/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC) stock has been a major outperformer this year as CEO Lip-Bu Tan’ strategic vision renewed investor confidence in the company’s ability to compete in the global AI arms race.

Under his leadership, the company secured billions in private and federal investments, paving the way to advance its foundry ambitions.

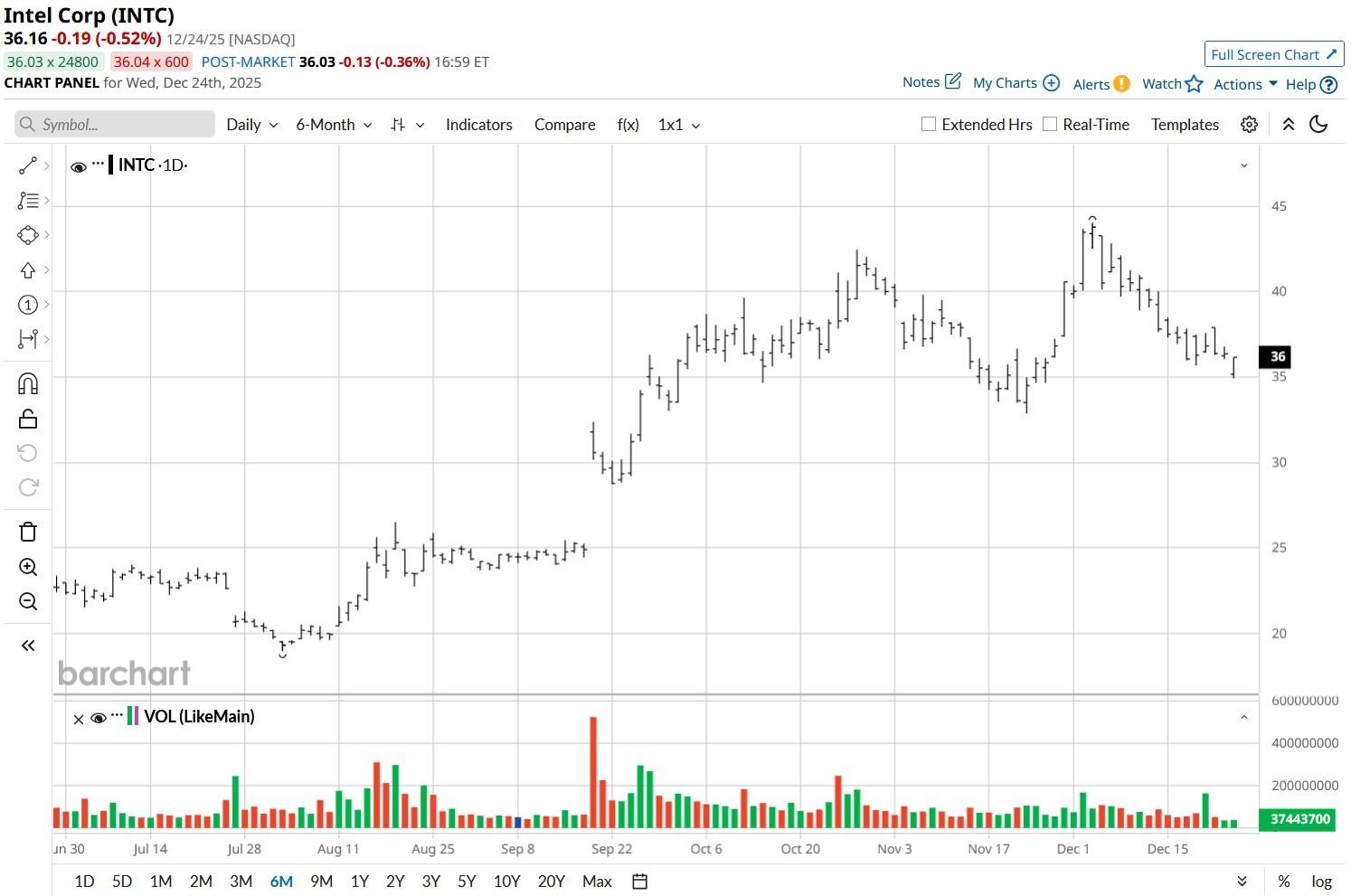

Versus their pandemic high, however, Intel shares remain down some 50%, suggesting persistent structural and executions risks continue to weigh on sentiment.

What to Expect From Intel Stock in 2026

The latest setback for INTC stock came from Nvidia (NVDA) that’s reportedly scrapped plans of producing its advanced chips using Intel’s 18A node.

Still, Daniel Newman – the chief executive of Futurum Group – believes the longer term bull case remains intact for one simple reason: Taiwan Semi (TSM) just “can’t produce enough chips.”

The unprecedented AI-driven demand is making big names like Apple (AAPL), Qualcomm (QCOM), and even AMD (AMD) explore alternatives, reinforcing Intel’s role as an auxiliary capacity provider.

