Mel Brooks' classic movie “High Anxiety” featured a bumbling assistant who had a habit of thinking he could lift things he couldn’t. Each time he’d pick up something heavy, and shout, “I got it… I got it… I don’t got it!” Then he’d drop it.

That’s what I think of watching the Dow Jones Industrial Average ($DOWI) and the SPDR Dow Industrials ETF (DIA) in its psychological wrestling match with the 50,000 mark. After a blistering run in 2025 that saw the index leap from 40,000 to the doorstep of 50,000 in record time, the momentum has suddenly stalled.

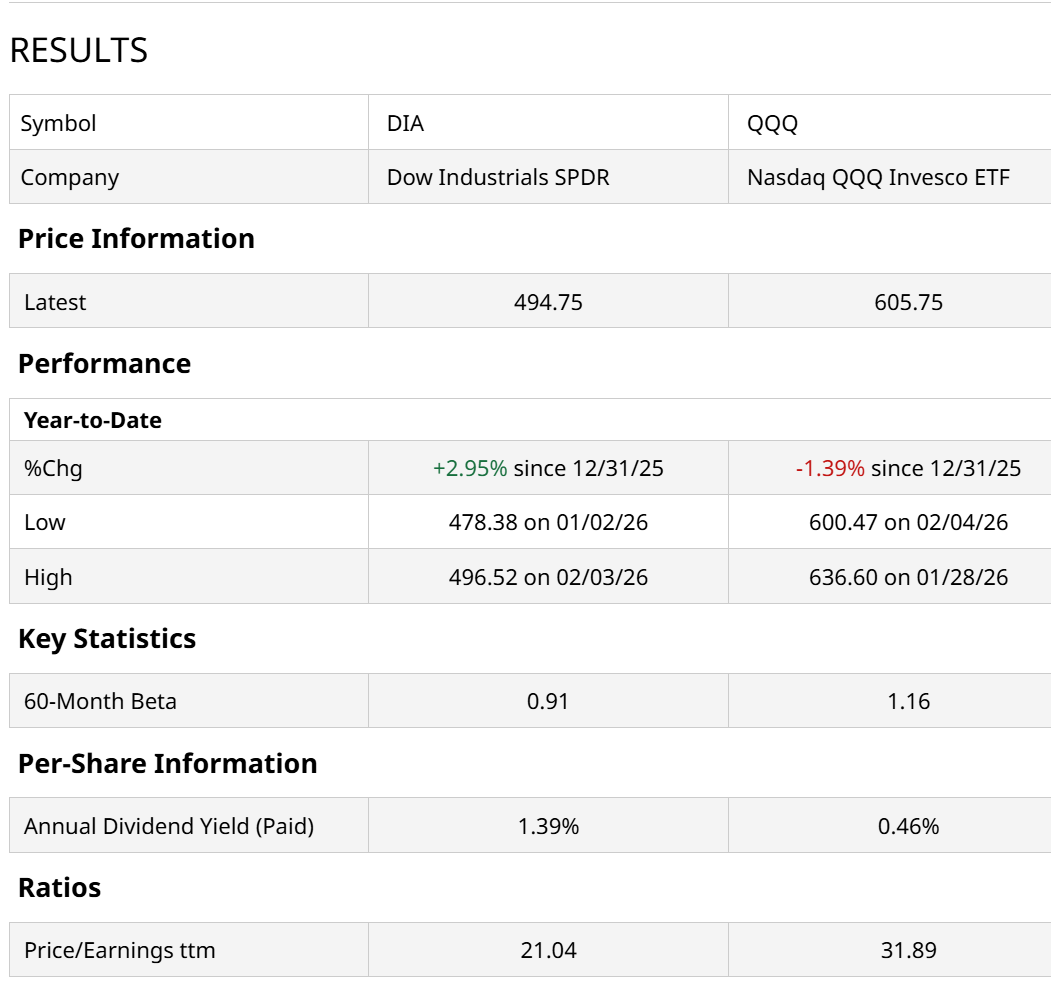

As a consolation prize, it has outperformed the Nasdaq 100 Index ($IUXX) so far this year, something that doesn’t happen often in the post-pandemic era. And DIA sells at about two-thirds of the price-to-earnings (P/E) multiple of the Nasdaq QQQ Invesco ETF (QQQ).

So, what’s the aversion to 50,000? This two-year chart shows the steep rise from way down around 30,000 less than a year ago.

However, a closer look at what’s occurred so far in 2026 indicates that there’s a hard ceiling at that round number. At least for now.

To a risk manager (like me), the Dow isn't "afraid" of a number, per se. But markets can be very psychologically driven. As legendary investor Benjamin Graham said, “In the short-term, the market is a voting machine, but in the long term, it is a weighing machine.”

There’s a lot of “no” votes appearing once the Dow approaches that 50,000 level, which is roughly $500 a share in DIA terms. Still, it is just a few hundred points away.

In trading, major round numbers like 50,000 act as psychological magnets. Investors are drawn to them, but as the price approaches, a stalemate often occurs. Buyers who have ridden the wave from 40,000 are looking for a reason to lock in profits, while short-sellers view 50,000 as a logical place to park their bets.

We are currently in the hype phase. Every time the Dow gets within 500 points of 50,000, headlines surge (this article included, just with a different spin). Retail FOMO (fear of missing out) kicks in, and the market gets giddy. What’s different this time around is that the Dow is rising when QQQ is falling. That in itself brings into question just how high DIA can rise, even if the Dow does break through the 50,000 level.

The Fundamentals: 3 Weights Holding the Dow Down

- Valuation nosebleed: The Dow’s valuation is not outrageous, but that of some of its components are. And this is a period in which high valuations are suddenly mattering to the market.

- Tariff cold front: Early 2026 has been defined by trade uncertainty. From Greenland to renewed friction with China, the Dow's industrial heavyweights are feeling the heat.

- Stagflation lite concerns: While the Fed cut rates three times in late 2025, inflation has remained sticky near 3%. This "stagflation lite" — modest growth with persistent prices — is a nightmare for the Dow's consumer and industrial sectors. If the Fed has to pause rate cuts because inflation won't hit their 2% target, the liquidity fuel for the Dow’s 50,000 run evaporates.

The Bottom Line

The Dow isn't "afraid" of 50,000; it is simply waiting for a reason to justify the price of admission. Between the Silicon Renaissance distraction in tech and the industrial drag of trade wars, the Dow is a coiled spring.

In particular, I’m watching what the Dow does relative to the Nasdaq. My most vivid memory of the dot-com bubble is that at the very end, QQQ faded, the Dow stayed up, but then succumbed to the pressure and fell as well. That cued three straight down years for stocks. This is something to keep in mind at a time when round numbers, impressive as they are, crowd out the bigger picture.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com, Substack site. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)