/U_S_%20Bancorp_%20logo%20on%20building-by%20Sundry%20Photography%20via%20iStock.jpg)

Valued at a market cap of $76.9 billion, U.S. Bancorp (USB) is one of the largest U.S. regional banks, operating through its subsidiary U.S. Bank. With roots dating back to 1863, the bank offers a wide range of services spanning consumer and business banking, wealth and institutional services, corporate lending, and payment processing.

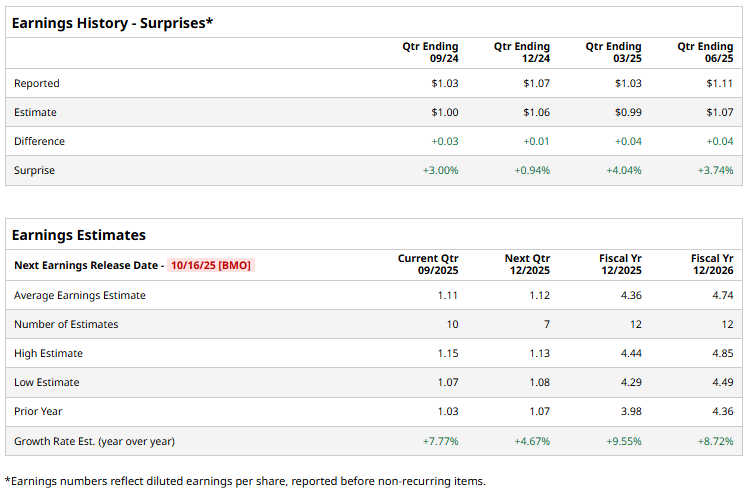

The Minneapolis, Minnesota-based bank is expected to announce its fiscal Q3 earnings before the market opens on Thursday, Oct. 16. Before this event, analysts project this financial services company to report a profit of $1.11 per share, up 7.7% from $1.03 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the current year, analysts expect USB to report EPS of $4.36, up 9.6% from $3.98 in fiscal 2024. Furthermore, its EPS is expected to grow 8.7% year over year to $4.74 in fiscal 2026.

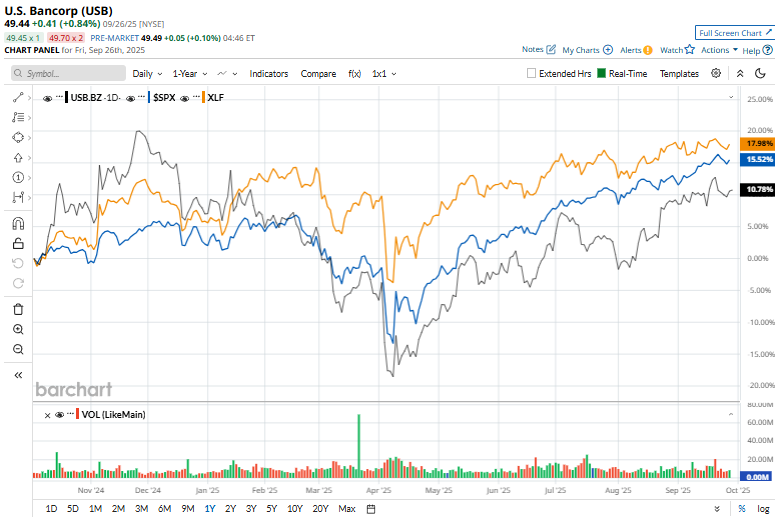

Shares of USB have surged 9.1% over the past year, trailing both the S&P 500 Index's ($SPX) 15.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the same time frame.

On Sept. 17, U.S. Bancorp lit up the markets after unveiling a cut to its prime lending rate, trimming it from 7.50% to 7.25% effective tomorrow, Sept. 18, 2025, across all U.S. Bank locations. The announcement ignited investor optimism, propelling USB shares more than 2% higher on the day.

Wall Street analysts are moderately optimistic about USB’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 11 recommend "Strong Buy," two suggest “Moderate Buy,” 11 indicate “Hold,” and one recommends a “Strong Sell” rating. The mean price target for USB is $53.83, which indicates an 8.9% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)