/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

Nebius (NBIS), which provides artificial intelligence (AI) services and infrastructure to data centers, recently announced that it has been chosen by Israel to launch and manage the country's supercomputer system. Given this deal and other agreements that Nebius has made, it's clear that the company has top-notch technology, and the firm is well-positioned to benefit tremendously from the continued rapid growth of AI.

Nonetheless, its valuation is rather high. And at a time when investors' enthusiasm for AI-infrastructure stocks appears to be stalling, one of Nebius' competitors seems to be a safer alternative. Therefore, I would not advise buying NBIS stock now, but the shares could very well become a buy down the road.

About Nebius

The company's graphics processing unit (GPU) chips and other hardware, based in data centers, are used by major hyperscalers, including Microsoft (MSFT) and Meta Platforms (META) to develop AI. Nebius also has other customers in several different sectors, including robotics, healthcare, finance, and government. Founder Arkady Volozh serves as the CEO of the company, which has also moved into launching and servicing supercomputers. Volozh holds Israeli citizenship and has called himself “an Israeli businessman."

In the third quarter, Nebius' revenue climbed 39% versus the same period a year earlier to $146.1 million, while its EBITDA loss, excluding certain items, narrowed sharply to $5.2 million from -$45.9 million in Q3 of 2024.

NBIS has a trailing price-to-sales (P/S) ratio of 66x. But based on analysts' average 2026 sales estimate for the firm of $3.45 billion, its forward P/S ratio is about 8x.

Nebius' Technology Has Been Extensively Validated and It's Growing Rapidly

In addition to Israel, Microsoft and Meta have also signed major deals with the startup. Specifically, Nebius in November disclosed a multi-year agreement with Microsoft valued between $17.4 billion and $19.4 billion. In November, NBIS announced that it had obtained a five-year deal with Meta worth about $3 billion.

On the growth front, in the 12 months that ended in September, the startup's total revenue came in at $363.3 million, versus $117.5 million in 2024. Its deals with Microsoft and Meta will supercharge its growth going forward.

AI Infrastructure Stocks Have Been Stalling

Amid high valuations, doubts about the sustainability of some companies' gigantic investments in AI, and macro concerns, AI infrastructure plays have not performed very well in the last several months. For example, Nvidia (NVDA) , the most prominent AI infrastructure play, closed at $178.07 on Jan. 20, down from $202.49 on Oct. 31, 2025.

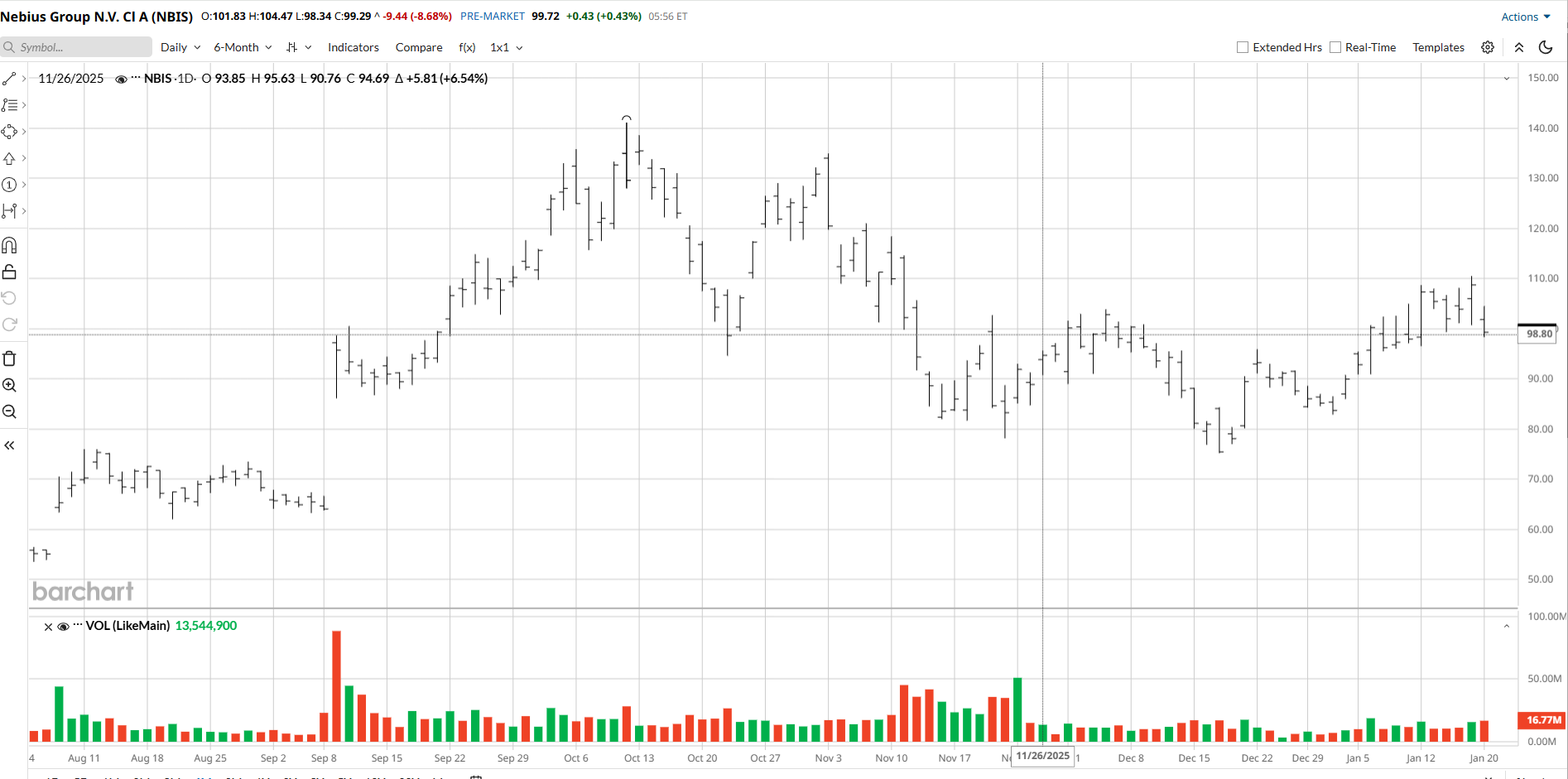

Nebius itself closed at $99.29 on Jan. 20, down from $130.82 on Oct. 31, 2025. What's more, according to Barchart's technical analysis, NBIS “is a 56% Buy with a Weakest short term outlook on maintaining the current direction.” That's not exactly a ringing endorsement.

A Better, Safer Play

CoreWeave (CRWV), one of Nebius' competitors, also has a very formidable list of customers and is similarly growing very rapidly. However, CRWV's trailing P/S ratio is 8.9x, much lower than Nebius' 66x. And while CoreWeave's operating cash flow in the 12 months that ended in September came in at $1.685 billion, Nebius’ equivalent figure was -$524 million.

Finally, while 15% of Nebius' shares outstanding were shorted as of Dec. 31, 2025, the equivalent figure was just 10.6% for CRWV. Although stocks with high short interest can rocket higher if they rally, in my experience, they're also much more likely to fall sharply if the underlying company stumbles or if the sector falls out of favor with the Street. Moreover, it's typically harder for heavily shorted stocks to start rallying.

The Bottom Line on NBIS

If the Street starts loving AI infrastructure stocks again or if NBIS stock drops sharply, the name would likely be worth buying. But for now, with CRWV also growing rapidly and carrying significantly less risk at a challenging time for the sector, it's clearly the better choice.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)