/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

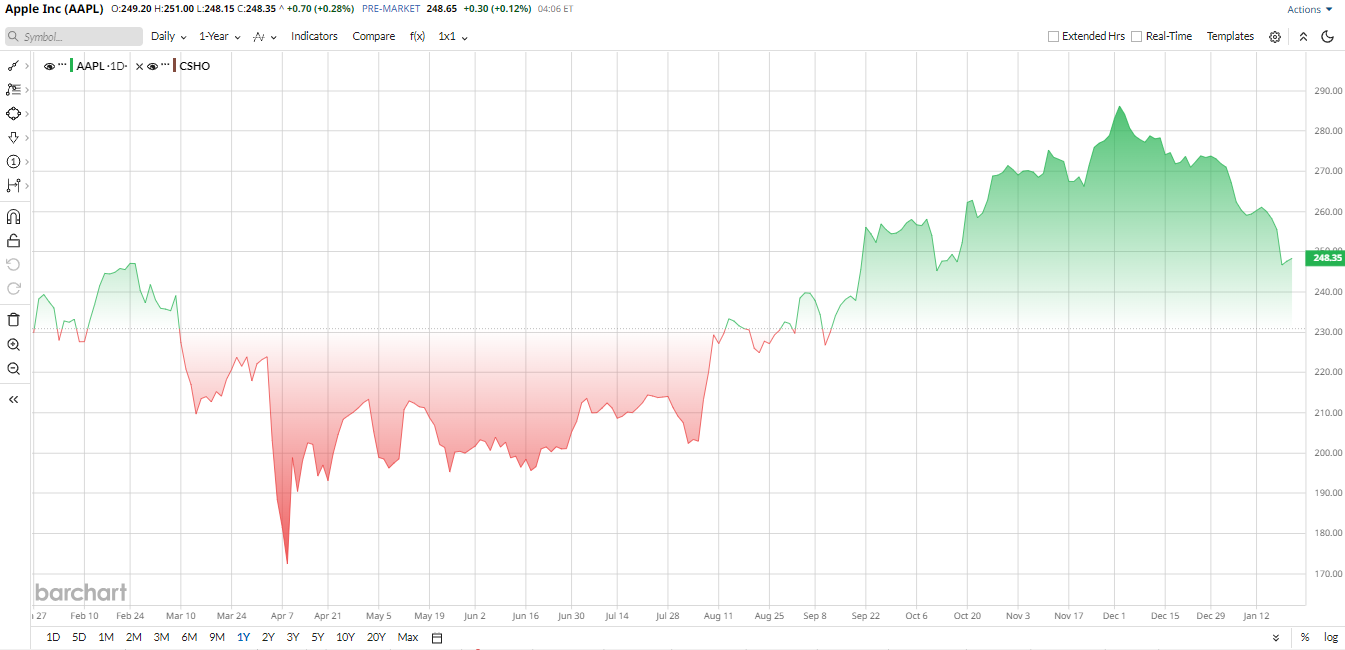

It’s been a choppy run for Apple (AAPL) investors. While an AI-fueled rally lifted many tech names in 2025, Apple’s stock lagged 8.76% year-to-date (YTD) versus a 1% gain for the S&P 500 Index ($SPX), as investors favored high-valuation AI and cloud plays and questioned the pace at which Apple could turn AI into new revenue.

Now comes a potential game-changing product. Reports are surfacing that Apple is developing a wearable AI “pin” that could arrive as soon as 2027. Said to be about the size of an AirTag, it may pack multiple cameras, mics, a speaker and wireless charging.

The idea isn’t untested. Humane (HUM) launched a similar AI pin in 2024 but saw poor uptake and was later acquired by HP (HPQ). So the big question is whether Apple’s design, ecosystem, and scale could create a wearable pin as a real growth catalyst.

Wearable "AI Pin" Potential Impact

Reports reveal that Apple could launch its AI pin as early as 2027. It looks like the company sees an opportunity to tap the wearable-AI market, where rivals such as OpenAI created by former Apple design chief Jony Ive are beginning to enter the market.

However, such an idea is not new. Mentioned earlier, Humane introduced a pin based on AI in 2023, but it did not become popular, selling less than 10,000 units. Apple offers an opportunity to gain a lead where all other companies have failed by its powerful ecosystem linkage to iPhone, Watch, and Vision Pro, and execution capabilities, according to investors. Nevertheless, the Apple pin is reported to be in the preliminary stage of development and may be abandoned.

In the most basic perspective, a wearable AI pin would be a niche product in the Apple line.

On the one hand, it emphasizes Apple's push to establish itself in the AI space and may ultimately broaden the ecosystem. On the other hand, it is unclear whether consumers will embrace another wearable device.

Apple is About To Report Holiday Quarter

Apple’s next report is due Jan. 29, marking the key holiday quarter which usually drives annual highs. Wall Street consensus forecasts revenue of nearly $138.4 billion, up 10.4% year-over-year (YOY) with earnings of $2.65 per share. These targets imply modest growth roughly in line with CEO Tim Cook’s October guidance for 10 to 12% revenue growth and double‑digit iPhone unit growth in the holiday quarter. Notably, Apple said it struggled with iPhone supply constraints, so it may have more pent-up demand in early 2026.

Investors will watch several fundamentals in the earnings report and conference call. First, iPhone demand, especially in China, is the biggest variable. Surveys and promotions will be scrutinized. Apple hinted that iPhones finally qualified for Chinese subsidies late in 2025, which should help Q1 volumes. CFO Parekh said gross margins could be 47-48%, assuming $1.4 billion in holiday tariffs.

Finally, guidance and margin commentary are crucial. Any hints on Apple Intelligence or subscription services (rumored Apple AI or Creator Studio) could also be noted, but the main focus remains iPhones, Macs, and wearables performance.

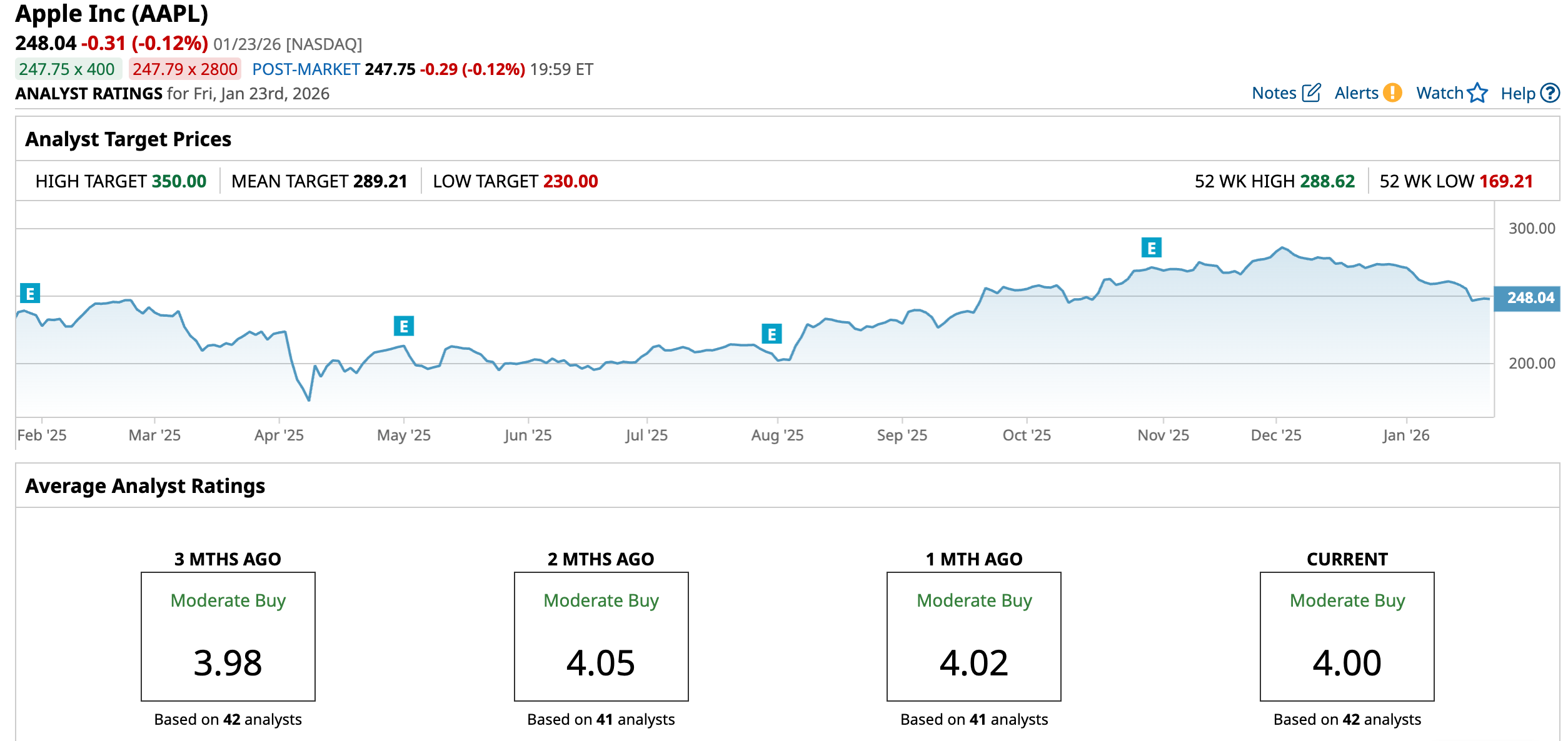

Analyst Outlook and Price Targets

The Street view on Apple is widely positive, with a concentration on the fundamentals. To illustrate, Morgan Stanley has recently increased its 12-month target to $315 and upgraded it to an Overweight rating. Analysts peg this on a 30.46x price-to-earnings of its 2027 EPS forecast of $9.83, and observe that it can be compensated by an increase in costs (memory chips) and sustained iPhone demand.

