The war in Ukraine creates an emerging disaster for the world’s food supply as the fertile soil in Europe’s breadbasket has become a mine and battlefield. Moreover, the war zone in the Black Sea Ports has cut off a crucial logistical hub that distributes wheat, corn, barley, and other agricultural products worldwide.

When war broke out in late February, grain and oilseed prices soared to the highest levels since 2012, with CBOT wheat futures moving to a new all-time high. On May 16, in the wake of the latest WASDE report, prices remain at the highest levels in years, with little hope of corrections. While the weather is typically the primary price driver each crop year, the war has trumped the weather conditions. Meanwhile, droughts or floods in other critical growing regions would only exacerbate food shortages caused by the turmoil in Europe’s breadbasket.

The USDA qualifies the May WASDE report

The typical supply and demand fundamentals have taken a backseat to the war raging in Ukraine. The US Department of Agriculture qualified the May WASDE by saying:

Source: USDA

The full text of the May agricultural report can be found via this link.

On Wednesday, May 11, nearby July CBOT soybean futures settled at $16.0675 per bushel, with corn at the $7.885 level. CBOT wheat futures settled at $11.13 the day before the latest WASDE report. On Monday, May 16, prices were higher.

Sal Gilberte’s take on the latest WASDE

I reached out to Sal Gilberte, the founder of the Teucrium family of grain and oilseed ETF products, including the CORN, SOYB, and WEAT ETFs. Sal told me:

The May WASDE is important because it gives the first official look at next year’s crop estimates. Attention to this year’s report is heightened due to the uncertainties injected into global grain markets by Russia’s invasion of Ukraine. That said, the USDA did the expected regarding Ukraine and issued estimates in line with what has generally been reported as official Ukraine estimates concerning their own farming sector. It looks like the USDA may have underestimated Russian wheat production and is still overestimating Brazilian soybean production for the current crop year. Most significant in this entire report in terms of specific estimates is the yield reduction for U.S. corn of nearly four bushels an acre below trend line; even with current weather issues it is probably too early to call for such a substantial reduction in yield especially given the large number of estimated planted corn acres – any revisions in yields from this point forward will have major impacts to market expectations and price volatility. The report is overall supportive to the grain sector because it again confirms tightening global grain balance sheets relative to five- and ten-year historical norms, but we are in a seasonal time period when grain market prices often plateau, which could limit upside potential from here barring substantial weather issues as the growing season progresses. Expect the elevated level of price volatility in grain markets to continue for the remainder of the year as weather and geopolitical events continue to unfold.

Sal believes the latest fundamental data support the current high price levels but points out that grain and oilseed prices tend to peak in the spring when uncertainty over the weather and crop is at its highest level. While Ukraine dominates the markets, the weather conditions in the US and other growing regions still have the potential to add lots of volatility to the grain and oilseed futures markets over the coming weeks and months.

Soybeans recover and remain close to record territory

The USDA increased its forecasts for the US and global ending stockpiles in the latest WASDE, but the price moved higher.

The chart highlights that soybean futures edged higher after the WASDE report, trading at the $16.55 level on May 16. Short-term technical resistance stands at $17.34 per bushel, the April 22 high.

Corn is still in striking distance of the 2012 peak

The USDA forecast lower US and global corn stockpiles in the latest report and the price edged higher.

The July futures chart shows technical resistance at $8.2450 per bushel, the April 29 high. Corn was trading around the $6.00 level on May 16, abovr the pre-WASDE level.

Ukraine is a leading corn exporter, threatening global supplies in 2022 and 2023.

