/Honeywell%20International%20Inc%20operations%20facility%20by-JHVEPhoto%20via%20iStock.jpg)

Honeywell International Inc. (HON) is a global conglomerate focused on diversified technology and manufacturing operations. It specializes in aerospace systems, building automation, industrial automation, performance materials, and safety solutions. The company is headquartered in Charlotte, North Carolina. It has a market capitalization of $151.34 billion.

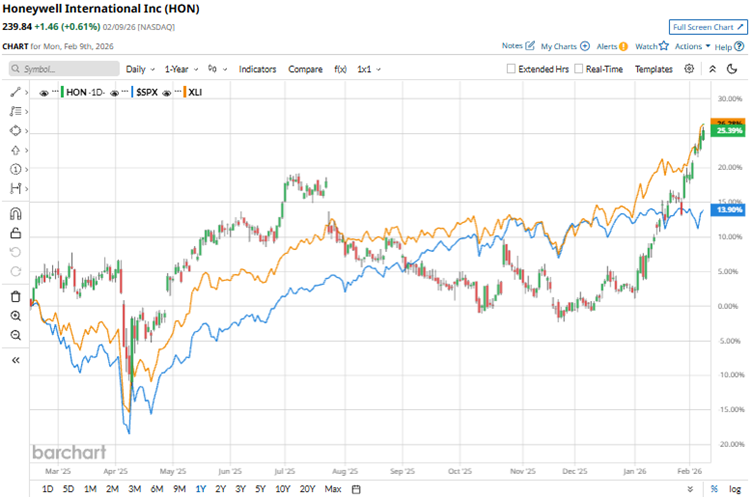

Over the past 52 weeks, Honeywell’s stock has gained 23.7%. Based on a record backlog and solid 2026 guidance, the stock is up 22.9% year-to-date (YTD). Amid positive momentum, it reached a 52-week high of $240.95 on Feb. 9 and is down only marginally from that level.

The S&P 500 index ($SPX) is up 15.6% over the past 52 weeks and 1.7% YTD. Therefore, the stock has outperformed the broader market over these periods. The State Street Industrial Select Sector SPDR ETF (XLI) has increased 26.5% over the past 52 weeks, outperforming Honeywell, while it has rallied 12% YTD, underperforming the stock.

For the fourth quarter of fiscal 2025, Honeywell reported a 6% year-over-year (YOY) growth in its topline to $9.76 billion, while reporting an 11% organic growth. However, the topline figure fell short of Wall Street analysts’ estimates. On an adjusted basis, the company’s sales grew 10% YOY. Honeywell’s adjusted EPS grew 17% from the prior-year period to $2.59, exceeding the estimated figure.

The company exited 2025 with a record backlog exceeding $37 billion. It is also on track to spin off Honeywell Aerospace into an independent publicly traded company in the third quarter of 2026.

For the current quarter, Street analysts expect Honeywell’s profit to drop 7.6% YOY to $2.32 per diluted share, while for the current year, it is expected to increase 7.5% to $10.51 per diluted share, followed by an 8.6% growth to $11.41 per diluted share in the following year. The company also has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

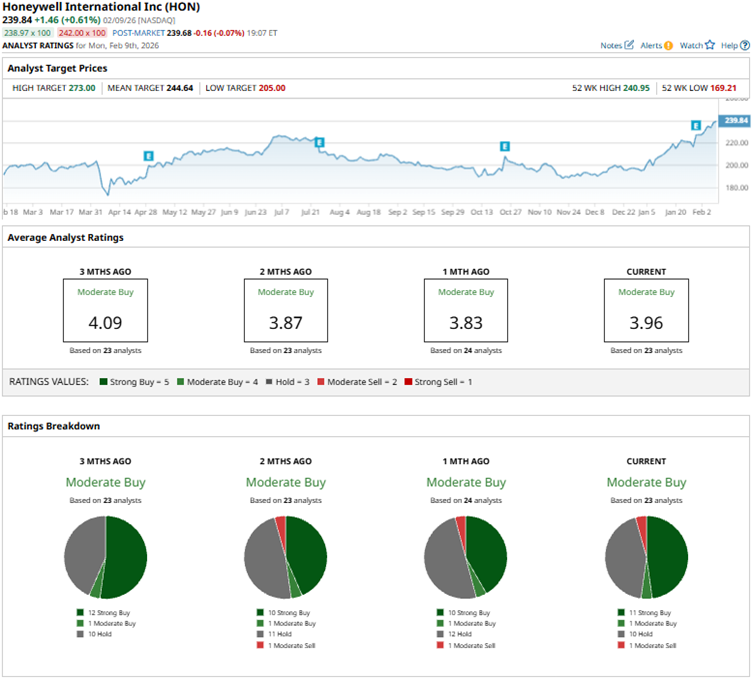

Among the 23 Wall Street analysts covering Honeywell’s stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Moderate Sell.” The ratings configuration has become more bullish than a month ago, with the number of “Strong Buy” ratings increasing from 10 to 11.

Last month, analysts at JPMorgan upgraded the stock from “Neutral” to “Overweight” and raised its price target from $218 to $255. JPMorgan has turned more positive on Honeywell, citing a clear valuation discount. The stock trades below its sum-of-the-parts value, with analysts noting a stark gap between the share price and Honeywell's underlying assets, especially in its aerospace segment.

Honeywell’s mean price target of $244.64 indicates a 2% upside over current market prices. Moreover, the Street-high price target of $273 implies a potential upside of 13.8%.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)