With a market cap of $19.6 billion, DuPont de Nemours, Inc. (DD) delivers advanced materials and solutions across markets including electronics, industrials, transportation, healthcare, and safety. Operating through its ElectronicsCo and IndustrialsCo segments, the company supports industries ranging from semiconductors and displays to automotive, water purification, and building materials, with a presence across the Americas, Europe, the Middle East, Africa, and Asia Pacific.

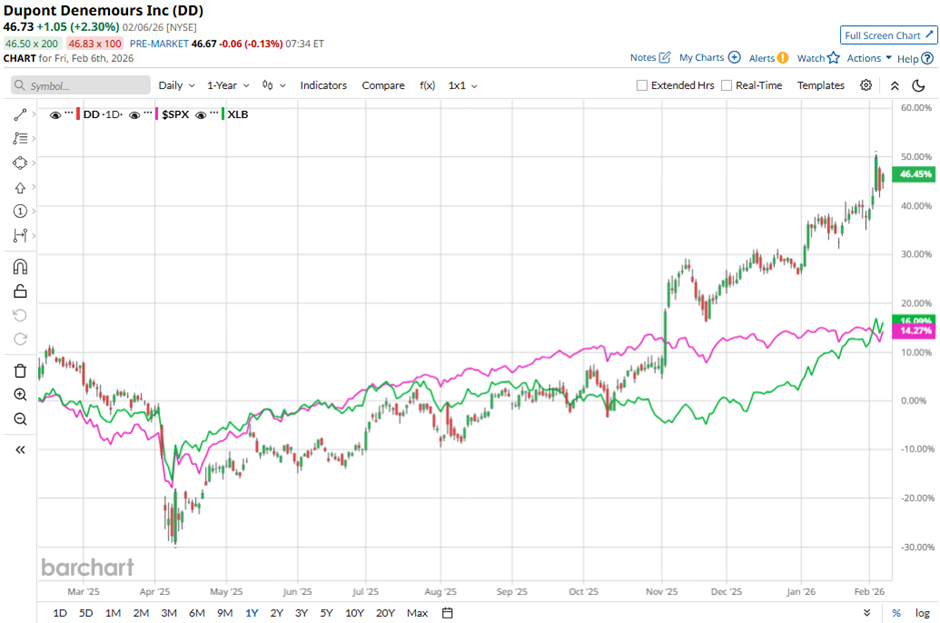

Shares of the Wilmington, Delaware-based company have outpaced the broader market over the past 52 weeks. DD stock has jumped 44.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained nearly 14%. Moreover, shares of the company have increased 16.2% on a YTD basis, compared to SPX's 1.3% return.

Looking closer, shares of the industrial materials maker have also exceeded the State Street Materials Select Sector SPDR ETF's (XLB) 15.3% rise over the past 52 weeks.

Shares of DuPont rose 1.2% on Nov. 6, 2025, after the company exceeded its Q3 2025 guidance, reporting net sales of $3.1 billion, operating EBITDA of $840 million, and adjusted EPS of $1.09. Investor sentiment was further boosted by DuPont raising its full-year 2025 operating EBITDA guidance to ~$1.6 billion and announcing strong cash generation, including $576 million in transaction-adjusted free cash flow for the quarter.

For the fiscal year that ended in December 2025, analysts expect DD's adjusted EPS to decline 59% year-over-year to $1.67. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

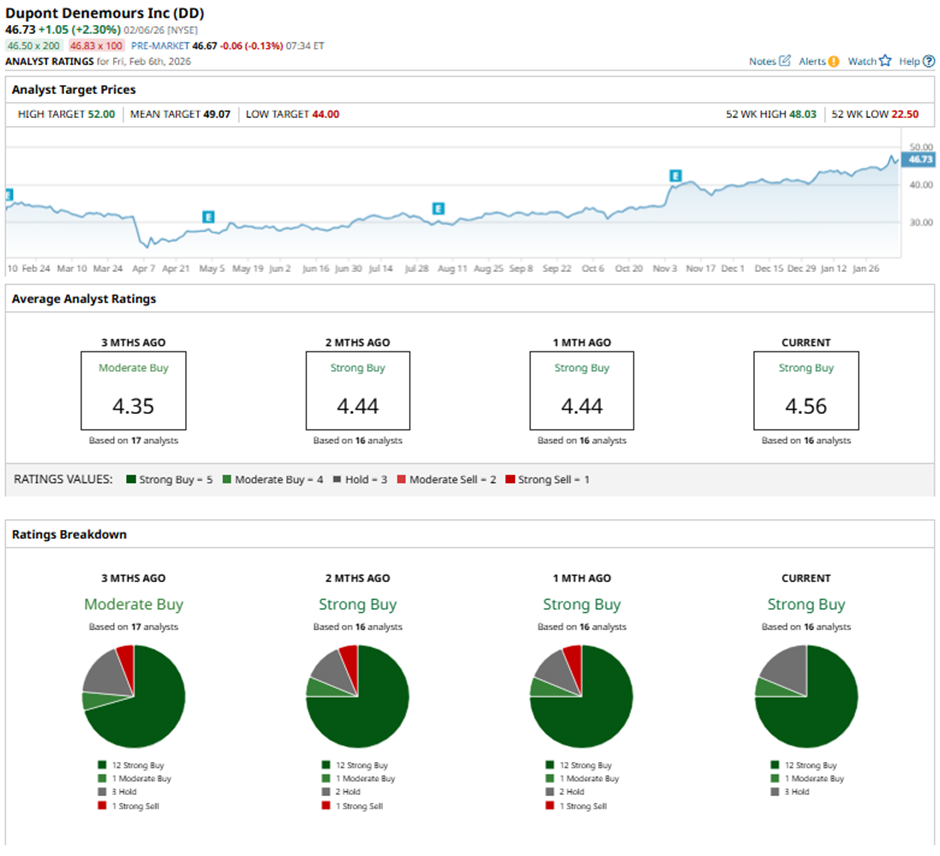

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and three “Holds.”

On Jan. 21, RBC Capital raised its price target on DuPont to $51 and maintained an “Outperform” rating.

The mean price target of $49.07 represents a premium of 5% to DD's current levels. The Street-high price target of $52 implies a potential upside of 11.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.