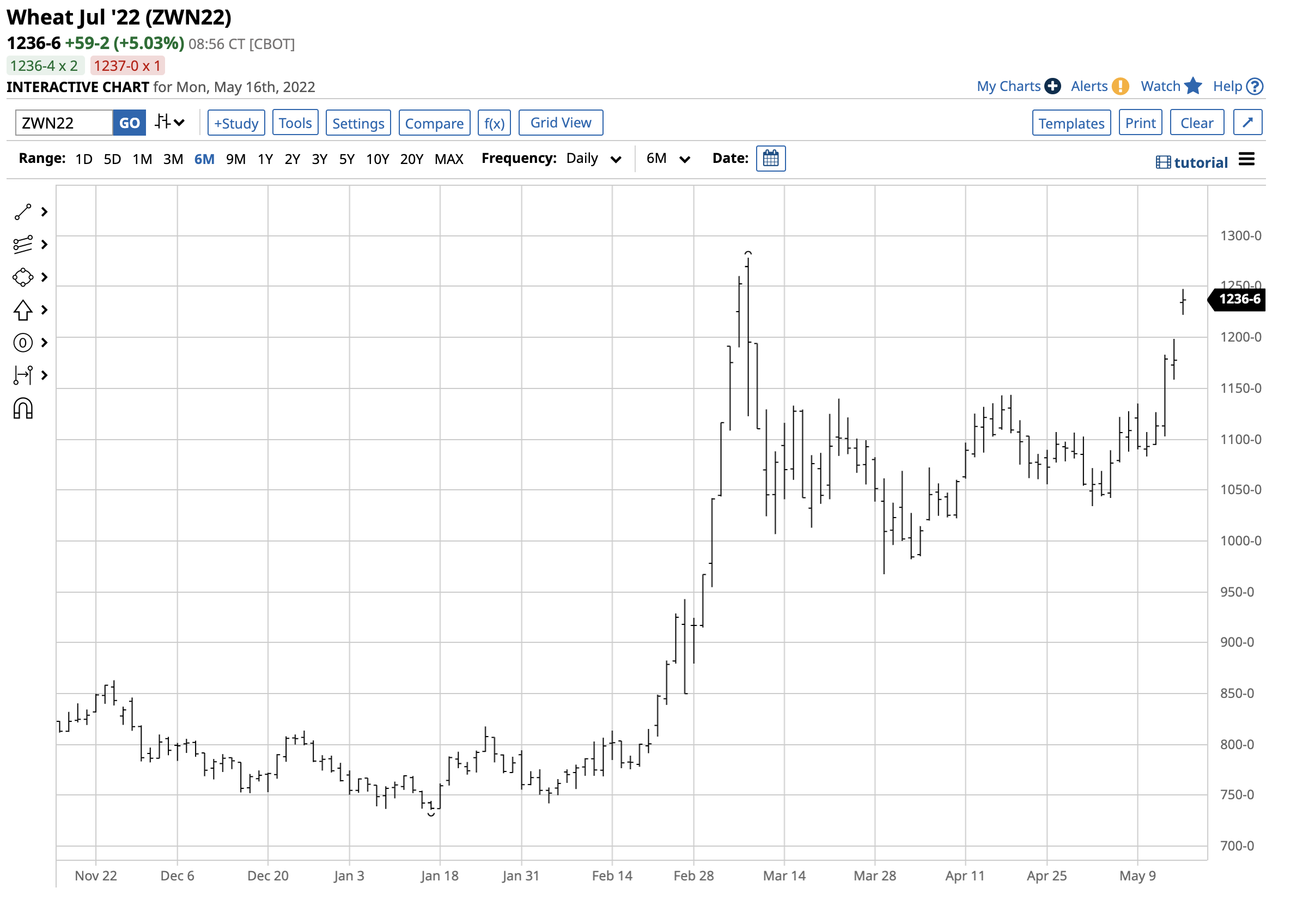

CBOT wheat already reached a record high in March- Higher highs could be on the horizon.

Russia and Ukraine export one-third of the world’s annual wheat supplies. The May WASDE told the wheat market that the US and global inventories have declined, with worldwide stocks at the lowest level in six years.

According to the US Census Bureau, the global population grows by around 20 million people each quarter. Over the past six years, the world has added approximately 480 million more mouths to feed, and wheat is a critical nutritional source.

The July CBOT wheat futures chart shows that the price moved higher after the May WASDE report and was sitting at just above the $12.35 per bushel level on May 16. Technical resistance is at the March 8, $12.7825 high. An Indian export ban pushed the grain’s price higher on May 16 adding bullish fuel to the wheat futures market.

The May WASDE report once again took a backseat to the turmoil in Ukraine. The crop shortages caused by the war and port blockades will impact the global food supply over the coming months and years and should continue to underpin prices.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)