Allentown, Pennsylvania-based Air Products and Chemicals, Inc. (APD) is a leading industrial gases company that supplies essential gases, equipment, and technology to industries such as energy, chemicals, electronics, manufacturing, and healthcare. Valued at a market cap of $58.2 billion, the company is known for its expertise in hydrogen, helium, nitrogen, and oxygen production, and also plays a major role in developing clean energy solutions.

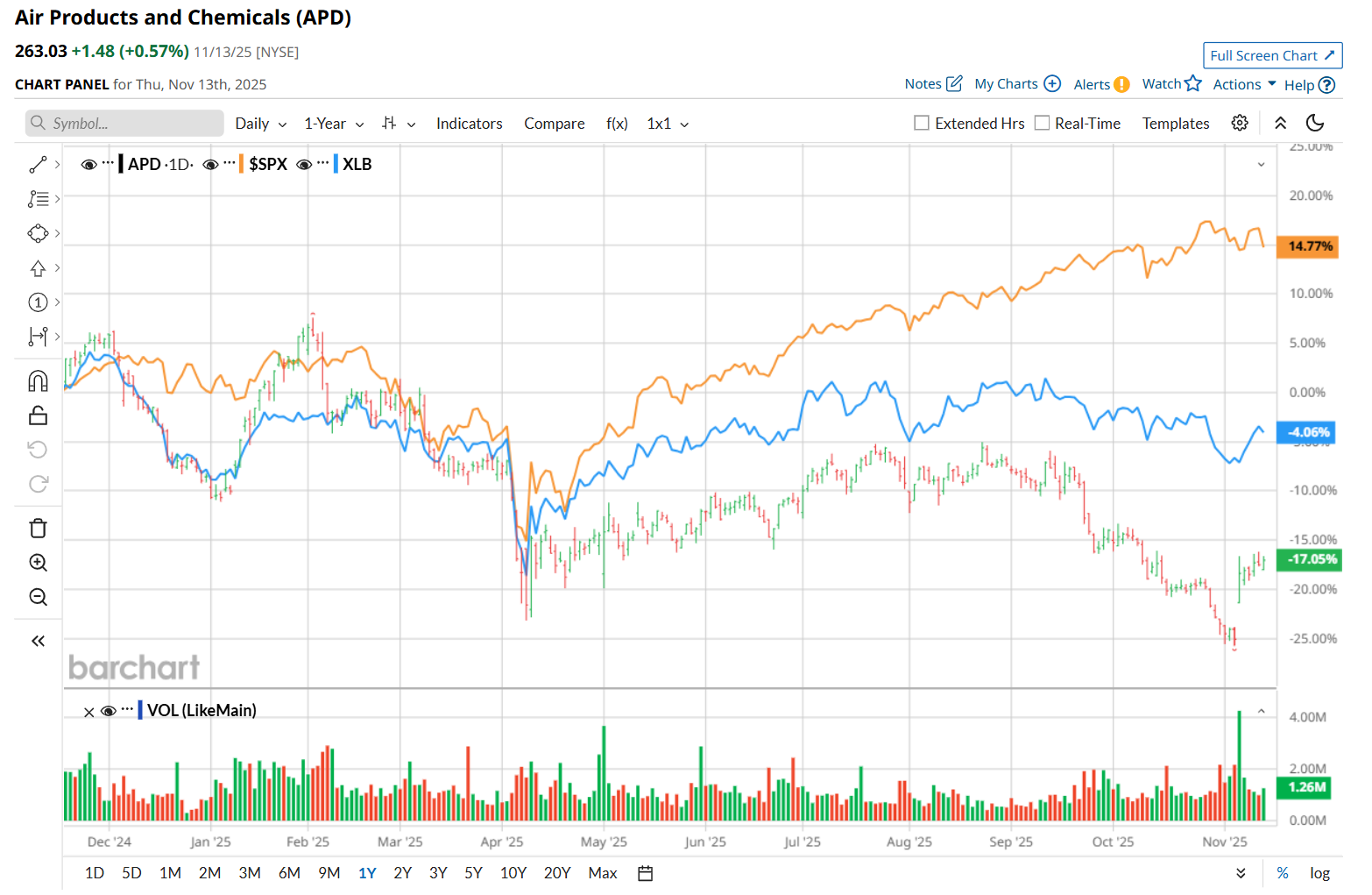

Shares of this specialty chemical company have considerably underperformed the broader market over the past 52 weeks. APD has declined 15.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.6%. Moreover, on a YTD basis, the stock is down 9.3%, compared to SPX’s 14.6% uptick.

Narrowing the focus, APD has also trailed behind the Materials Select Sector SPDR Fund (XLB), which has declined 5.5% over the past 52 weeks and gained 4.1% on a YTD basis.

On Nov. 6, shares of APD closed up 8.9% after its Q4 earnings release. The company’s revenue declined marginally year-over-year to $3.2 billion, largely due to lower volumes. This decline in volumes was primarily driven by the September 2024 LNG sale, a one-time asset sale in the Americas segment last year related to an early contract termination at a customer’s request, and softer global helium demand. Meanwhile, on the earnings front, its adjusted EPS also fell 4.8% from the year-ago quarter to $3.39. However, its selling and administrative expenses dropped 3.9% from the prior-year quarter, reflecting productivity gains and strong cost control, which helped bolster investor confidence.

