/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Nvidia (NVDA) has completed its $5 billion equity investment in Intel (INTC), the semiconductor giant confirmed in a filing on Monday. The announcement finalizes a deal first announced in September that positions the world's most valuable company as a roughly 4% stakeholder in its struggling rival.

The AI chip leader purchased over 214.7 million Intel shares at $23.28 apiece in a private placement, a price that now sits 36% below Intel's recent trading levels, according to the filing.

The transaction, which received regulatory clearance from the Federal Trade Commission earlier this month, could serve as a major financial lifeline for Intel after years of missteps and capital-intensive manufacturing expansions that have drained its resources.

The companies announced they will collaborate on multiple generations of custom data center and PC products, including Nvidia-designed x86 CPUs for AI infrastructure and system-on-chips combining Intel CPU cores with Nvidia RTX GPU chiplets.

However, neither chipmaker has committed to moving Nvidia's crown-jewel GPU production away from Taiwan Semiconductor Manufacturing Company (TSM) to Intel's contract manufacturing services.

Is Intel Stock a Good Buy Right Now?

Valued at a market cap of $175 billion, INTC stock has returned almost 90% in 2025. Despite strong demand for its legacy chip, Intel is wrestling with manufacturing bottlenecks. Intel is undershipping its 10 nm and 7 nm chips for the personal computer and server markets right now. These products still account for the bulk of Intel’s production volume.

CFO John Pitzer acknowledged that supply constraints could peak in Q1 of 2026 and ease gradually over the next few months. However, it suggests that Intel is unlikely to meet demand even beyond Q1. The silver lining is that server shortages are actually worse than PC shortages, as servers carry better margins.

Multiple factors are driving server demand for Intel:

- First, hyperscalers spent the last few years focused on AI infrastructure buildouts while delaying refreshes of their existing server fleets.

- Second, these same companies are now severely power-constrained, and replacing a five-year-old server with a new one delivers 80 percent better power efficiency.

- Third, and most intriguing, the shift from large language model training to agentic AI appears to be putting unexpected demand on traditional computing infrastructure.

On the technology front, Intel's 18A node is advancing but remains a work in progress. The company shipped its first Panther Lake chip on schedule by year-end, though yields aren't in line with expectations.

New CEO Lip-Bu Tan has brought significant cultural changes since joining in March. The organization has been flattened from 11 or 12 management layers down to just five or six. Engineers now sit on the executive staff and are required to participate in customer conversations. The company has also implemented a return-to-office policy with employees back in the office four days per week.

What Is the INTC Stock Price Target?

Analysts tracking INTC stock forecast revenue to increase from $52.55 billion in 2025 to $74 billion in 2029. Investors are concerned about narrowing gross margins driven by early 18A ramp costs and pricing actions on newer products to manage tight supply. However, the company is projected to improve adjusted earnings per share from $0.34 in 2025 to $2.84 in 2030.

As Intel continues to invest in capital expenditures, its free cash outflow is expected to total $11 billion between 2025 and 2026. Notably, free cash flow is likely to improve from $640 million in 2027 to $4.32 billion in 2029. If INTC stock trades at 25x forward earnings, which is in line with its 10-year average, it could return 100% over the next three years.

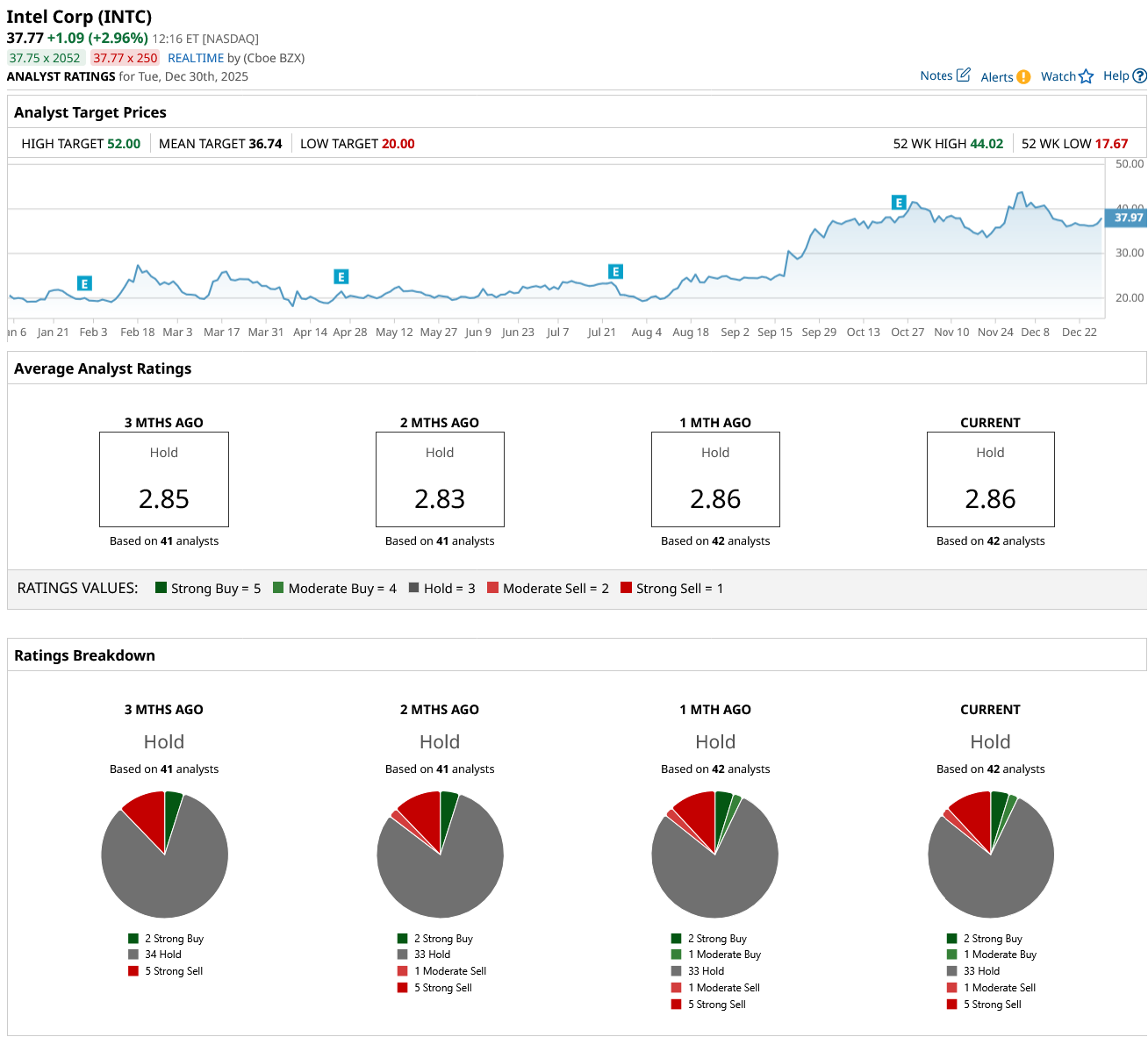

Out of the 42 analysts covering INTC stock, two recommend “Strong Buy,” one recommends “Moderate Buy,” 33 recommend “Hold,” one recommends “Moderate Sell,” and five recommend “Strong Sell.”

The average INTC stock price target is $36.74, which is similar to the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)