The jobs report was the big story on Wednesday. Far better than expected, markets were mostly muted as investors worried that the 130,000 jobs added in January meant no immediate interest rate cuts.

“‘[Wednesday’s] employment report was a 10 out of 10 with positive surprises across the board,’ said Peter Graf at Amova Asset Management Americas. ‘It should quell recent concerns about growth, but puts incoming Fed Chair Warsh in the hot seat — it will be even harder to persuade the FOMC members to go along with the president’s mandate to cut rates,’” Barchart’s Oleksandr Pylypenko reported Graf’s comments.

I’m not so convinced that all is well in the job market. The healthcare industry added 124,000 jobs last month. Without those, the report looks far less optimistic.

America is an aging country. New healthcare jobs are predictable. What is needed are new jobs in tech, industrials, materials, and other sectors of the economy. Manufacturing added just 5,000 new jobs, financial services lost 22,000, and information-related businesses lost 12,000. That’s hardly a booming economy--but I digress.

In yesterday’s unusual options activity, there were 1,149 calls and puts with volume of 500 contracts or higher. Exxon Mobil (XOM) not only had the fourth-highest Vol/OI ratio at 54.65, but it also had 31 of the top 100.

I’m not a big energy follower, but I can’t help but notice how concentrated the options action for XOM was yesterday. Clearly, investors see good times ahead.

There are many bets at play here. Here are three possible strategies to profit from Exxon Mobil’s unusual options activity.

Yesterday’s Exxon Mobil Unusual Options Activity

As I mentioned, XOM had 31 options in the top 100, with all but three calls. I’d say that’s bullish. Barchart’s Options Flow page shows a Net Trade Sentiment of nearly $470 million yesterday, confirming my read on the situation.

Needless to say, the three strategies I suggest will be bullish by nature, leaning heavily on call-focused ideas.

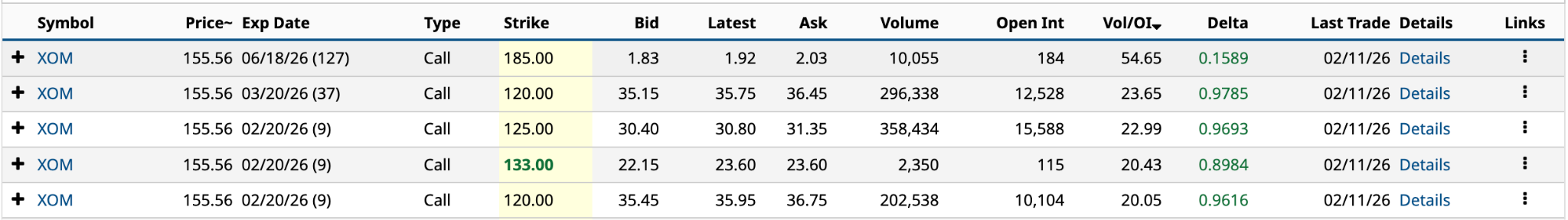

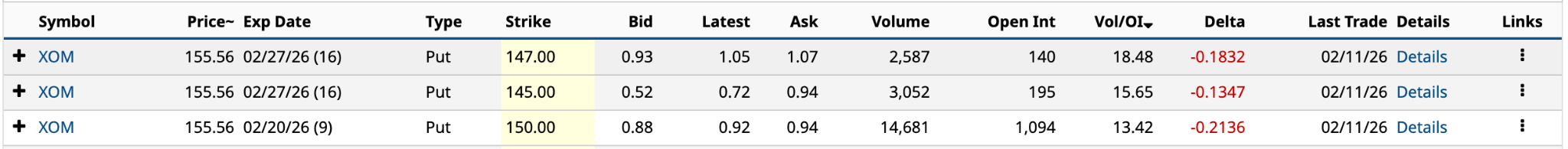

Here are the top five calls and three puts from yesterday’s unusual options activity.