Equally, Goldman Sachs maintains a “Buy” rating on AAPL and a target of $320. GS believes that the recent pullback is a marketing opportunity before a new iPhone launch. Their projections are a 13% YOY growth in iPhone revenue, in Q1 5% unit growth, and 8% ASP growth, and 14% Services growth.

Even JPMorgan became more positive. Analyst Samik Chatterjee increased his 12-month outlook to $305 by maintaining an “Overweight” rating. He used the optimistic advice given by Apple on the March quarter due to the subsidies in China and the reduction in inventory as a reason. It is an indication that the demand has stabilized because Chatterjee indicated that Apple is now projecting low to mid single-digit increases in revenue next quarter, even with the forex headwinds.

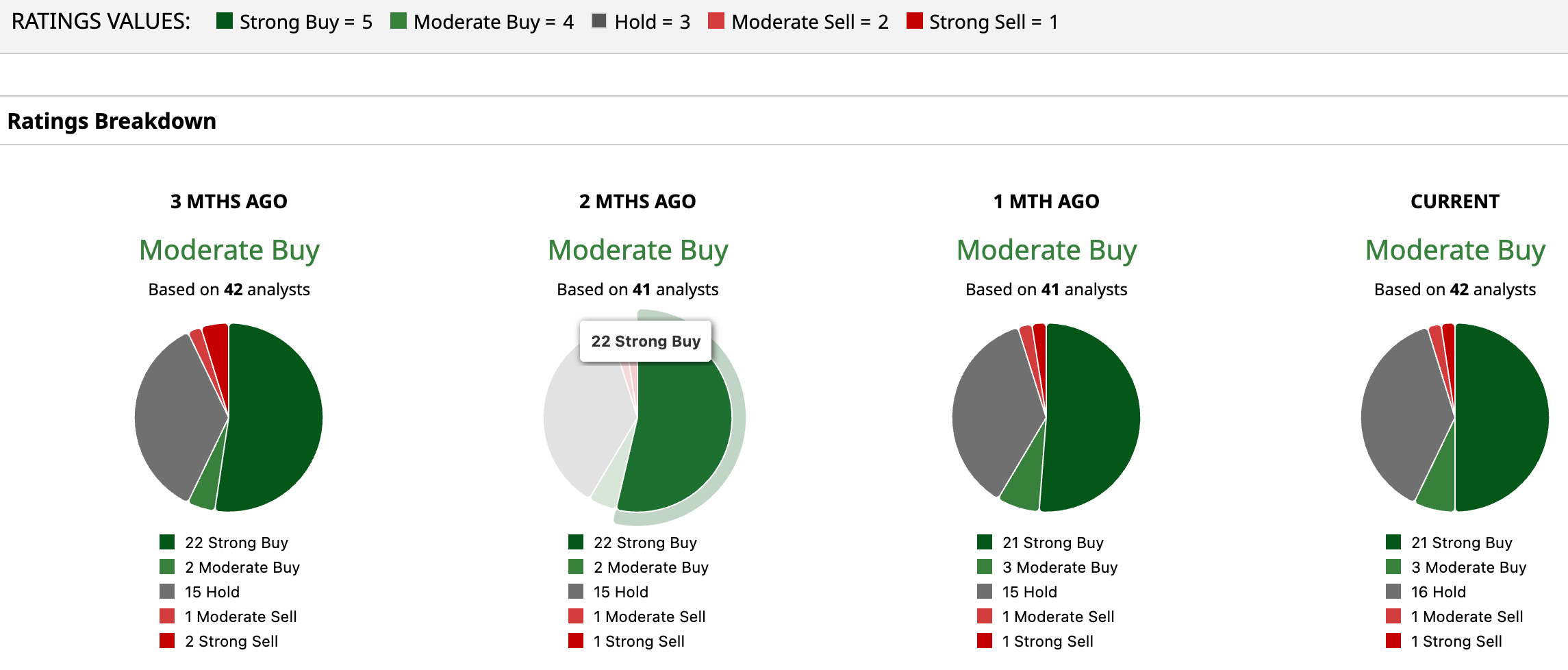

Apple's rating of “Moderate Buy” is shown among 42 analysts, of which 21 rate it, three as a “Moderate Buy,” 16 as a “Hold,” one as a “Moderate Sell,” and one as a “Strong Sell.” The consensus price targets sit at $289.21, suggesting a 16.6% upside potential from current levels. And with a high target price set at $350, the share price could climb 41% from here.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)