With the coming Labor Day holiday, many will see this as the end of the summer season. Many people share fond memories with their family and friends during the summer holidays, much like the memories created from past summers.

Have you ever considered some of the products you have used to create these memories?

An essential product that is used during summer travel is gasoline. Gasoline demand begins to build near the Memorial Day holiday in preparation for the upcoming driving season. Demand usually stays strong until after the Labor Day holiday, when children return to school, and families travel less for vacation for the next few months.

Another high-demand product during the grilling months is red meat. This demand causes stores such as Costco and other warehouse-style stores to keep a high inventory available for their customers. For many people, the frequency of dining out increases during the summer months, requiring restaurants to maintain a higher stock of red meats.

Summer clothing is another product that has a high demand. There always seems to be a need for shorts, shirts, bathing suits, etc., purchased at the beginning of summer so one can be more comfortable outdoors in the heat.

With the arrival of the fall season, there is a need for products to help us get through the cooler weather. Like every year, consumers typically purchase many of the same products.

Heating the homes on the chilly evenings creates demand for the natural gas and heating oil markets.

A demand that is often overlooked is coffee. When cooler weather comes to the northern hemisphere, consumers will drink more coffee than during the warmer summer months.

Cooler weather will also change the demand for the type of clothing one will be wearing. Consumers will be looking for heavier clothing material to help keep them warm in the fall and winter.

I have listed a small portion of the products used by consumers for two seasons out of the year. I intended to demonstrate how consumer buying habits create seasonal demand patterns for many products.

The products I listed are crude oil, natural gas, heating oil, gasoline, cotton, coffee, and live cattle. There is an entity called commercial producers and processors to provide these much-needed products to the consumers.

A commercial entity uses the physical commodity or product in its daily line of work. For example:

- Farmers could have many acres of corn growing. (Producer)

- Companies like General Mills would need large amounts of wheat to make cereals, flour, pastries, etc. (Processor/Refiner)

- Miners could have several gold mines where they extract the metal from the earth. (Producer)

- Mortgage companies would produce large amounts of home loans. (Producer)

- Jewelers would need more gold around the significant holidays though out the year. (Processor/Refiner)

Producers extract, grow, drill, etc., their products. They now own this product and want prices to increase, intending to sell them later for a profit.

Processors/Refiners will need to buy these products at a low price so they can process, package, and ship these refined products; and still make a profit.

Commercial entities are professionals and are very well versed in the products they produce or process/refine. Commercials know when their products will be in high or low demand periods. This knowledge allows them to plan for higher demand by having more raw materials available. Likewise, the processor/refiner may use this knowledge if they need to buy more or less raw materials.

