A long call butterfly is entered when a trader thinks a stock will not rise or fall by much between trade initiation and expiration. When using calls, the trade is constructed by buying an in-the-money call, selling two at-the-money calls and buying an out-of-the-money call. The trade is entered for a net debit meaning the trader pays to enter the trade. This debit is also the maximum possible loss.

The maximum profit is calculated as the difference between the short and long calls less the premium that you paid for the spread.

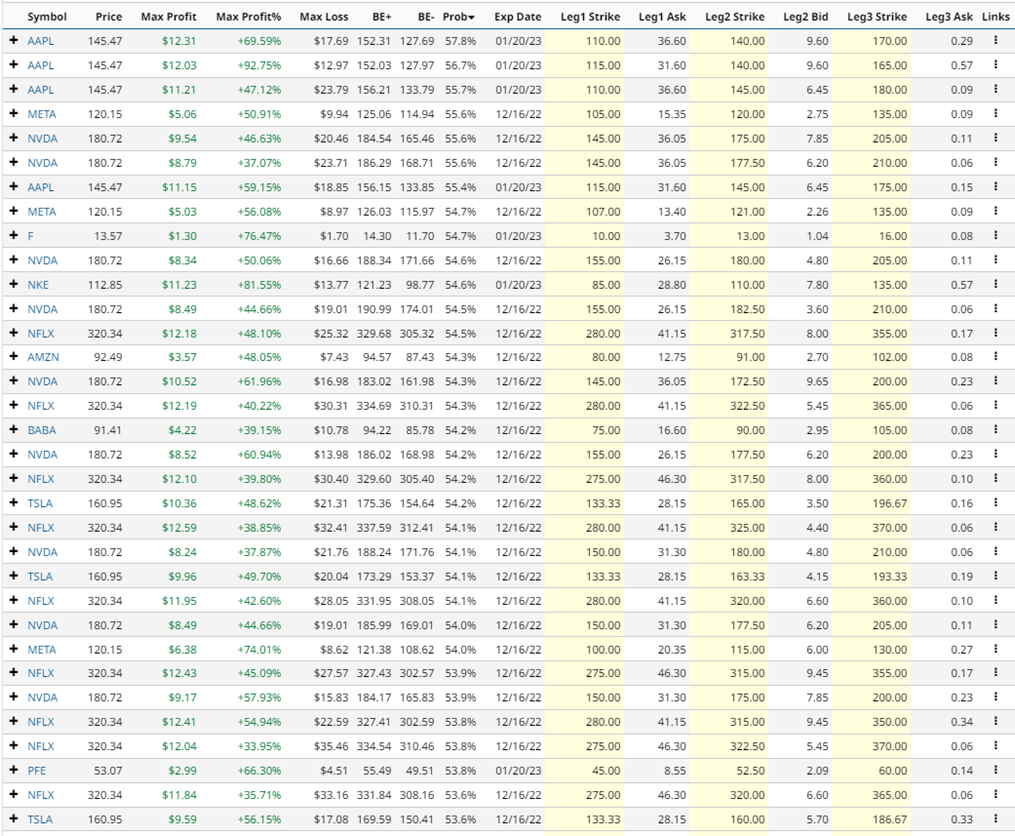

Let’s take a look at Barchart’s Long Call Calendar Screener for December 14th:

The screener shows some interesting long call butterfly trades on popular stocks such as AAPL, META, F, NVDA, NFLX and TSLA.

Let’s take a look at the first line item – a Long Call Butterfly on Apple stock.

Using the January 20 expiry, the trade would involve buying the 110 strike call, selling two of the 140 strike calls and buying one of the 170 strike calls. The cost for the trade would be $1,769 which is the most the trade could lose. The maximum potential gain is $1,231. The lower breakeven price is 127.69 and the upper breakeven price is 152.31. The maximum profit is 69.59% with a probability of success of 57.8%.

The Barchart Technical Opinion rating is a 72% Sell with a weakening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Ford Long Call Butterfly Example

Let’s take a look at another example, this time on Ford stock.

Using the January 20 expiry, the trade would involve buying the 10 strike call, selling two of the 13 strike calls and buying one of the 16 strike calls. The cost for the trade would be $170 which is the most the trade could lose. The maximum potential gain is $130. The lower breakeven price is 11.70 and the upper breakeven price is 14.30. The maximum profit is 76.47% with a probability of success of 54.7%.

The Barchart Technical Opinion rating is a 48% Sell with a weakest short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Mitigating Risk

Thankfully, Long Call Butterfly Spreads are risk defined trades, so they have some built in risk management. Some trades might like to exit the trade is the upper or lower breakeven price is breached.

Position sizing is important so that a 100% loss does not cause more than a 1-2% loss in total portfolio value.

Long Call Butterfly’s can also contain early assignment risk, so be mindful of that if the short calls are in-the-money and it’s getting close to expiry.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Ah, "Shucks," Corn Prices are Looking Higher

- Stocks Close Higher as U.S. Consumer Prices Moderate

- Shorting Tech Stocks May Remain Profitable Next Year

- Stocks HIgher on Fed-Friendly U.S. CPI Report

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)