Based in New York City, The Estée Lauder Companies Inc. (EL) is a global force in skincare, makeup, fragrance, and hair care. Recently, it has launched major restructuring under the “Beauty Reimagined” initiative, emphasizing digital transformation, operational streamlining, and rapid market innovation.

The company is investing heavily in AI, targeting emerging markets, and focusing on new trends, while also implementing workforce reductions to boost efficiency. These strategies aim to revitalize growth and strengthen Estée Lauder’s market standing. Estée Lauder has a market capitalization of $33.43 billion.

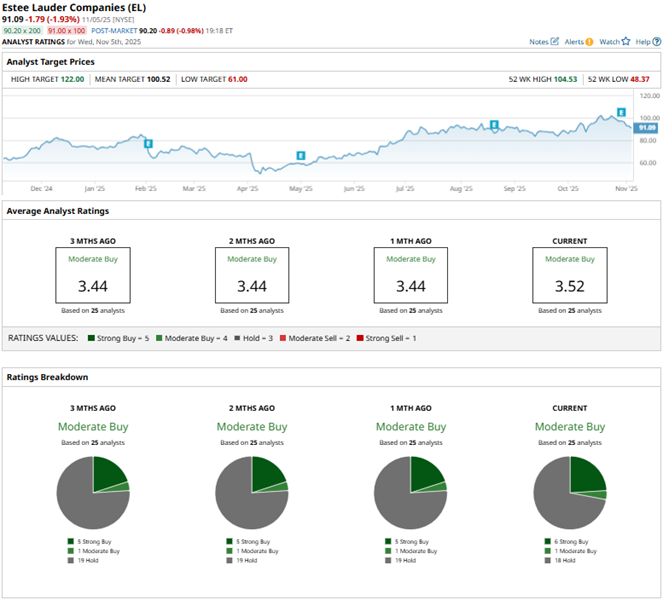

The efficiency-focused “Beauty Reimagined” strategy has reinjected growth into the company’s stock. Over the past 52 weeks, the stock has gained 38.3%, while it is up 57.9% over the past six months. It had reached a 52-week high of $104.53 in October, but is down 12.9% from that level.

In contrast, the S&P 500 Index ($SPX) has gained 17.5% and 20.3% over the same periods, respectively, which reflects that the stock is outperforming the broader market. The nature of the household and personal items business classifies it as a consumer defensive stock. Comparing with the Consumer Staples Select Sector SPDR Fund (XLP), we see that the ETF is down 6.1% over the past 52 weeks and 6.8% over the past six months, underperforming Estée Lauder’s stock.

On Oct. 30, Estée Lauder reported its first-quarter results for fiscal 2026 (the quarter that ended on Sep. 30). In that, the company reported a 4% year-over-year (YOY) growth in its net sales to $3.48 billion, which was higher than the $3.38 billion that Wall Street analysts had expected. Its organic net sales also increased by 3% YOY to $3.46 billion. Adjusted EPS more than doubled annually to $0.32, higher than the analyst-expected $0.18 figure.

The company has also set organic sales growth and profitability expansion as key goals for this year, with operational changes being executed across its business to increase agility. Last month, its M.A.C Cosmetics brand announced plans to launch in select Sephora locations in the U.S. in early 2026, which is expected to boost its sales.

For the fiscal year 2026, which ends in June 2026, Wall Street analysts expect Estée Lauder’s EPS to grow 41.1% YOY to $2.13 on a diluted basis. Moreover, EPS is expected to increase 36.2% annually to $2.90 in fiscal 2027. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

Among the 25 Wall Street analysts covering Estée Lauder’s stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and 18 “Holds.” The ratings configuration is more bullish than it was a month ago, with six “Strong Buy” ratings now, up from five previously.

Late last month, RBC Capital analyst Nik Modi raised the price target on Estée Lauder’s stock from $107 to $113, while maintaining an “Outperform” rating on its shares, citing the company’s solid quarterly results. Andrea Teixeira of JP Morgan maintained the “Overweight” rating, while raising the price target from $114 to $116.

Estée Lauder’s mean price target of $100.52 indicates a 10.4% upside over current market prices. The Street-high price target of $122 implies a potential upside of 33.9%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg)