With a market cap of $13.5 billion, Hormel Foods Corporation (HRL) is a nearly 135-year-old American multinational food company. Headquartered in Austin, Minnesota, the company is a global branded food manufacturer, processor, and distributor with a presence in more than 80 countries. The company produces a wide range of meat and grocery products, including fresh and refrigerated items such as bacon, sausages, hams and prepared proteins, as well as shelf-stable foods like canned luncheon meats, snacks, nut butters and chili.

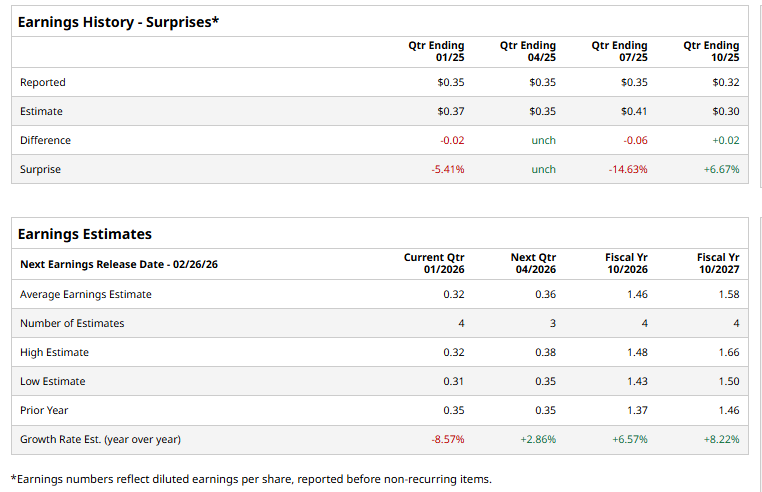

The food titan is expected to announce its fiscal Q1 2026 results soon. Ahead of this event, analysts expect Hormel Foods to report an adjusted EPS of $0.32, down 8.6% from $0.35 in the year-ago quarter. It has met or surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect the company report an adjusted EPS of $1.46, 6.6% increase from $1.37 in fiscal 2024.

Shares of Hormel Foods have declined 20.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.7% increase and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.2% rise over the same period.

Hormel Foods has trailed the broader market over the past year primarily due to weakening operating fundamentals and limited earnings momentum. The company has experienced a decline in sales volumes, with average quarterly volumes falling about 2.5% over the past two years, signaling softer demand in its core consumer staples business. At the same time, Hormel’s relatively low gross margin of around 16.4% reflects weak pricing power and intense competition, which have constrained profitability. These pressures have contributed to a steady decline in earnings, with EPS falling at an annual rate of roughly 9% over the past three years.

But, Hormel shares rose 3.2% on Dec. 4, after the company issued an upbeat outlook for fiscal 2026, outweighing its mixed third-quarter performance. While third-quarter revenue of $3.19 billion slightly missed expectations, adjusted earnings of $0.32 per share beat forecasts. Investors focused on Hormel’s stronger-than-expected guidance, which projected fiscal 2026 adjusted EPS of $1.43 to $1.51 on revenues of $12.2 billion to $12.5 billion, despite ongoing pressure from high input costs.

Analysts' consensus view on HRL stock is cautiously bullish, with an overall "Moderate Buy" rating. Among 10 analysts covering the stock, three recommend "Strong Buy" and seven suggest "Hold." The average analyst price target for Hormel Foods is $27.14, indicating a potential upside of 11.1% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)