/Western%20Digital%20Corp_%20logo%20on%20sign-by%20360b%20via%20Shutterstock.jpg)

Valued at $95.6 billion by market cap, Western Digital Corporation (WDC) is a major data storage technology company that designs, manufactures, and markets a wide range of digital storage devices and solutions globally. The San Jose, California-based company is one of the world’s largest producers of hard disk drives (HDDs) and plays a significant role in supporting data-intensive applications such as cloud computing and artificial intelligence (AI).

The HDD giant has been on a clear winning streak, comfortably outpacing both the broader market and its sector peers. WDC stock prices have soared a whopping 491.1% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 15.4% gains. Over the past six months, WDC shares have climbed 294.3%, surpassing $SPX’s 9.4% rally.

Zooming in further, the stock has also outpaced the sector-focused Technology Select Sector SPDR Fund’s (XLK) 26.8% gains over the past year and 11.2% rally over the past six months.

On Jan. 29, Western Digital released its second-quarter fiscal 2026 earnings, reporting revenue of $3.02 billion, up 25% year over year, driven largely by strong demand from cloud and hyperscale customers. Its non-GAAP EPS stood at $2.13, reflecting a strong 78% annual increase. Non-GAAP gross margins expanded to 46.1%, and the business generated robust operating cash flow of $745 million and free cash flow of $653 million, underscoring solid profitability and cash generation. Management highlighted continued customer demand for high-capacity storage solutions in the AI-driven data economy and provided constructive guidance for Q3 FY2026, with expected revenue of approximately $3.2 billion and further margin improvement.

For fiscal 2026, ending in June, analysts anticipate that Western Digital will deliver earnings of $7.17 per share, marking an impressive 58.3% year-over-year surge. The company has a mixed earnings surprise history. It has surpassed consensus estimates in three of the past four quarters while missing one quarter.

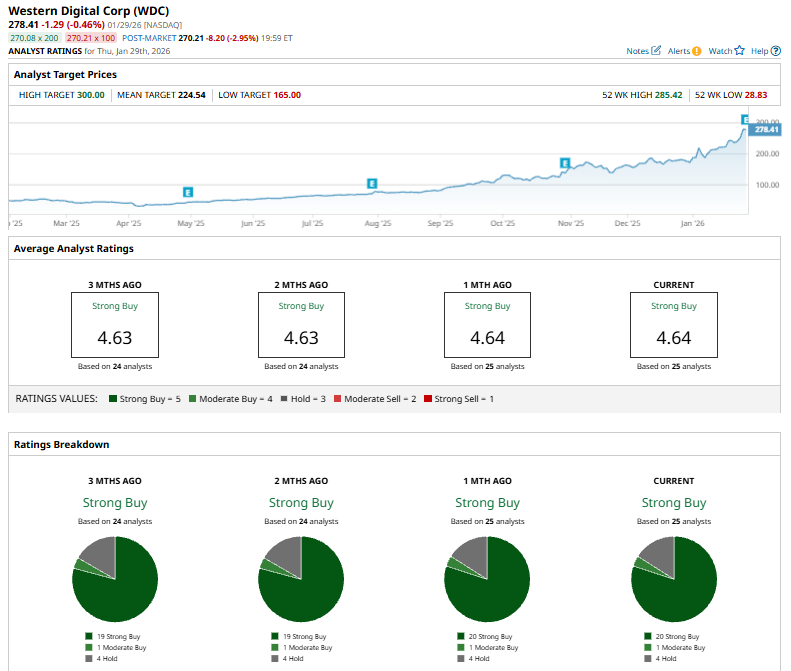

Among the 25 analysts covering the WDC stock, the consensus rating is a “Strong Buy.” That’s based on 20 “Strong Buys,” one “Moderate Buy,” and four “Holds.”

This configuration is bullish than two months ago, when 19 analysts gave “Strong Buy” recommendations for the stock.

On Jan. 27, Mizuho raised its price target on Western Digital to $265 from $240 and reaffirmed its “Outperform” rating, reflecting increased confidence in the stock’s outlook.

WDC currently trades above its mean price target of $224.54 and the Street-high target of $300 suggests a 7.8% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)