While much of the artificial intelligence (AI) debate remained centered on Nvidia (NVDA) in 2025 – it still didn’t succeed in emerging as the top performing S&P 500 Index ($SPX) stock.

Instead, a handful of unexpected names, including SanDisk (SNDK), Western Digital (WDC), and Robinhood Markets (HOOD) outperformed the bigger names to lead the index this year.

WDC and HOOD shares are currently up more than 200% each (YTD), while SNDK is going for about 8x its price in late April.

How High Could SNDK Stock Fly in 2026?

According to Citi analysts, AI momentum will sustain demand for SanDisk’s enterprise solid state drives (eSSDs) – helping its stock push higher to $280 next year.

“The industry should remain in tight production supply, with eSSDs benefitting from super strong hyperscale demand on generative AI training/inferencing services,” they wrote.

Despite artificial intelligence tailwinds, SNDK stock is trading at about 20x forward earnings only, indicating it remains inexpensive compared to some of its tech peers.

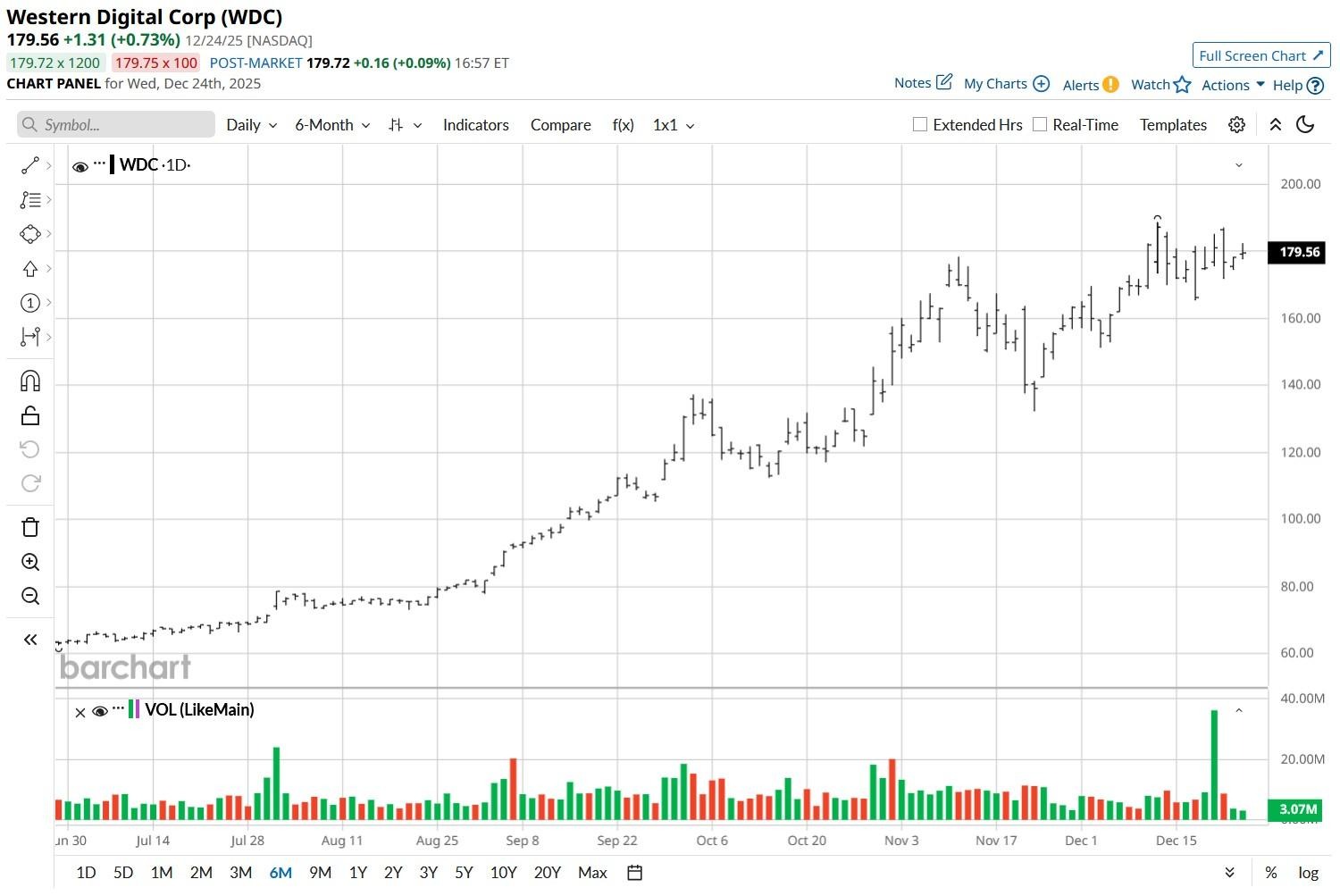

How High Could Western Digital Stock Fly in 2026?

