MicroStrategy’s (MSTR) founder and executive chairman, Michael Saylor, says the software-firm-turned-crypto-proxy will buy Bitcoin (BTCUSD) “every quarter forever.” His latest remarks on CNBC came shortly after MSTR loaded up on another 1,142 BTC for about $90 million, pushing its overall hoard to more than 714,000.

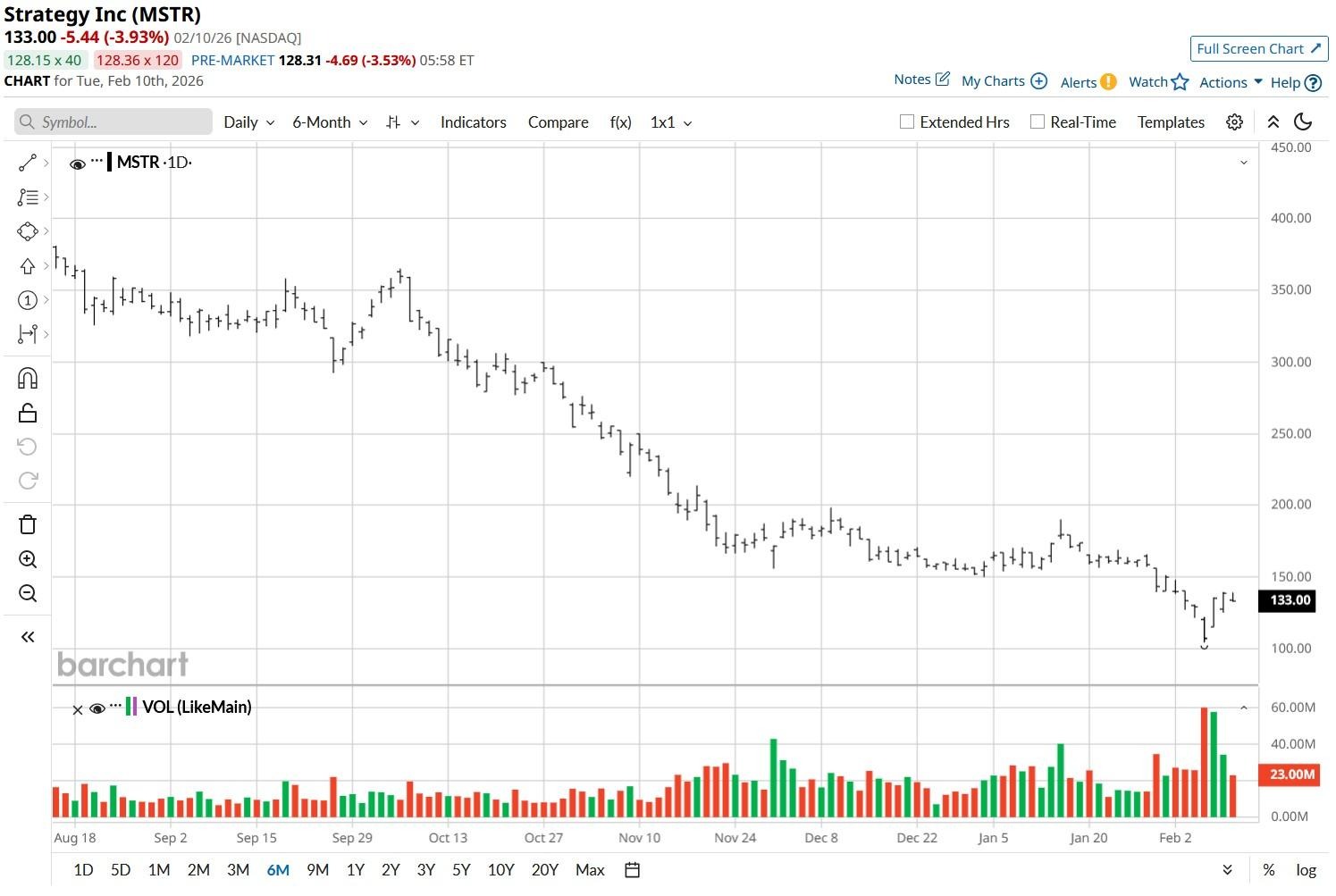

At the time of writing, MicroStrategy stock is down more than 25% versus its year-to-date high.

Why MSTR Stock Slipped on Saylor’s Remarks?

MSTR stock inched further down following Saylor’s remarks on Feb. 10, due to dilution concerns.

Investors fear MicroStrategy is no longer an enterprise software company, but a leveraged Bitcoin proxy that must continuously issue new equity and debt to fund its crypto investments.

With BTC trading at about $67,000 at the time of writing — notably below the price at which MSTR bought it recently — the firm’s total holdings are currently underwater by an estimated $4.5 billion.

Critics argue that buying at any price erodes shareholder value and increases the risk of a liquidity crunch if MicroStrategy can’t cover the rising interest and dividend obligations on its massive debt pile.

Are MicroStrategy Shares Still Worth Buying?

