/Adobe%20Inc%20logo%20on%20phone%20with%20festive%20background-by%20rafapress%20via%20Shutterstock.jpg)

It’s been a tough year for Photoshop maker Adobe (ADBE), which has been racing to harness the power of artificial intelligence (AI) just like every major tech company today. Adobe’s products have long been essential for students, creatives, and enterprises, but the rise of powerful AI tools has opened the door for fast-growing rivals to win customers and contracts. As the creative landscape shifts, Adobe suddenly finds itself fighting harder to hold the ground it once easily dominated.

In a world where anyone can generate a brochure, presentation, or video simply by giving an AI tool a few instructions, investors are understandably questioning what Adobe’s future looks like. Ever since OpenAI’s ChatGPT burst onto the scene in 2022, Adobe has doubled down on generative AI with its Firefly model, integrated across Creative Cloud to help users create images and videos with ease, in hopes of staying ahead and expanding its user base.

And with competition heating up, Adobe is now looking for new ways to expand its reach and keep users engaged. And that’s where its latest move comes in. On Dec. 10, Adobe struck a major partnership with Microsoft (MSFT)-backed OpenAI to bring Photoshop, Express, and Acrobat directly into ChatGPT, effectively placing its industry-leading creative and productivity apps in front of the chatbot’s enormous base of 800 million users.

This means anyone can now ask ChatGPT to edit photos, design graphics, or work on PDFs using Adobe’s tools. So, given this latest development, what’s the smartest way for investors to approach Adobe’s stock now?

About Adobe Stock

Adobe is a global software company headquartered in San Jose, California, best known for creating tools that help people design, edit, and share digital content. Founded in 1982 by John Warnock and Charles Geschke, Adobe’s journey has spanned several defining milestones, such as the launch of PostScript, the introduction of Photoshop, the invention of the PDF format, and the development of the digital marketing software category.

Today, Adobe serves a massive global user base, ranging from students and content creators to professional designers and large enterprises. Adobe’s product ecosystem includes Creative Cloud apps such as Photoshop, Illustrator, Premiere, and Express, along with Document Cloud tools like Acrobat for PDFs, and Experience Cloud solutions that support marketing and analytics.

More recently, Adobe has boldly entered the AI era with its Firefly generative models, which have already generated more than 29 billion images since its 2023 launch, underscoring how quickly users have embraced this new creative power. While Adobe has rapidly moved to stake its claim in the AI race, its stock hasn’t shared the same momentum.

Shares have slumped as investors worry that the company may not emerge as a true AI leader, or that AI itself could chip away at Adobe’s long-held dominance by making it easier for users to work with text, images, and videos without relying on its software.

Currently valued at a market capitalization of roughly $143.6 billion, the stock has spent the past few years in the red, and 2025 is shaping up no differently. Adobe is down nearly 20.61% this year, sharply lagging the broader S&P 500 Index ($SPX), which is up a solid 17.1% over the same period.

Adobe Reports Strong Q4 Earnings Results

Adobe’s fiscal 2025 fourth-quarter earnings, released on Dec. 10, painted a picture of a company performing far better than its stock chart suggests. Revenue hit a record $6.19 billion, rising 10% year-over-year (YOY) and topping Wall Street’s $6.10 billion estimate. For a company battling competitive pressure and market skepticism, this top-line beat signals solid underlying demand across its key products.

Additionally, the company closed the quarter with a solid foundation for future growth. Remaining Performance Obligations (RPO) reached $22.52 billion, with current RPO at 65%, reflecting solid commitments from customers. Adobe’s bottom line impressed as well. Non-GAAP EPS came in at $5.50, up 14.3% from last year and ahead of the consensus estimate of $5.39.

Cash flow was another standout. Adobe generated a record $10.03 billion in operating cash flow for the full year, with $3.16 billion coming in Q4, a new quarterly record. Also, the company returned capital to shareholders, repurchasing roughly 7.2 million shares during the quarter, a sign of continued confidence in its financial strength. Digging deeper, performance appeared solid across Adobe’s two core business segments.

The Digital Media segment, home to Creative Cloud and Document Cloud, posted $4.62 billion in Q4 revenue, growing 11% YOY. Digital Media ARR climbed to $19.20 billion, also up 11.5%, underscoring the sticky, subscription-driven nature of the business. Meanwhile, the Digital Experience segment, which includes Adobe’s marketing and analytics tools, generated $1.52 billion in revenue, marking 9% YOY growth.