The State of Exxon Mobil’s Business

The company reported its Q4 2025 results on Jan. 30. They were decent. On the top line, its revenue was $82.31 billion, slightly below Wall Street’s $83.18 billion estimate. At the same time, its adjusted earnings per share were $1.71, three cents better than the Zacks Investment Research consensus estimate.

Of the 5.0 million BOE/d (barrels of oil equivalent per day), production from the Permian Basin and Guyana accounted for nearly 54%. While production rose by 300,000 BOE/d, oil prices fell, leading to lower revenue and earnings than in Q4 2024.

At the end of the day, despite low oil prices, it still earned $6.99 a share on an adjusted basis in 2025. It trades at 22.3 times that amount. Exxon Mobil’s free cash flow yield 3.8% based on an enterprise value of $690.2 billion and 2025 free cash flow of $26.1 billion.

To me, that suggests its shares are fairly priced to slightly overvalued. Analysts seem to agree. They have an average target price of $140.56, which is below yesterday's close.

The options traders feel differently.

Options Strategy 1

The most obvious and simplest, if you’re bullish, would be to buy a long call like the June 18 $185 strike or buy XOM shares and sell a call for income. However, I’m interested in multi-leg strategies, where possible.

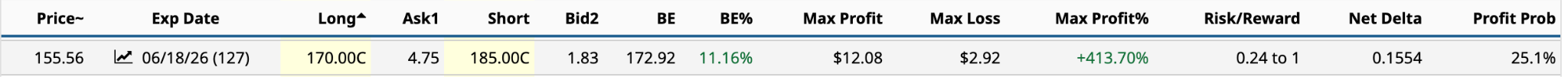

So, the first strategy is the Bull Call Spread, which involves buying a call option and selling a call option at a higher strike price. The short call reduces the cost of the vertical spread. Based on yesterday’s unusual options activity, buy a June 18 $170 call (Vol/OI ratio of 3.83) and sell the June 18 $185 call.

Based on the information above, the most you can lose on this bet is $2.92, which is a low 1.9% of XOM’s share price. Your maximum profit is $12.08, a risk/reward ratio of just 0.24 to 1. The only downside — the likelihood that the share price at expiration is above the $172.92 breakeven [$170 strike + $2.92 net debit] is just 25.1%, or 1 in 4. To obtain your maximum profit, the share price would have to appreciate by 18.9% to $185. The expected move is just 10.68%.

Options Strategy 2

The second options strategy is a Covered Strangle, which involves buying 100 shares of XOM, selling a call OTM, and selling a put OTM. The covered stangle, or covered combination, is the combination of the covered call and cash-secured put.

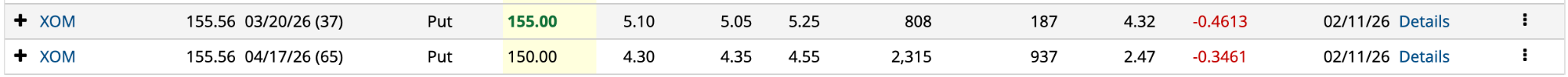

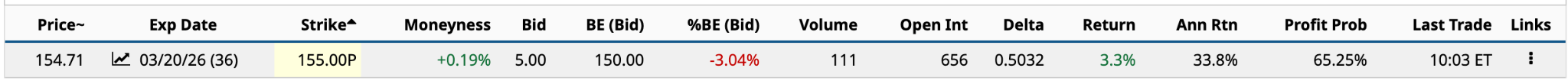

I’m ideally looking for a DTE of 30-45 days. Therefore, for the put, I’m not going to use one of the three top-100 unusually active options because the DTEs are 16 days or less. Two puts came close to fitting the bill. Even though they’re not quite OTM, I’ll try to make it work.