For fiscal 2026, ending in September, analysts expect APD’s EPS to grow 7.8% year over year to $12.97. The company’s earnings surprise history is mixed. It topped or met consensus estimates in two of the last four quarters, while missing on two other occasions.

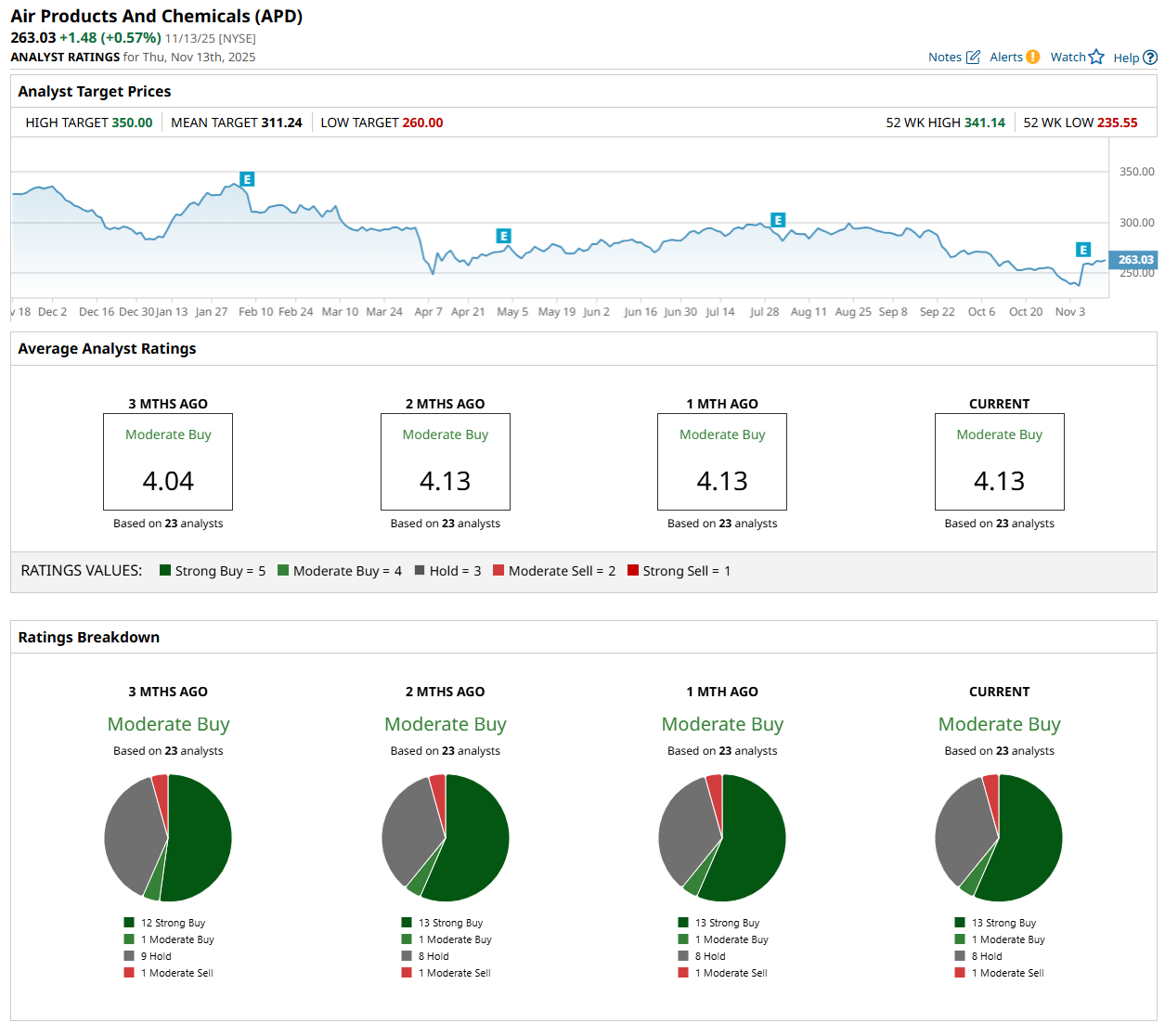

Among the 23 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 13 “Strong Buy,” one "Moderate Buy,” eight “Hold,” and one "Moderate Sell” rating.

This configuration is slightly more bullish than three months ago, with 12 analysts suggesting a “Strong Buy” rating.

On Nov. 11, Evercore Inc. (EVR) maintained an "Outperform" rating on APD, but lowered its price target to $325, indicating a 23.6% potential upside from the current levels.

The mean price target of $311.24 represents an 18.3% premium from APD’s current price levels, while the Street-high price target of $350 suggests a 33% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20products%20on%20desk%20by%20Ake%20Ngiamsanguan%20via%20iStock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)