With a market cap of $37.2 billion, Keurig Dr Pepper Inc. (KDP) is a leading beverage and coffee company that owns, manufactures, and distributes a wide portfolio of beverages and single-serve brewing systems across the United States and internationally. It operates through the U.S. Refreshment Beverages, U.S. Coffee, and International segments, offering well-known brands such as Dr Pepper, 7UP, Snapple, Green Mountain Coffee Roasters, and Starbucks.

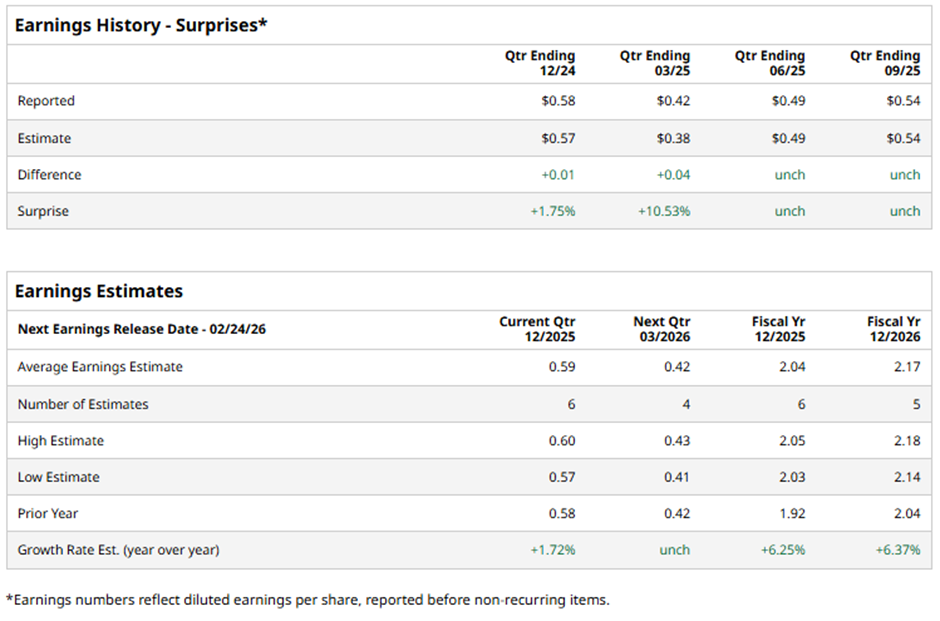

The Burlington, Massachusetts-based company is set to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect KDP to report an adjusted EPS of $0.59, up 1.7% from $0.58 in the year-ago quarter. It has met or surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the beverage giant to report an adjusted EPS of $2.04, a rise of 6.3% from $1.92 in fiscal 2024. Moreover, adjusted EPS is expected to grow 6.4% year-over-year to $2.17 in fiscal 2026.

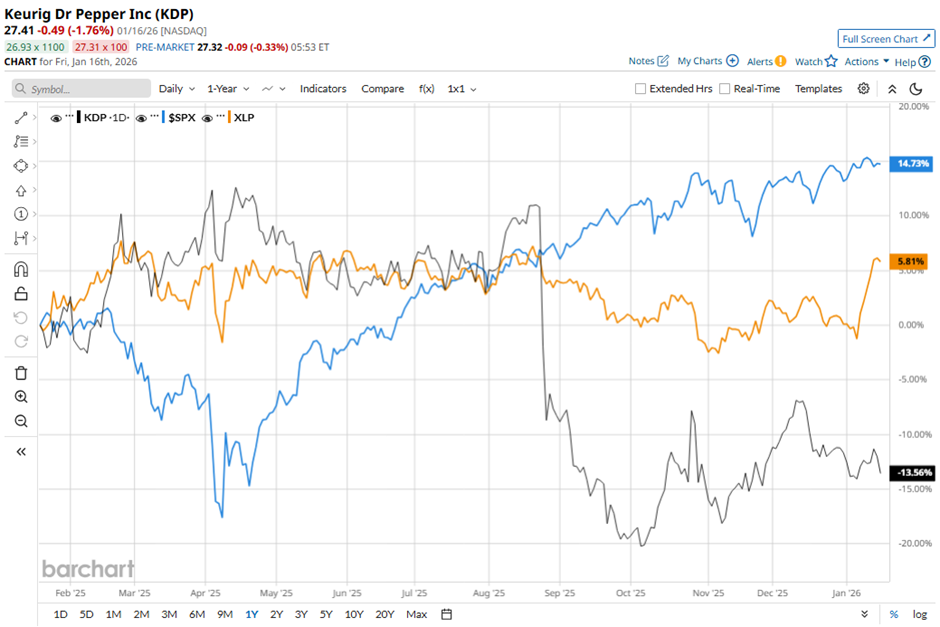

Shares of Keurig Dr Pepper have declined 12.4% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.9% increase and the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 6.9% return over the same period.

Shares of Keurig Dr Pepper climbed 7.6% on Oct. 27 after the company reported strong Q3 2025 results, with net sales rising 10.7% to $4.31 billion and adjusted EPS increasing 5.9% to $0.54. Growth was driven by robust performance in U.S. Refreshment Beverages, where sales surged 14.4%, aided by the GHOST acquisition contributing 7.2 percentage points to volume growth. Investor confidence was further boosted as KDP raised its full-year constant currency net sales growth outlook to a high-single-digit range.

Analysts' consensus view on KDP’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 15 analysts covering the stock, seven recommend "Strong Buy," one suggests "Moderate Buy," six indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Keurig Dr Pepper is $34.47, suggesting a potential upside of 25.8% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)