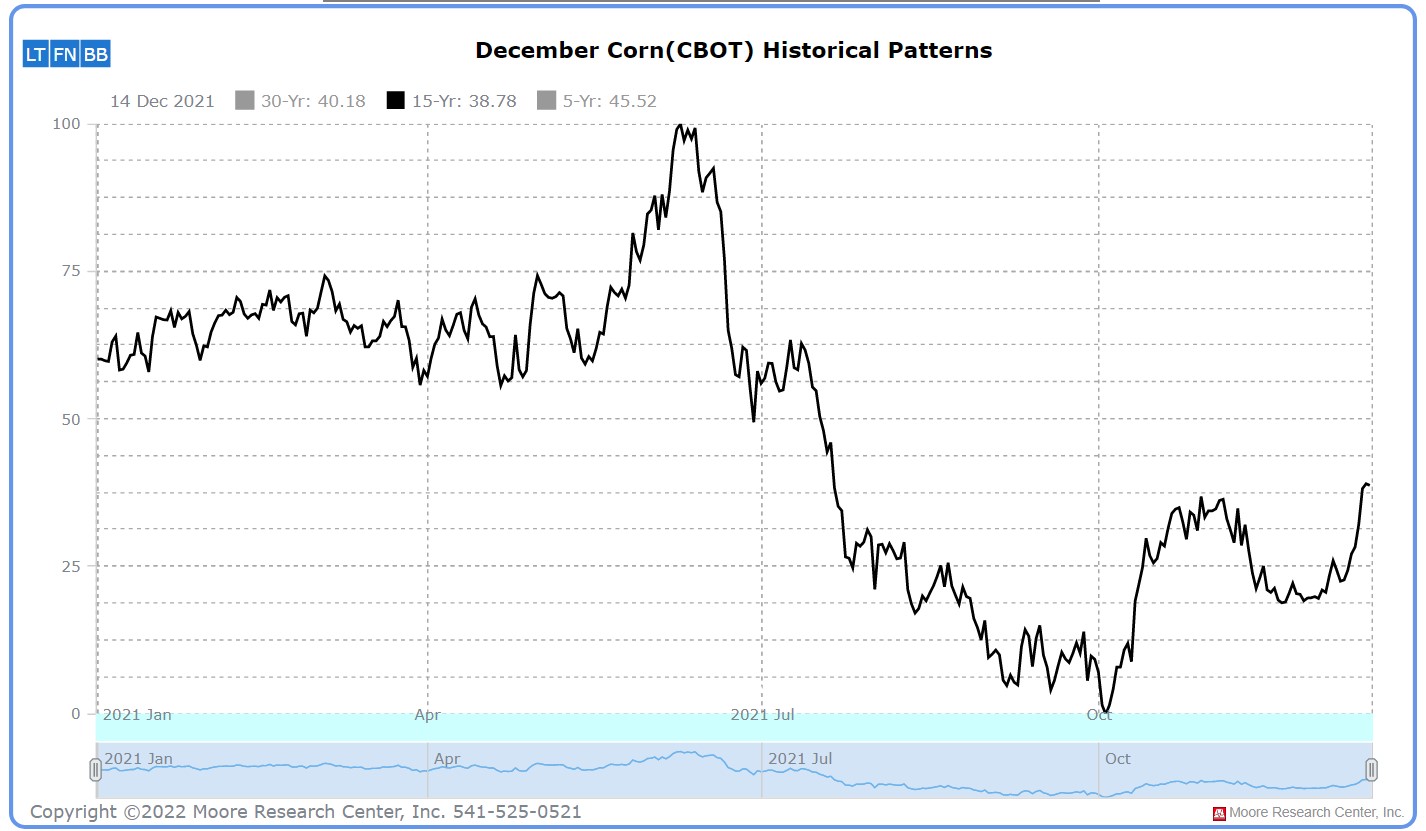

Because these seasonal patterns occur regularly, companies such as Moore Research Center, Inc. (MRCI) generate seasonal reports to anticipate future price moves after analyzing and researching past seasonal data. MRCI does not give trade recommendations but offers their clients extensive research results.

Based upon consumer buying habits and commercial entities needing to hold high-demand products at particular periods, seasonal charts can illustrate market tendencies for the price to rally or decline based on seasonal trends. Seasonal charts can also show when a product would tend to make its seasonal high or low of the year.

When looking at the 15-year seasonal pattern for corn, MRCI has found that the May/June timeframe is when corn prices tend to make the seasonal high of the year. On the other hand, September and October typically lower the seasonal price. Multiple seasonal trends may be up or down between the high and low.

As traders, there are multiple ways of using seasonal patterns. But, first, a warning: Never blindly take a seasonal trade because it has a specific entry and exit date. Traders should use seasonal setups in conjunction with other technical and fundamental analyses.

When appropriately used, seasonal patterns may give the trader an edge in the upcoming trade. Seasonal analysis can screen for markets that have historically been shown to make significant moves up or down. Seasonal analysis should be combined with other technical or fundamental studies to confirm the seasonal trend.

If your trading style is trend following, then knowing when a seasonal high is approaching would be helpful. You could move your trail stops closer to protect more of your profits in case the market does indeed turn down. The reverse also holds for a downtrend coming into a seasonal low.

When taking a trade based on a seasonal pattern, the trade has a better chance of working if the market trend is in the same direction as the seasonal pattern. As with all trading techniques, there is nothing that will work all the time.

If you are currently in a trade and a seasonal pattern supports your position, this might help give you more confidence to remain in the trade. It can help you avoid jumping out of a good trade too early.

Seasonality is just one of many tools available to a trader. When used correctly, seasonal patterns can make a trader aware of a market that is offering a potential opportunity. Remember, even a perfect seasonal pattern could fail in the time that you decide to trade it. Weather, war, geopolitics, supply disruptions, etc., can lead to a seasonal pattern failure at any time. Remember always to use sound risk management in your trades so that you may participate in as many seasonal pattern setups as possible.

More Softs News from Barchart

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)