/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon stock (AMZN) could be undervalued here, especially given its high put option yields over the next month. The market fears another drop in free cash flow (FCF) as occurred in Q3. However, analysts have been raising their price targets (PTs) in the past two months.

AMZN is at $234.11 in midday trading on Tuesday, Jan. 20. After Amazon released its Q3 results on Oct. 30, AMZN initially spiked to over $253, but later dropped to $217.14 on Nov. 30. Since then, it has slowly drifted higher.

Anticipating Amazon's Results

But AMZN could be worth more. I discussed this in my Oct. 31, 2025, Barchart article after the Q3 results ("Amazon's Revenue Beat Surprises Analysts and Its Cash Flow Surges (Not FCF) - AMZN Stock Could Still Be Undervalued.")

Amazon's free cash flow (FCF) over the trailing 12 months (TTM) actually fell in Q3 from $18.2 billion to $14.8 billion, as shown on page 10 of its release. Moreover, its TTM FCF margin dropped from 2.7% in the prior quarter to 2.14%. This was due to its heavy capex spending related to AI initiatives.

However, I showed that AMZN stock could be worth $311.50 based on its strong operating cash flow (OCF) - i.e., cash flow before capex spending.

Nevertheless, if Amazon produces higher free cash flow (FCF) this past quarter (i.e., over the trailing 12-month period), AMZN stock could rally.

Analyst Price Targets (PTs)

This seems to be what analysts are expecting. For example, Yahoo! Finance now shows that 67 analysts have an average PT of $295.63. That's up from $280.77 on Oct. 31, 2025, as seen in my Barchart article.

Barchart's mean analyst survey PT is now $294.44, up from $268.84 on Oct. 31.

The point is that AMZN stock could be undervalued, based on its expected FCF and analysts' price targets.

However, there is one more indicator - a contrarian data point - that may imply AMZN stock is cheap: high put option premiums for the next month.

High AMZN Put Yields - Worth Shorting

Short put yield play yields have been rising. This can be seen from an earlier Barchart article, comparing the short-put yield then to today's yield.

For example, I discussed this in my more recent Nov. 28, 2025, Barchart article ("Shorting Secured Out-of-the-Money Amazon Puts Works Here").

At the time, AMZN was at $232.38, close to today's price, but a one-month (12-26-25 expiry) short-put yield (at 3.17% below the trading price) was 2.0% (i.e., $4.53/$220.00). (The trade worked out as AMZN closed at $232.52 on Dec. 26.)

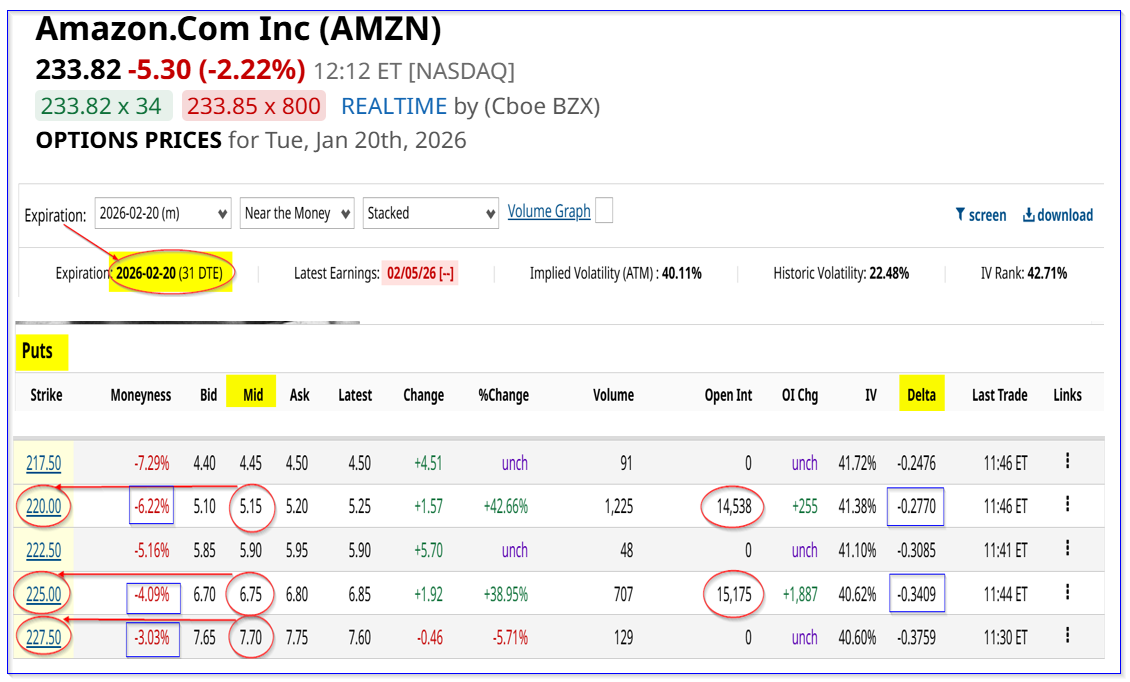

Today, a similar one-month 3% out-of-the-money short put yield (i.e., expiring Feb. 20, 2026) provides a 3.385% one-month cash-secured put yield. That's +69% higher than at the end of November.

This is evident in the table above. It shows that the $227.50 put contract expiring Feb. 20, 2026, has a $7.70 midpoint premium.

That means an investor who secures $22,750 with their brokerage firm, and enters an order to “Sell to Open” 1 put contract at $227.50, can immediately earn $770. That represents a 3.385% income yield for the next month (i.e., $770/$22,750).

Moreover, look at the huge volume of contracts at the $225.00 and the $220.00 strike price put contracts. These imply that investors could expect AMZN to drop to between $220 to $225 after its expected Feb. 3, 2026, earnings release.

Just to be conservative, look at the $220.00 exercise price, which has a large volume of contracts outstanding. The midpoint premium is $5.15 today.

That implies an investor who does a cash-secured short-put play can make $515 immediately on an investment of $22,000. That works out to a one-month yield of 2.34% for a strike price that is over 6% out-of-the-money.

This is still higher than the 2.0% yield at the end of November for a 3% OTM short-put play. In fact, the $4.45 premium available at the $217.50 strike price is close to the $4.53 in Nov. for the $220.00 strike price. But the strike price is lower this time, although the yields are similar at 2.0%.

Contrarian Indicator

The point is that with higher yields, investors are already pricing in a drop in AMZN stock.

That could be a contrarian indicator, as all the put option buying implies negative AMZN sentiment. If earnings come in better than expected, AMZN could rally.

Nevertheless, even if AMZN falls, a short-put play at $220.00 has an attractive breakeven point (i.e., $220.00 - $5.15 = $214.85). That is over 8% lower than today's price and provides a good entry point for investors in AMZN stock.

The bottom line is that AMZN stock could be undervalued here, and shorting OTM puts may be a good play here.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)