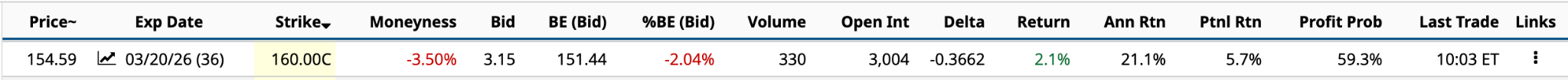

Unfortunately, no calls from yesterday’s unusual options activity had a 37-day DTE and were OTM. I’ll substitute another call expiring on March 20.

The data for this $160 call is from Thursday mid-morning trading.

So, in this example, I’d buy 100 shares of XOM at $154.59 each. I’d sell one March 20 $160 call for $3.15 in premium, one March 20 $155 put for $5.00 in premium. While there’s a possibility of assignment for both the call and put, it’s unlikely.

Assuming the share price at expiration is above $155 and below $160, I’d pocket $815 in income, an annualized return of 53.7% [$815 premium / $154.71 share price * 365 / 36].

Now, if you’re bullish, it’s not the end of the world if the put is assigned and you have to buy another 100 shares. However, the profit on the ExxonMobil shares bought is capped at $5.29 each [$160 short call - $154.71 share price] if the share price is higher than that at expiration and the shares are assigned to the buyer of the call.

Options Strategy 3

The final strategy is a Long Ratio Call Spread. It hopes to benefit from a sharp move higher in Exxon Mobil’s share price. It involves selling one call short and buying two calls long with the same expiration date. The strike price of the two long calls is higher than the strike price of the short call. Think of this strategy as combining a Bear Call Spread and a long call.

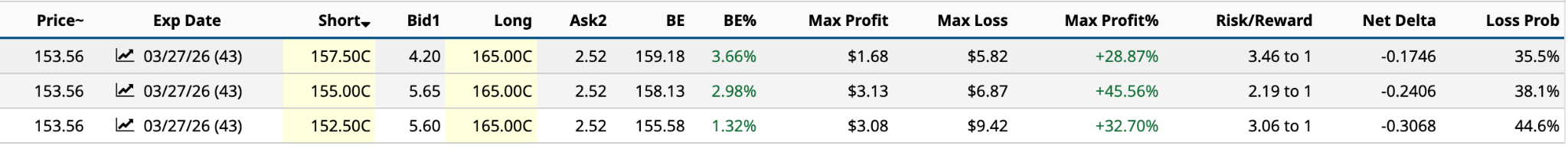

In this situation, the short call’s strike price should be ATM, while the two long calls should be OTM, or as close as possible. A 30-60-day expiration is ideal. There were nine unusually active calls with DTEs between 30 and 60 days. Unfortunately, all were deep ITM.

Instead, I’ve focused on the March 27 expiration, a 43-day DTE, for the bear call spread. The $152.50 short call is ITM by 86 cents, while the $155 is $1.44 OTM. I’d go with the $155. The maximum loss is much lower, while the maximum profit is five cents higher.

Now, remember, you also have to buy a second $165 long call to complete the long ratio call spread. So, your net credit is $0.61 [$5.65 bid price - 2 * $2.52 ask price]. Your maximum loss is $9.39 [$165 strike price - $155 strike price - $0.61 net credit] or 6.1% of the share price. The maximum loss happens if the share price at expiration is $165 on the nose.

Your maximum profit? The sky’s the limit with a catch.

Because there is a net credit, there are two breakevens: one for the $155 strike and one for the $165 strike. The former is $155.61 [$155 strike price + $0.61 net credit], while the latter is $174.39 [$165 strike price + $9.39 maximum loss].

So, let’s consider three share prices at expiration: $150, $165, and $180.

At $150, the long call ratio spread gains $5.61 [$155 strike - $150 share price + $0.61 net credit] -- the two calls expire worthless. At $165, the strategy generates a maximum loss of $9.39; the two calls expire worthless; and at $180, the strategy delivers a $30.61 profit [2 * $180 share price - $165 strike price + $0.61 net credit], an annualized return of 169%.

Unlikely, but not too shabby, nonetheless.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.