Intel (INTC) has a long way to go to truly establish credibility, at least among some skeptics. Sure, you can point to the excellent performance of INTC stock in recent sessions. However, the rally still doesn’t erase the fact that over the past five years, the security is down about 22%. However, what’s really interesting here is that the smart money is refusing the opportunity to heavily insure against downside risk.

Let’s look at the facts. On a year-to-date basis, INTC stock is up a very impressive 31%. In the past 52 weeks, the resurgent chipmaker has gained nearly 115% in market value. Unsurprisingly, the Barchart Technical Opinion indicator rates Intel as an 88% Strong Buy. It’s also interesting to point out that the Top Trade Alerts screener last flashed a Sell signal in August of last year. Still, this also raises some questions.

Primarily, with such a long run of optimism, it’s only natural for a corrective cycle to occur. People are already shaky about the innovation sector and especially about a possible bubble popping in artificial intelligence. Given that INTC stock still needs to prove itself, now would be a good time to either trim exposure or engage in concerted hedging activity.

We just don’t see much evidence of these action items.

First, options flow — which focuses exclusively on big block transactions likely placed by institutional investors — shows that in the month so far, net trade sentiment is overwhelmingly positive when viewed from a cumulative basis. Also, some of the most bullish transactions are debit-based calls, suggesting that INTC stock must rise to certain profitability thresholds to be beneficial for contract holders.

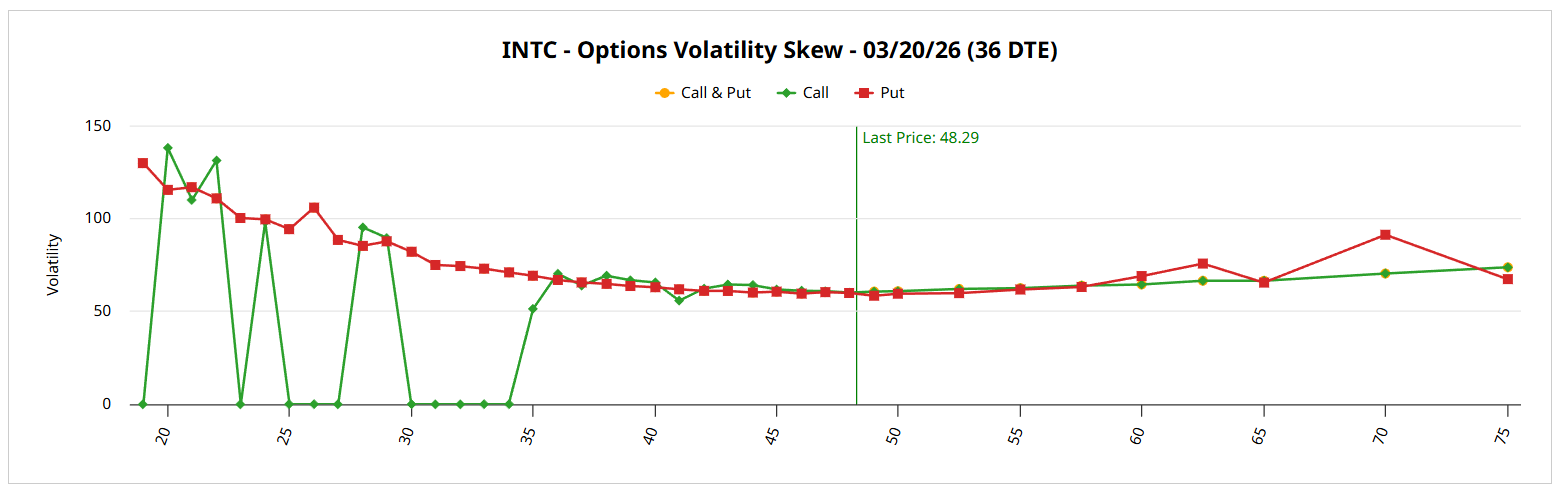

Second, volatility skew for the March 20 options chain reveals that there is limited urgency for downside protection. On the lower strike boundaries, implied volatility (IV) pricing for calls actually rises above puts for many strikes. For levels near the spot price, both put and call IV curvatures are relatively flat, indicating a lack of prioritization for insuring against a corrective cycle.

It doesn’t mean that a correction won’t occur — but the smart money failing to price in a contingency plan seems to be a significant detail.

Establishing the Trading Parameters of INTC Stock

While we now have a general understanding of smart money sentiments, we’re still at a loss as to how this may translate into actual price outcomes. For that, we may turn to the Black-Scholes-derived Expected Move calculator. Wall Street’s standard mechanism for pricing options calculates that Intel stock may land between $42.08 and $54.50 for the March 20 expiration date.

Where does this dispersion come from? Black-Scholes assumes a world where stock market returns are lognormally distributed. Under this framework, the above range represents where INTC stock may symmetrically fall one standard deviation away from spot (while accounting for volatility and days to expiration).

Mathematically, the dispersion is likely a realistic one. What Black-Scholes is saying is that in 68% of cases, we would expect Intel stock to trade within the prescribed range when the expiration date flashes. Again, that’s a fair take, in large part because it would require an extraordinary catalyst to move a security beyond one standard deviation from spot.

