Tyson Foods, Inc. (TSN), headquartered in Springdale, Arkansas, stands as a global leader in protein production. The company produces raw meat products, including fresh beef, pork, and chicken, as well as prepared foods such as nuggets, wings, sausages, and ready-to-eat meals, for consumers worldwide.

Through vertical integration, it manages the entire supply chain, from farming and livestock raising to processing and distribution, ensuring efficiency, quality control, and reliable delivery to global markets. The company has a market capitalization of $20.49 billion.

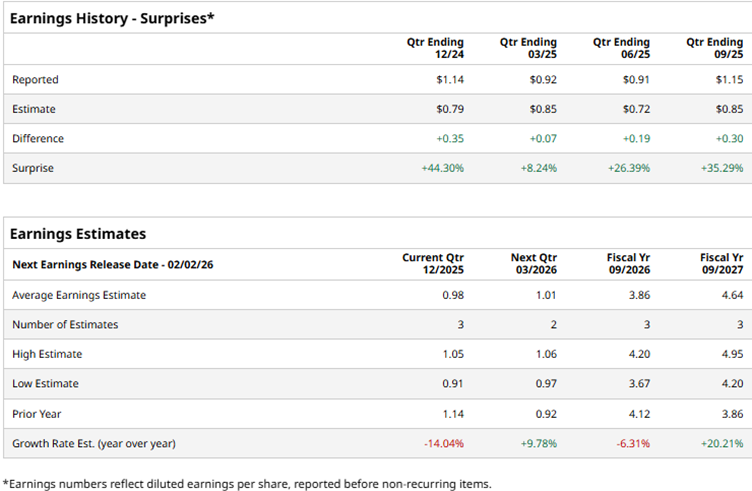

Tyson Foods is set to report its first-quarter results for fiscal 2026 (quarter ended in December 2025) soon. Ahead of the results, Wall Street analysts expect the company to report a profit of $0.98 per diluted share in Q1, down 14% year-over-year (YOY). However, the company has a solid record of earnings surprises, exceeding estimates in all four trailing quarters.

Analysts expect the company’s bottom line to decline in the current fiscal year. For the full fiscal year 2026, Wall Street analysts expect TSN’s diluted EPS to drop by 6.3% annually to $3.86, followed by a 20.2% YOY improvement to $4.64 in the next fiscal year.

Weakness in the beef segment has led Tyson Foods’ stock to underperform the broader market over the past year. Over the past 52 weeks, the stock has dropped marginally, while over the past six months it has risen modestly by 1%. On the other hand, the broader S&P 500 Index ($SPX) has increased by 16.9% and 10.1% over the same periods, respectively.

By contrast, the State Street Consumer Staples Select Sector SPDR ETF (XLP) has declined marginally over the past 52 weeks and by 5.5% over the past six months. Therefore, TSN has outperformed its sector over these periods.

Tyson Foods is downsizing its business, announcing it will close its beef plant in Lexington, Nebraska. The company stated that closing the plant is an effort to “right-size” its beef business, as this segment experiences low cattle production.

In its fourth-quarter release for fiscal 2025 (quarter ended Sept. 27), Tyson reported a 2.2% YOY growth in sales to reach $13.86 billion, with the beef segment also reporting sales growth. However, as a 2% YOY decline in domestic beef production is expected in fiscal 2026, the company expects an adjusted operating loss in the range of $600 million to $400 million from this segment in the current fiscal year.

Wall Street analysts have a measured view about Tyson Foods’ prospects. Among the 10 analysts covering the stock, the consensus rating is “Hold.” The rating configuration is less bearish than it was three months ago, as it no longer has the single “Strong Sell” rating. The stock now has two “Strong Buy” ratings and eight “Holds.”

The mean price target of $62.20 indicates a 7.2% upside from current levels, while the Street-high price target of $75 implies a 29.2% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)