With a market cap of $8.1 billion, Lamb Weston Holdings, Inc. (LW) is a leading producer, distributor, and marketer of frozen potato products and appetizers across the United States and internationally. The company offers its products under brands such as Lamb Weston, Grown in Idaho, and Alexia, serving restaurants, retailers, and foodservice distributors worldwide.

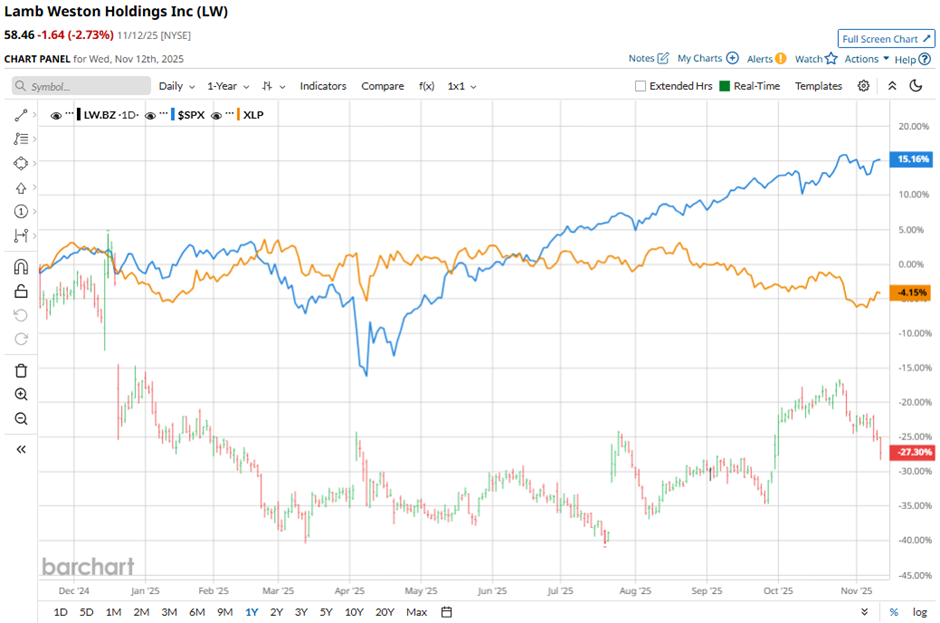

Shares of the frozen foods supplier have underperformed the broader market over the past 52 weeks. LW stock has declined 27.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, shares of LW are down 12.5% on a YTD basis, compared to SPX’s 16.5% increase.

Narrowing the focus, shares of the Eagle, Idaho-based company have also lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.1% drop over the past 52 weeks.

Shares of Lamb Weston soared 4.3% on Sept. 30 after the company reported Q1 2026 adjusted EPS of $0.74 and net sales reached $1.66 billion, surpassing estimates. Investor optimism was further fueled by 6% volume growth, improved cost savings and lower SG&A expenses, and management’s solid full-year outlook projecting net sales of $6.35 billion - $6.55 billion and adjusted EBITDA of $1 billion - $1.20 billion.

For the fiscal year ending in May 2026, analysts expect LW’s adjusted EPS to decline 6.3% year-over-year to $3.14. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

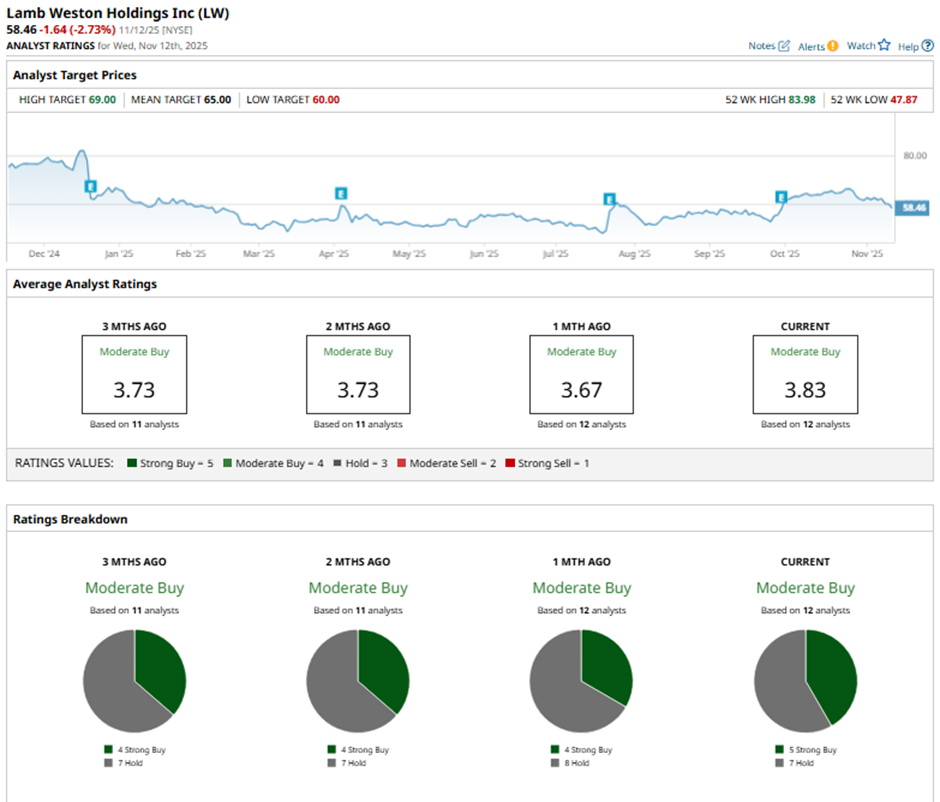

Among the 12 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings and seven “Holds.”

This configuration is slightly more bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Oct. 1, Stifel raised its price target on Lamb Weston to $63 and maintained a “Hold” rating.

The mean price target of $65 represents a 11.2% premium to LW’s current price levels. The Street-high price target of $69 suggests a 18% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)