/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

SanDisk (SNDK) was spun off from Western Digital (WDC) last February, marking a strategic separation to unlock value in its flash memory business. Since then, the company has delivered a master class in market dominance, capitalizing on surging demand for NAND flash driven by artificial intelligence (AI) and data centers.

The stock has skyrocketed around 1,100% since the spinoff, outpacing broader indices as analysts scramble to adjust. Price targets have been repeatedly hiked to reflect this momentum, with Citi raising theirs yesterday by 75% to $490, sparking a 10.6% jump in shares to close at $501.29.

Yet with its meteoric rise, have investors missed their chance to buy in, or does SanDisk's trajectory still offer upside because of ongoing industry tailwinds?

About SanDisk Stock

SanDisk designs, develops, manufactures, and markets NAND flash memory storage solutions, including solid-state drives (SSDs), memory cards, and embedded storage for consumer electronics, data centers, and enterprise applications. Headquartered in Milpitas, California, the company benefits from its expertise in high-performance memory chips, which are in high demand due to the explosion in AI workloads, cloud computing, and big data processing. Hyperscalers like Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) rely on these chips for efficient, high-speed storage in servers.

In 2026, SNDK stock has already surged 105%, vastly outperforming the S&P 500's ($SPX) modest 0.76% gain over the same period. This reflects strong investor enthusiasm for SanDisk's positioning in the AI boom.

Valuation metrics paint a picture of premium pricing amid growth expectations. The trailing P/E is unavailable due to recent losses, but the forward P/E stands at 35.64, higher than the semiconductor industry average of around 25, indicating investors are paying more for anticipated earnings growth. Forward price-to-sales is 6.72, or 52% of the peer average of 4.4, suggesting the stock is expensive relative to revenue but justified by projected expansion. The PEG ratio of 0.27 implies that if growth materializes at 95%, as some forecasts suggest, the valuation could appear cheap.

Compared to its brief post-spin-off history and industry norms, SNDK appears fairly to somewhat undervalued, balancing its high-growth potential against current premiums.

Can Anything Hold SanDisk Back?

The global shortage of advanced memory chips shows no signs of abating, fueled by insatiable AI and data center demand. NAND prices have risen sharply, with some categories up over 50% in 2025, and projections indicate continued increases into 2026 as supply lags 20% to 22% growth in demand. This pricing power benefits SanDisk, which has capitalized on the crunch to boost margins and revenue.

A key strength is SanDisk's vertical integration, spanning from wafer fabrication to SSD assembly. This end-to-end control reduces dependency on third-party suppliers, enabling faster innovation and cost efficiencies. It provides a competitive edge in supplying hyperscalers, who require reliable, high-capacity solutions for massive datasets. By owning the production chain, SanDisk can optimize yields and respond swiftly to market shifts, unlike its fragmented competitors.

Moreover, the company's expertise in high-bandwidth memory solutions minimizes risks from price volatility. Advanced architectures like TLC and QLC NAND allow for denser, more efficient storage, shielding against cyclical downturns in consumer segments. Now separated from Western Digital, SanDisk has greater financial flexibility, freeing up capital for aggressive R&D investments.

These efforts focus on enhancing product density and energy efficiency, with next-gen chips promising up to double the capacity at lower power. Analysts expect this to expand market share, particularly in enterprise SSDs, which are forecast to see the steepest price increases of 40% in Q1 2026.

While challenges like leverage (debt-to-equity at 0.14) and negative ROE remain from the transition, SanDisk's strategic focus positions it well. If AI adoption accelerates, momentum should continue, though any slowdown in tech spending might temper gains. Overall, structural tailwinds suggest SanDisk can maintain its surge, though at a potentially moderated pace.

What Do Analysts Expect for SNDK Stock?