And since demand is truly explosive, being only an adjunct resource for the semiconductor space may prove sufficient in driving Intel stock higher in 2026, he told CNBC in a recent interview.

INTC Shares Remain Inexpensive to Own

Newman doesn’t see NVDA news as a major setback for Intel shares since Lip-Bu Tan had already broadcast that the initial ramp-up of the firm’s 18A node is optimized for and dedicated to its own internal products.

According to him, the real inflection point for Intel will be its upcoming “14A” process, expected to enter volume production in 2028.

“This is the one where rubber meets the road for companies like Nvidia, Apple, and others.”

From a valuation perspective, INTC shares are just as attractive. Despite an explosive year-to-date rally, they’re going for just over 3x sales at the time of writing, versus more than 35x for Nvidia.

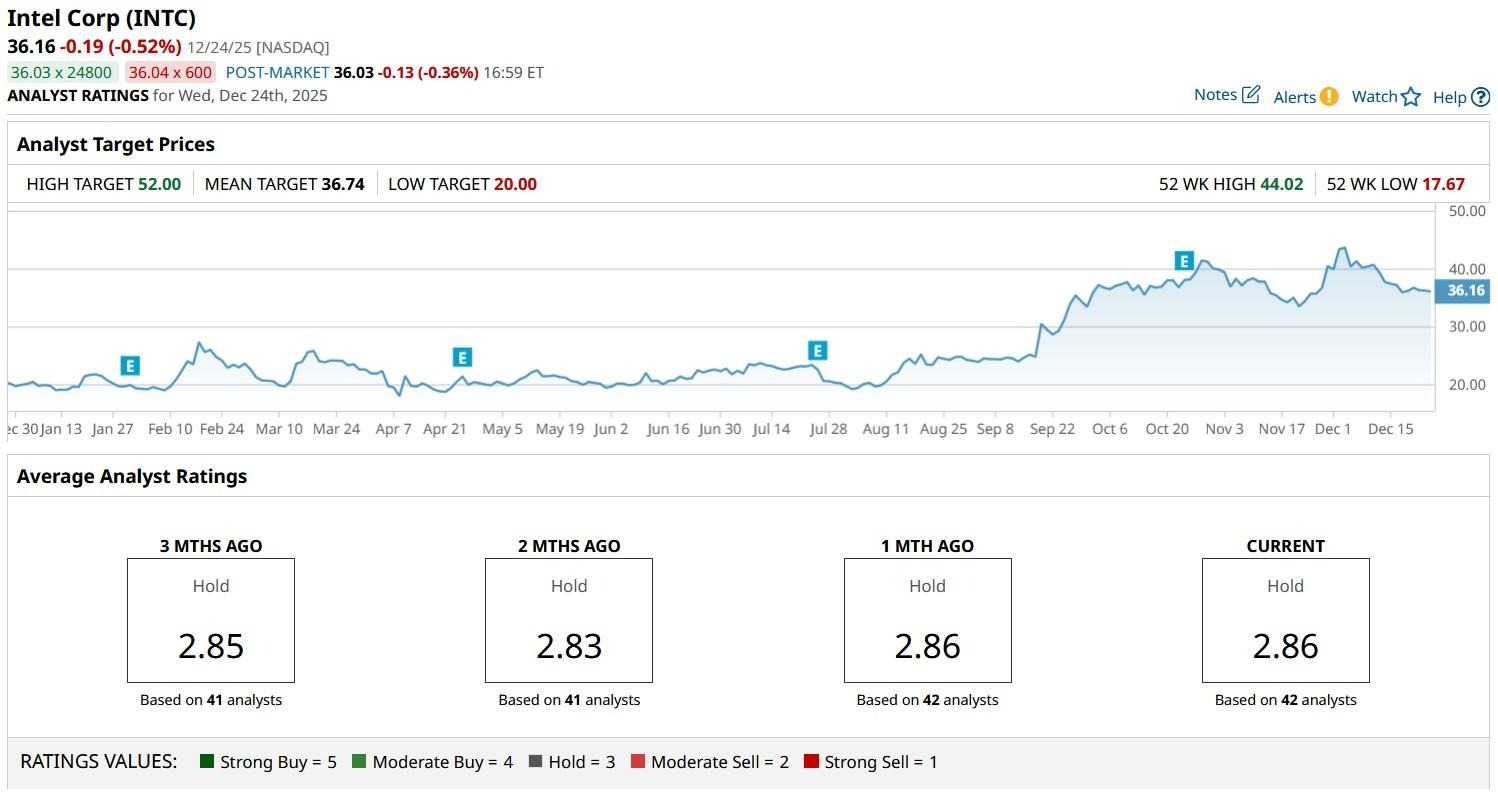

Wall Street Disagrees with Newman on Intel

Wall Street analysts do not entirely agree with Newman’s constructive view on Intel stock, though.

The consensus rating on INTC shares remains at “Hold” only with the mean target of nearly $37 already in line with the price at which they are trading currently.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Cisco%20Systems%2C%20Inc_%20magnified%20logo-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)