Stocks ended broadly lower today, but dividend aristocrat Ecolab Inc. (ECL) closed slightly higher to notch its fifth straight daily gain. Currently trading at $269.82 per share, with a market capitalization of $76.13 billion, the company specializes in sustainability solutions, sanitization, and water and power optimization.

ECL Stock is a Dividend Aristocrat

The S&P 500 Index ($SPX) component is a favorite of passive income investors for its long history of dividend payments - over 32 years of growth, to be specific. That makes Ecolab a dividend aristocrat, which refers to S&P 500 components who have consistently raised their quarterly payouts for at least 25 years.

Most recently, management announced a $1 billion stock repurchase program alongside a 14% increase in the quarterly dividend to $0.65 per share. ECL’s annual dividend yield now stands at 0.97%, which isn’t the highest on the S&P 500.

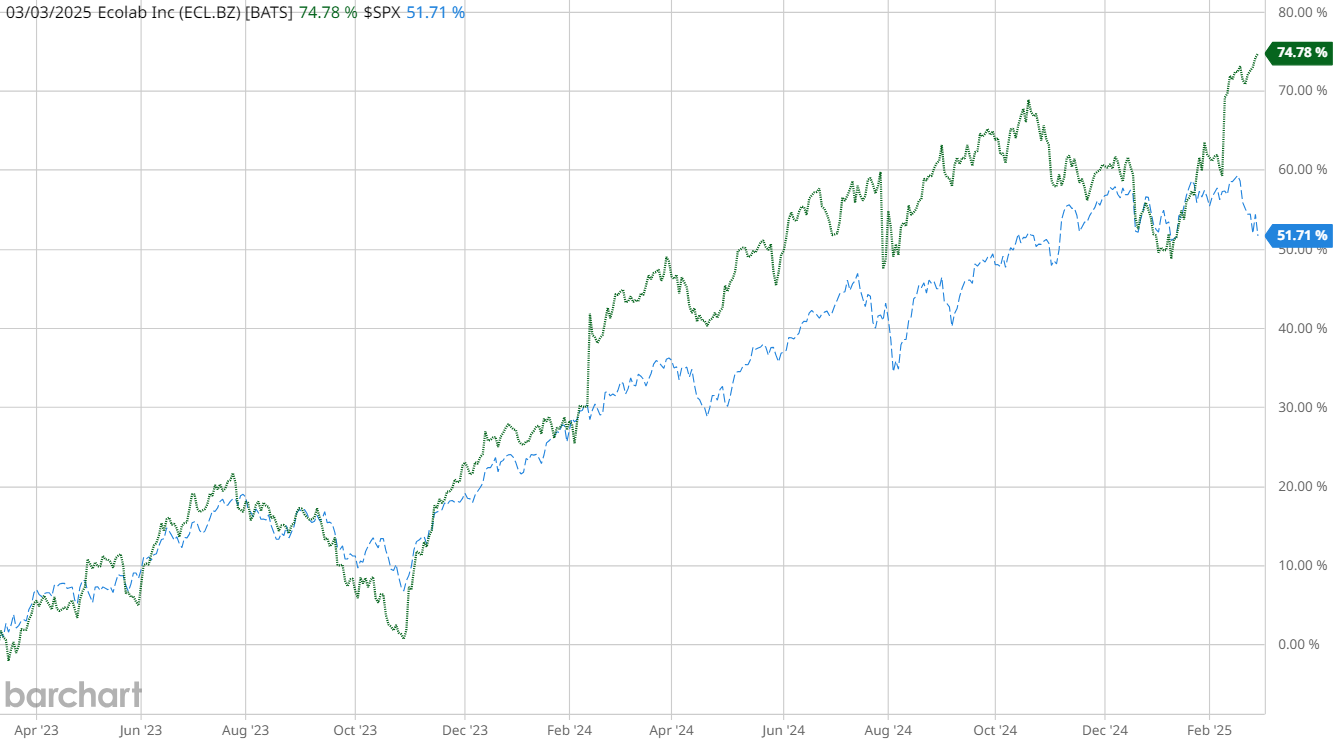

However, investors might not be too disappointed, as ECL stock has also been outperforming its benchmark index. Year-to-date, Ecolab shares are more than 15% higher, while the S&P 500 is now slightly negative for 2025. Over the past two years, ECL is up nearly 75%, while the SPX has gained 51.7%.

Is ECL Overvalued?

That said, ECL now trades at a forward price-to-earnings (P/E) ratio of 35.71, which is relatively high compared to its industry peers. This indicates that investors are paying a premium for the company's earnings at current prices. Similarly, Ecolab’s forward price-to-sales (P/S) ratio of 4.76 is significantly higher than the industry average.

With a five-year earnings growth rate of 14.26%, the company's price/earnings-to-growth (PEG) ratio calculates to approximately 2.81, further suggesting that ECL stock may be overvalued according to traditional PEG analysis. However, these metrics should be considered alongside Ecolab's strong return on equity of 22.5% and return on assets of 8.74%, which demonstrate efficient use of capital and assets.

Digging deeper, Ecolab's profit margin of 13.42% reflects solid operational efficiency, while its five-year revenue growth of 5.6% shows steady expansion. While the valuation multiples suggest a premium price, Ecolab's market leadership position, technological innovations in water treatment solutions, and focus on sustainability provide significant competitive advantages that may justify the higher valuations.

What’s Next for Ecolab Stock?

Ecolab achieved record growth in fiscal 2024, with Q4 showing 4% organic sales growth driven by volume increases and strategic pricing, and particular strength in the U.S. market, which accounts for over half of their sales.

Despite projections of a 3-4% decline in reported sales and adjusted earnings per share for 2025 due to currency exchange impacts, Ecolab's strategic investments in high-growth markets like data centers and microelectronics, coupled with artificial intelligence (AI)-driven solutions and digital transformation initiatives, position this dividend aristocrat favorably for long-term growth.

The Bottom Line on ECL Stock Now

While ECL appears expensive by traditional measures, the company's strong execution, market leadership position, and positive growth trajectory suggest the premium valuation may be warranted for long-term investors. Ecolab's strategic positioning in environmental solutions and consistent operational performance provide a strong foundation for future growth, though investors should monitor the high valuation multiples for potential risks.

This article was generated with the support of AI and reviewed by an editor. On the date of publication, the editor did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)