Valued at $217.5 billion by market cap, AppLovin Corporation (APP) is a technology company focused on mobile app marketing, monetization, and analytics, primarily serving mobile app developers and publishers. Founded in 2012 and headquartered in Palo Alto, California, AppLovin provides a software platform that helps developers acquire users, optimize app performance, and generate revenue through advertising.

Shares of AppLovin have considerably outperformed the broader market over the past year. APP has gained 47.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. Over the past six months, APP stock is up 47%, surpassing the SPX’s 8.8% rise.

Zooming in further, APP has also exceeded the SPDR S&P Software & Services ETF (XSW). The exchange-traded fund has plunged about 6.4% over the past year. Moreover, APP’s double-digit gains over the past six months outshine the ETF’s 6.2% fall over the same time frame.

On Jan. 21, AppLovin shares dropped 5.6% after short-seller CapitalWatch released a report alleging that the company had ties to money-laundering networks and had become a channel for illicit funds. The report accused AppLovin of being linked to illegal schemes, enabling unauthorized app installations, and benefiting from advertising linked to criminal activities. It also highlighted heavy insider selling over the previous six months, which further unsettled investors and weighed on the stock.

For FY2025, which ended in December, analysts expect APP’s EPS to grow 105.7% to $9.32 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

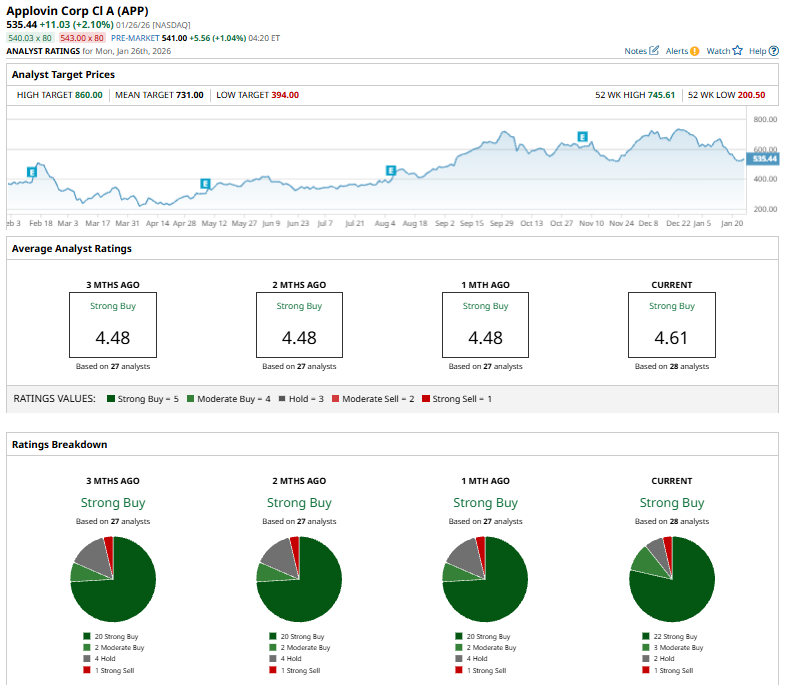

Among the 28 analysts covering APP stock, the consensus is a “Strong Buy.” That’s based on 22 “Strong Buy” ratings, three “Moderate Buys,” two “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with 20 analysts suggesting a “Strong Buy.”

On Jan. 14, Evercore ISI initiated coverage of AppLovin with an “Outperform” rating and a $835 price target, implying about 39% upside, citing its position as a dominant ad-tech platform with strong long-term growth potential. The firm expects revenue and EBITDA to grow at over 30% annually between FY25 and FY28. Supporting this bullish view, Benchmark also reiterated a “Buy” rating last month and raised its price target to $775, pointing to AppLovin’s expanding market opportunity, solid revenue growth, and industry-leading profitability.

The mean price target of $731 represents a 36.5% premium to APP’s current price levels. The Street-high price target of $860 suggests an ambitious upside potential of 60.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)