However, the challenge here is that we’re not necessarily interested in understanding how uncertainty is priced; as retail traders (who typically prefer debit-based strategies), we want to know whether that pricing is accurate or not. As such, we would require another model to take observed uncertainty and break it down into conditioned observations.

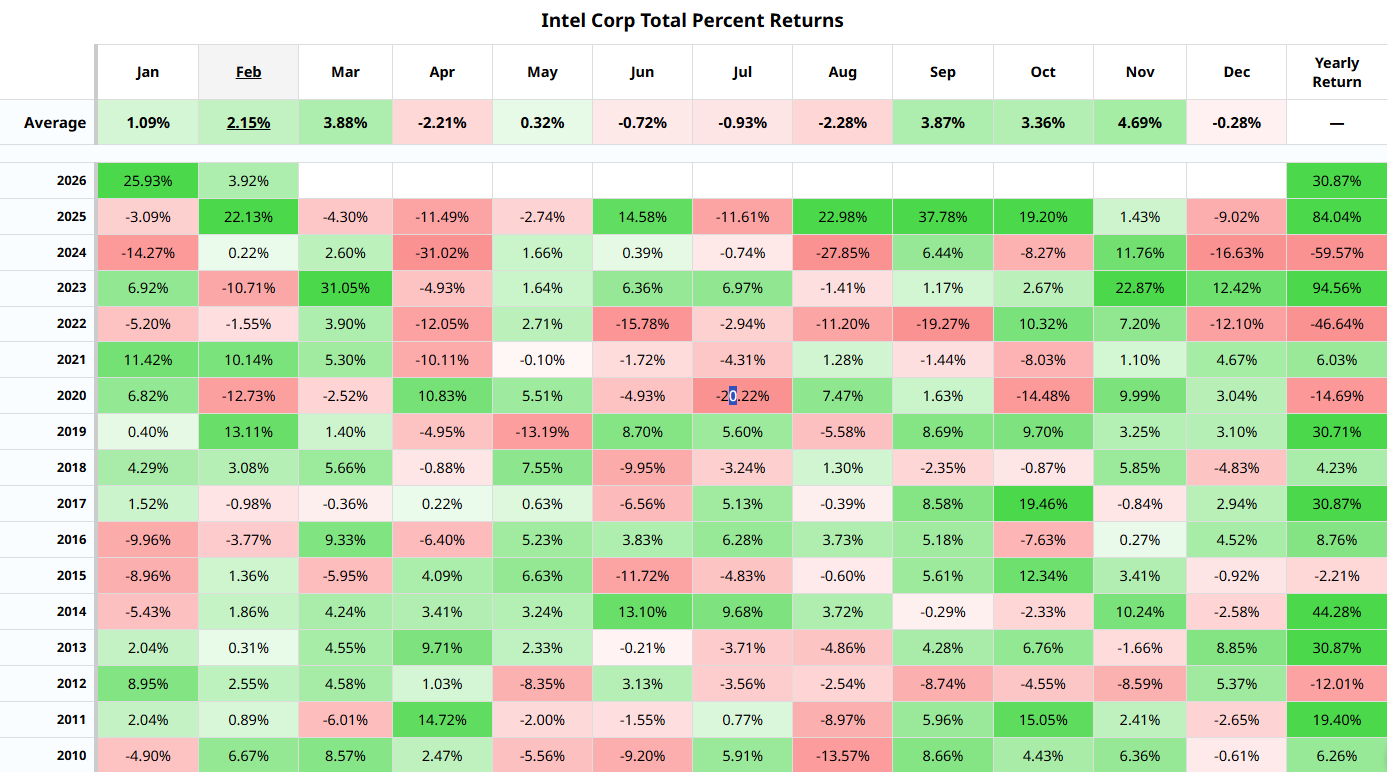

That’s going to be difficult without departing the reservation. However, for a name with an extensive trading record like Intel stock, we can use Barchart’s Seasonal Returns heatmap. We’re focused on the March 20 expiration date and for that month, INTC generally demonstrates an upward bias.

Eyeballing a rough median, we’re probably looking at upside of around 4%, which would likely take the security to nearly $50. Recall that Black-Scholes is targeting a price dispersion of between $42.08 and $54.50. So, a $50 price would not only represent a natural psychological target but a realistic one (within one standard deviation).

Putting Two and Two Together

Staying strictly on the analytical tools offered by Barchart, it’s possible that the most efficient options strategy is the 49/50 bull call spread expiring March 20. This wager involves two simultaneous transactions: buy the $49 call and sell the $50 call, for a net debit paid of $45 (the most that can be lost).

Should INTC stock rise through the second-leg strike ($50) at expiration, the maximum profit would be $55, a payout of over 122%. Breakeven lands at $49.45, thereby improving the trade’s probabilistic credibility.

Obviously, more aggressive spreads will get you a much bigger reward. However, the season returns suggest that the $50 level is reasonable. Also, while volatility skew doesn’t show downside insurance prioritization, it’s not like the smart money is gunning for big swings upward either. Therefore, the above spread arguably provides the most balanced compromise.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)