efficiency might become the buzzword for tech companies. I won't be surprised if tech companies slash their capex sometime later this year or at least talk about it tapering down in 2027, which would be in stark contrast to 2025 when most gradually increased their budgets.

All said, I continue to maintain a bullish bias towards tech stocks for now and would use any further weakness to add more shares on the belief that eventually sanity would prevail in the AI arms race or we would see breakthroughs in the coming months.

On the date of publication, Mohit Oberoi had a position in: AAPL , AMZN , META , MSFT , GOOG . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)