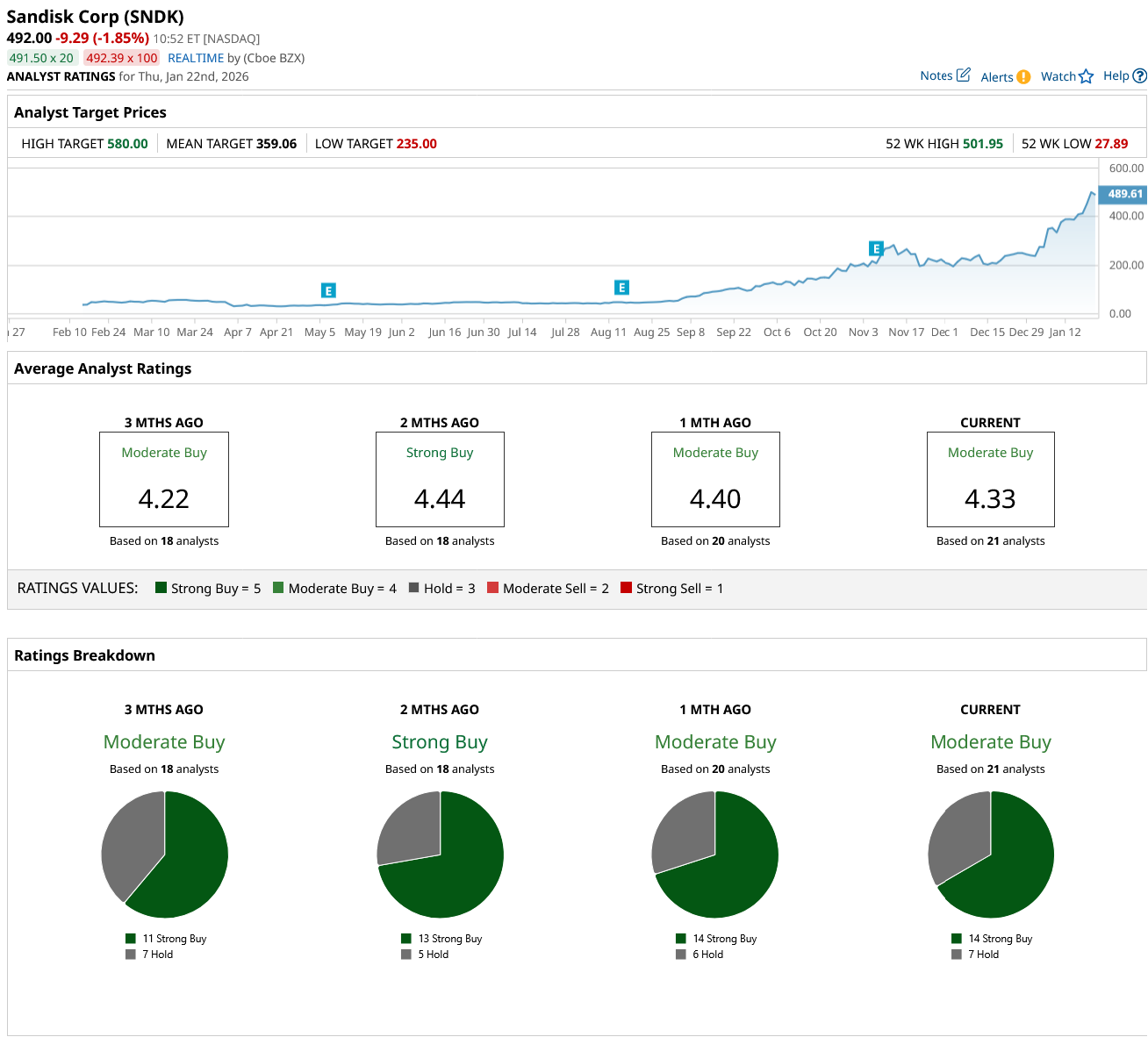

From Barchart's internal data, SNDK stock holds a consensus "Moderate Buy" rating based on 21 analysts, with 14 rating it a "Strong Buy" and seven rating it a "Hold," reflecting optimism tempered by valuation concerns. Recent months have seen a bullish shift, with multiple upgrades this month, including Citi's hike to $490 (Buy), Bernstein to $580 (from $300), and Benchmark to $450 (from $260). Consensus opinion has improved from three months ago, driven by NAND shortages and AI demand.

The mean price target is $359.06, with a low of $235 and a high of $580. Based on yesterday's close, its mean target represents a potential downside of 28%. This reflects caution after the rapid run-up, though upside outliers like Bernstein suggest 16% potential gains if growth exceeds expectations.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)