While MicroStrategy shares have been a big disappointment for investors in recent months, there’s still reason to stick with it in 2026.

By continuing to invest in Bitcoin, Saylor has built a digital fortress that allows investors to gain high-beta exposure to the world’s largest cryptocurrency without the complexities of direct owner-ship.

Financed mostly through long-dated convertible debt with no major maturities until 2028, MSTR’s capital structure is designed to weather even a 90% drawdown.

Plus, the recent launch of Stretch, a digital credit instrument, enables the firm to generate yield on its stack, effectively turning dead BTC into a productive asset.

All in all, with a $2.25 billion cash reserve covering 30 months of obligations, bulls argue Strategy is perfectly positioned to outperform when the next Bitcoin rally restores its premium to net asset value (NAV).

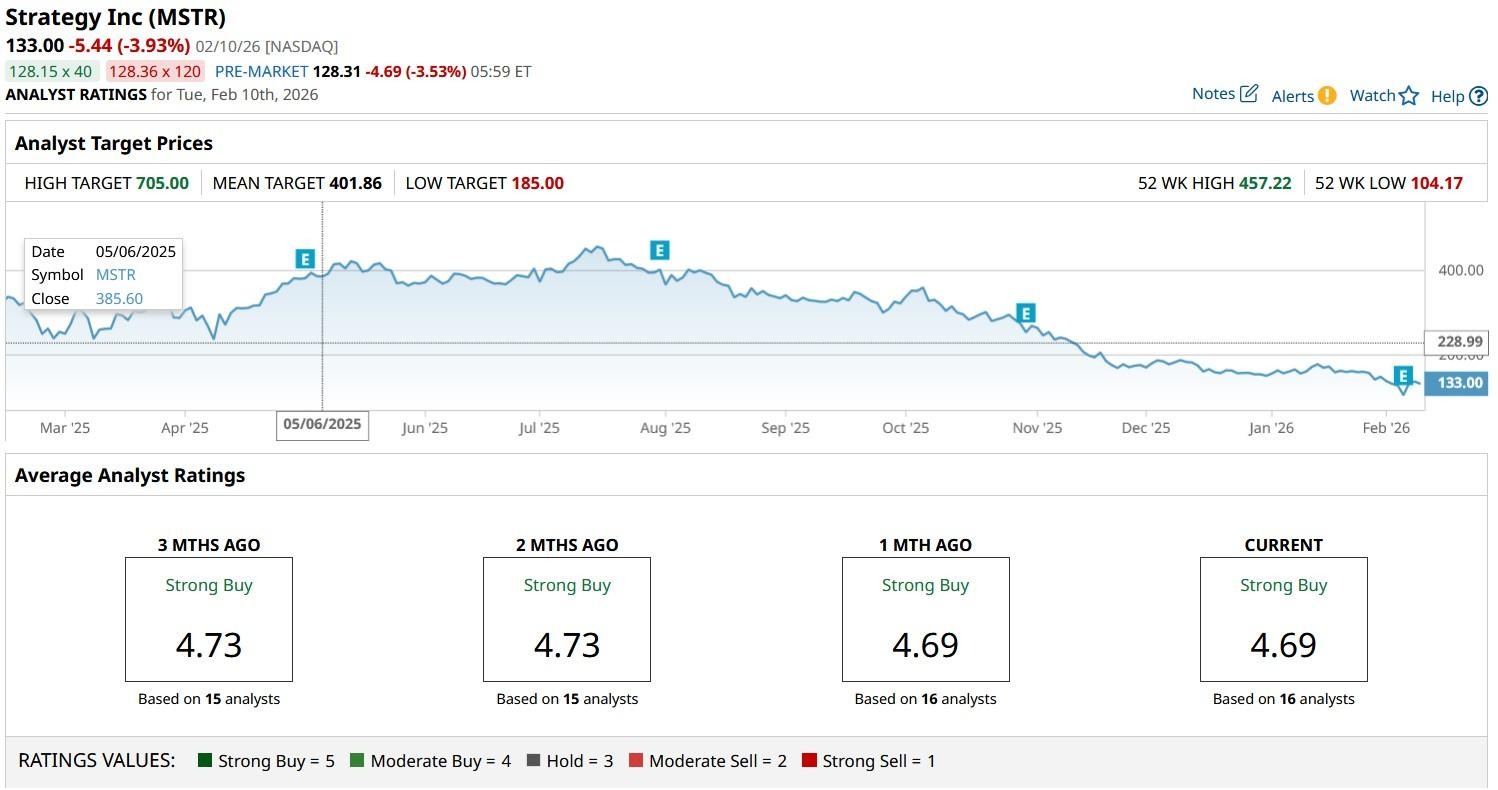

Wall Street Sees Massive Upside in MicroStrategy

Wall Street analysts also remain bullish as ever on MicroStrategy for the remainder of 2026.

The consensus rating on MSTR shares remains at a “Strong Buy,” with the mean target of about $402 indicating potential upside of more than 200% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)