Milpitas, California-based Sandisk Corporation (SNDK) develops, manufactures, and sells data storage devices and solutions using NAND flash technology. Valued at $73.5 billion by market cap, the company offers memory cards and readers, USB flash, micro SD cards, and digital audio players. The flash memory titan is expected to announce its fiscal second-quarter earnings for 2026 after the market closes on Thursday, Jan. 29.

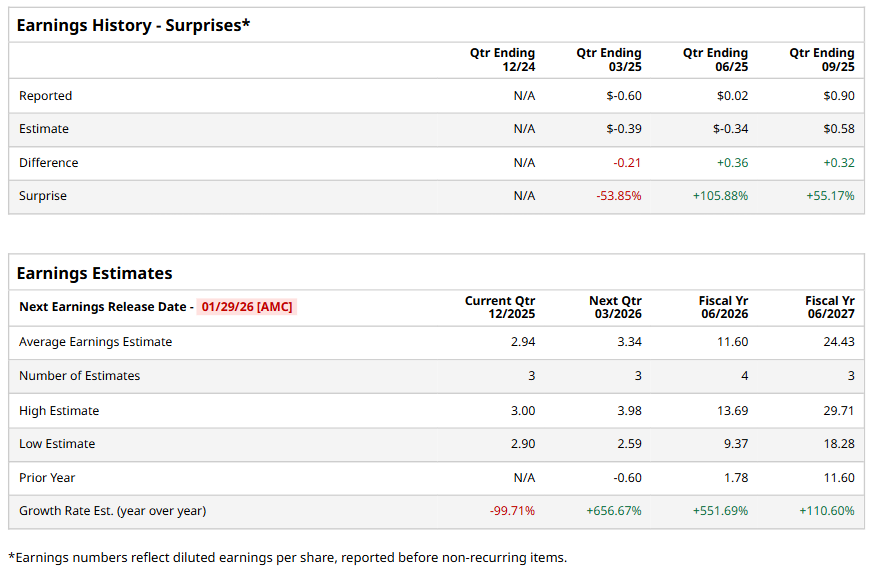

Ahead of the event, analysts expect SNDK to report a profit of $2.94 per share on a diluted basis, down 99.7% from the year-ago quarter. The company beat the consensus estimates in two of the last three quarters while missing the forecast on another occasion.

For the full year, analysts expect SNDK to report EPS of $11.60, up 551.7% from $1.78 in fiscal 2025. Its EPS is expected to rise 110.6% year over year to $24.43 in fiscal 2027.

SNDK stock has notably outperformed the S&P 500 Index’s ($SPX) 1% gain on a YTD basis, with shares up 112.1% during this period. Similarly, it considerably outperformed the Technology Select Sector SPDR Fund’s (XLK) marginal gains over the same time frame.

Sandisk's outperformance is driven by strong demand for high-capacity SSDs, fueled by AI and data centers. Its BiCS8 tech and vertical integration give it an edge, with NAND prices rising due to tight supply. Strategic partnerships with hyperscalers and growing data center demand further boost prospects.

On Nov. 6, 2025, SNDK reported its Q1 results, and its shares surged 27.2% in the subsequent two trading sessions. Its adjusted EPS came in at $1.22, down 32.6% year over year. The company’s revenue increased 22.6% year over year to $2.3 billion.

Analysts’ consensus opinion on SNDK stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 21 analysts covering the stock, 14 advise a “Strong Buy” rating, and seven give a “Hold.” While SNDK currently trades above its mean price target of $359.06, the Street-high price target of $580 suggests an upside potential of 15.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)