WDC stock has recently replaced athleisure specialist Lululemon (LULU) in the Nasdaq-100 Index ($IUXX) drawing massive demand from passive funds like the Invesco QQQ ETF (QQQ).

Additionally, AI tailwinds pushed the company’s free cash flow to record levels this year – making management decide in favor of reinstating dividend and announcing a $2 billion share repurchase program.

Together, these developments will prove sufficient in driving Western Digital stock to $228 in the coming year – indicating potential upside of another 25% from here.

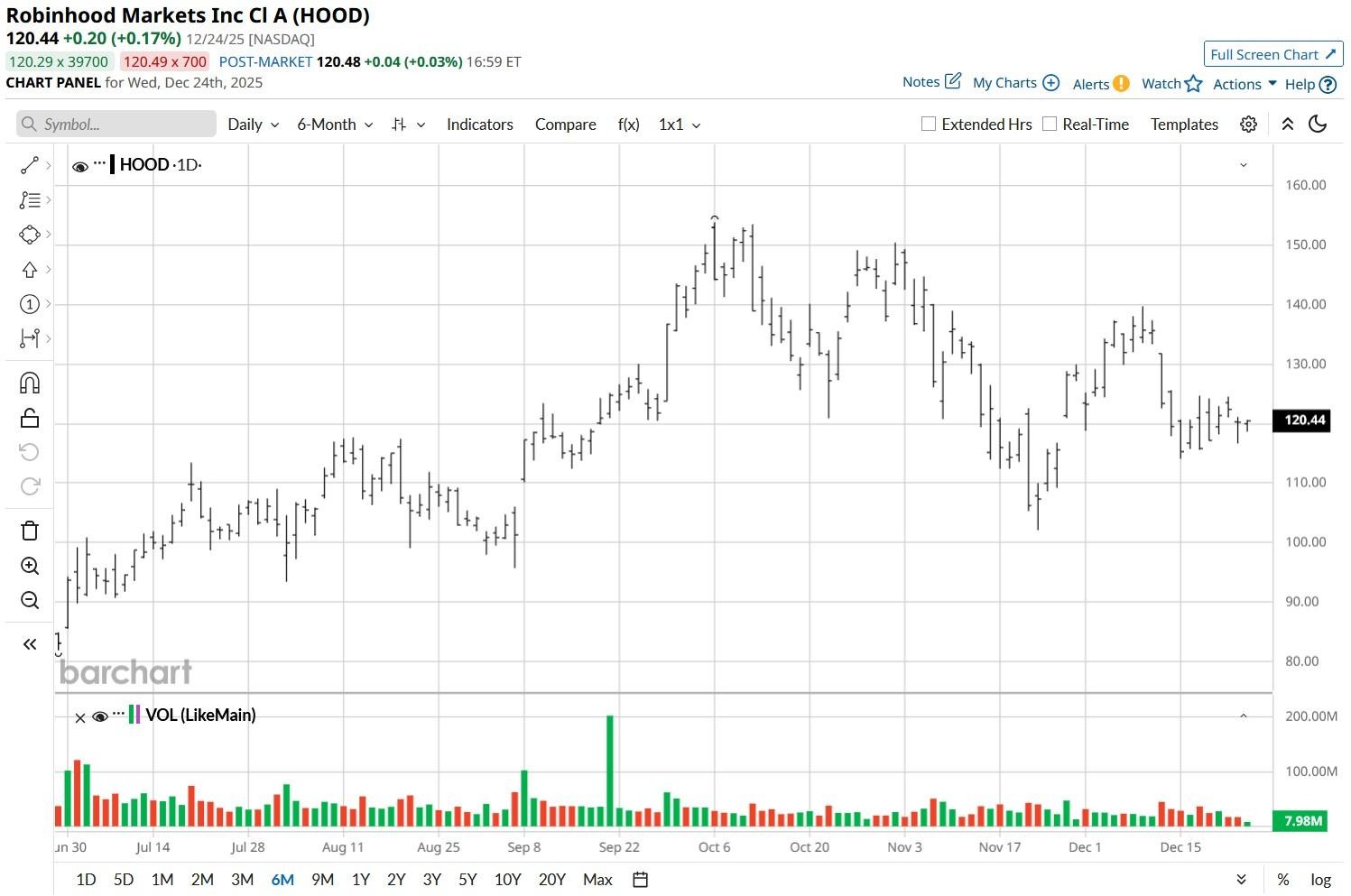

How High Could Robinhood Stock Fly in 2026?

Robinhood Markets’ recent push into prediction markets is broadly expected to unlock its next leg of growth.

In fact, it has already emerged as its “fastest-growing business ever,” according to Steve Quirk – the company’s chief brokerage officer.

Last week, Truist analysts maintained a “Buy” rating on HOOD stock, with a $155 price objective indicating potential upside of another 30% from current levels.

“Continued prospects for growth, combined with attractive scale economics, should enable margin expansion, despite leading pricing,” they told clients.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)