CEO Shantanu Narayen credited AI adoption for the company’s standout year. “Adobe’s record FY2025 results reflect our growing importance in the global AI ecosystem and the rapid adoption of our AI-driven tools,” he noted. The CEO added that the company will continue advancing its generative and agentic AI platforms while expanding its customer base, with a goal of achieving double-digit ARR growth in fiscal 2026.

Looking forward, Adobe expects momentum to continue into fiscal 2026. The company projects total revenue of $25.90-$26.10 billion, representing approximately 8.8% growth at the midpoint. And, management anticipates non-GAAP EPS of $23.30 to $23.50, signaling confidence that its AI-enabled ecosystem and strong subscription base will continue to drive growth.

How Are Analysts Viewing Adobe Stock?

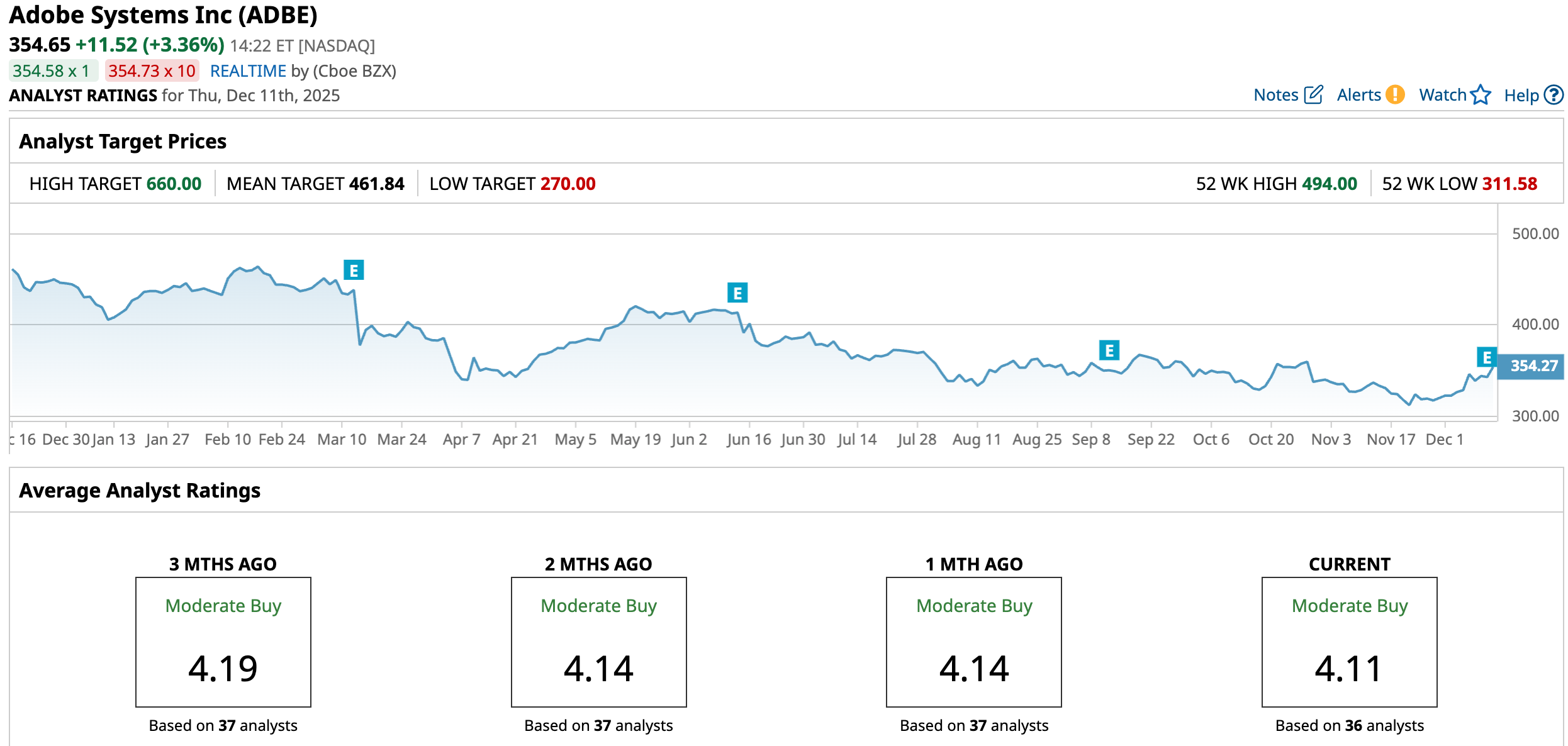

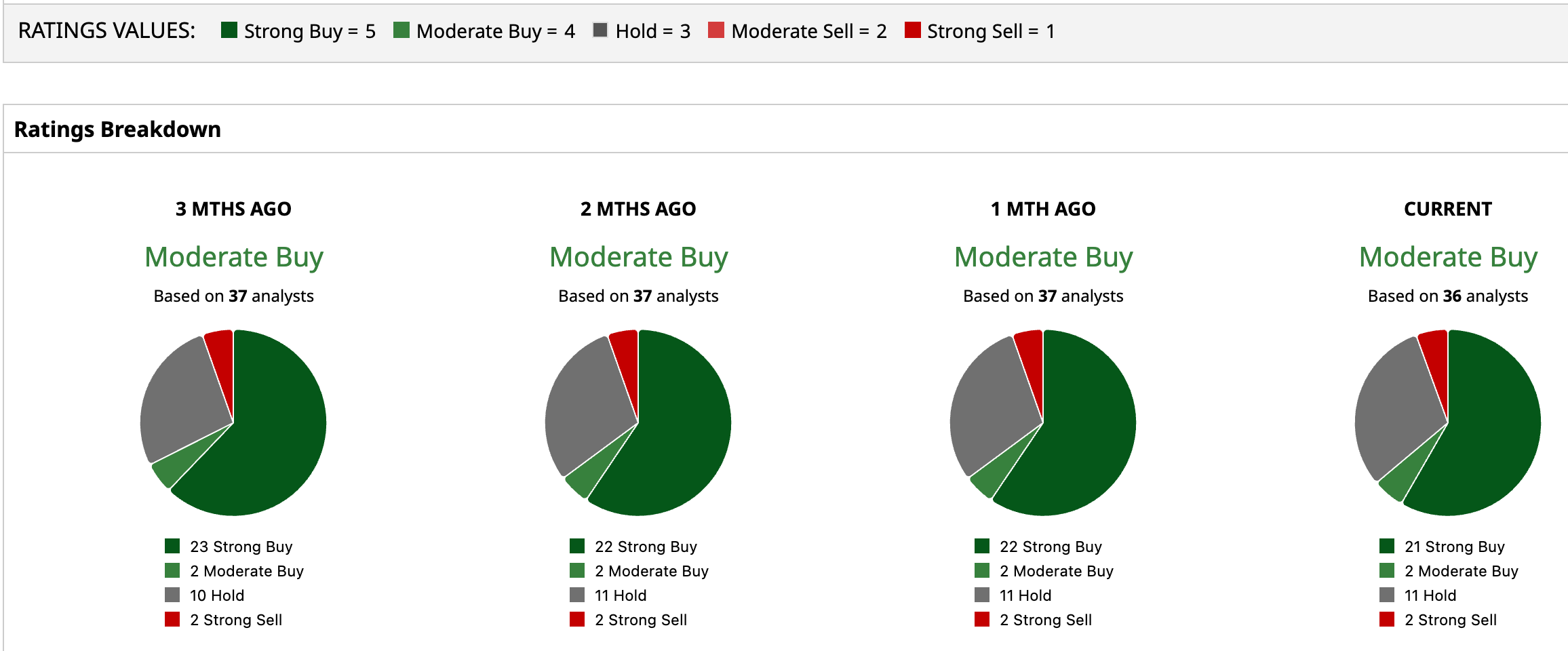

Even though Adobe’s stock has been under pressure, Wall Street isn’t ready to give up on the company. In fact, analysts remain broadly upbeat. Among the 36 experts covering the stock, Adobe holds a “Moderate Buy” consensus rating. The breakdown shows strong conviction. 21 analysts call it a “Strong Buy,” two rate it a “Moderate Buy,” 11 recommend “Hold,” and only two think it’s a “Strong Sell.” That’s a striking tilt toward bullish sentiment despite the stock’s recent slide.

Price targets tell an even more compelling story. Analysts collectively see Adobe heading toward an average target of $461.84, implying 30.14% upside from current levels. And the most optimistic forecast, an ambitious $660, suggests the stock could surge up to 85.95% if the company executes well. For all the concerns surrounding Adobe’s position in the AI race, Wall Street clearly believes the market may be underestimating its long-term potential.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)