/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Cathie Wood’s Ark Invest began the new year with a focus on innovation themes like autonomy, gene editing, and advanced air mobility. Wood added names like Archer Aviation (ACHR) and Joby Aviation (JOBY), as well as Deere and Company (DE) as a growing autonomy play. Ark Invest also added some healthcare names to its holdings. However, one name that stood out in particular was Palantir; Wood let go of approximately 58,000 shares of the software company.

The PLTR stock sale has a lot to do with profit taking and rebalancing, and amounts to less than 15% of Wood's total stake in the company. So, it doesn’t necessarily suggest there's anything wrong with the company, which is going strong. For example, Wedbush analyst Dan Ives selected Palantir stock as one of his top picks for 2026. Ives believes Palantir is on its way to becoming a trillion-dollar company.

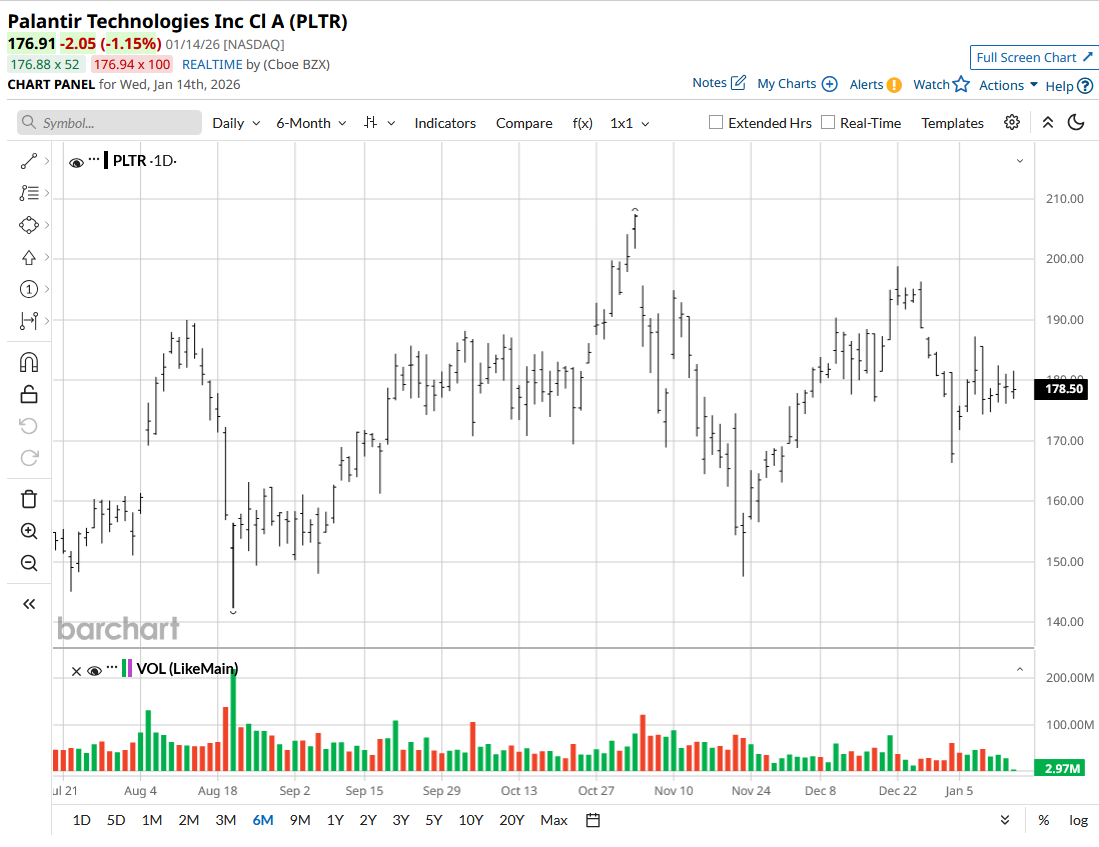

Citigroup analyst Tyler Radke also upgraded PLTR stock to a “Buy” on Jan. 12, raising his price target from $210 to $235. With earnings less than a month away, it won’t be surprising if the stock jumps up to those levels soon. Palantir has a tendency to be volatile before and after earnings, and going by the way the firm is progressing in both public and private sector, upward stock movement is the more likely scenario.

About Palantir Stock

Palantir Technologies builds and develops software platforms that add value to businesses and processes in various organizations. Initially criticized for relying on government contracts for revenue, the firm has done work to diversify into the commercial segment, which now accounts for almost half of its total revenue.

PLTR stock has gained about 159% in the past one year. This is nothing compared to the 340% gain that the company registered in 2024, where it was also the best performer in the S&P 500 ($SPX). Nonetheless, it's a great return compared to any benchmark.

A case can be made in favor of Cathe Wood for utilizing a high valuation for profit-taking. PLTR stock is currently trading at a forward price-to-earnings (P/E) ratio of 225 times, well above its already abnormally high five-year average. It is similarly trading far above its historic EV/EBITDA and historic forward price-to-sales (P/S) multiples. A lot of good things are already priced in, and Cathie Wood is simply taking advantage of that fact.

On the bright side, though, Wall Street still expects substantial growth in the coming years. The company is set to grow its earnings at 39% in 2026, 40% in 2027, and 34% in 2028. If CEO Alex Karp’s legacy is anything to go by, the company could easily beat that growth rate, hence the outrageous valuation.

Palantir Posts Impressive Earnings

Palantir’s recent earnings posted a 50% earnings surprise with EPS of $0.18. The earnings, announced on Nov. 3, also comfortably beat revenue estimates. Management increased its revenue guidance for the next quarter to $1.33 billion, exactly the kind of progress investors continue to expect from Palantir.

Leading into the earnings, Palantir announced deals with companies like Nvidia (NVDA) and Snowflake (SNOW). Alex Karp has previously stated that the company is registering real, authentic, and substantive growth. Karp acknowledged that valuations are crazy, but was careful to exclude his own company from the ones that may eventually feel the pain of an AI bubble.

What Are Analysts Saying About Palantir Stock?

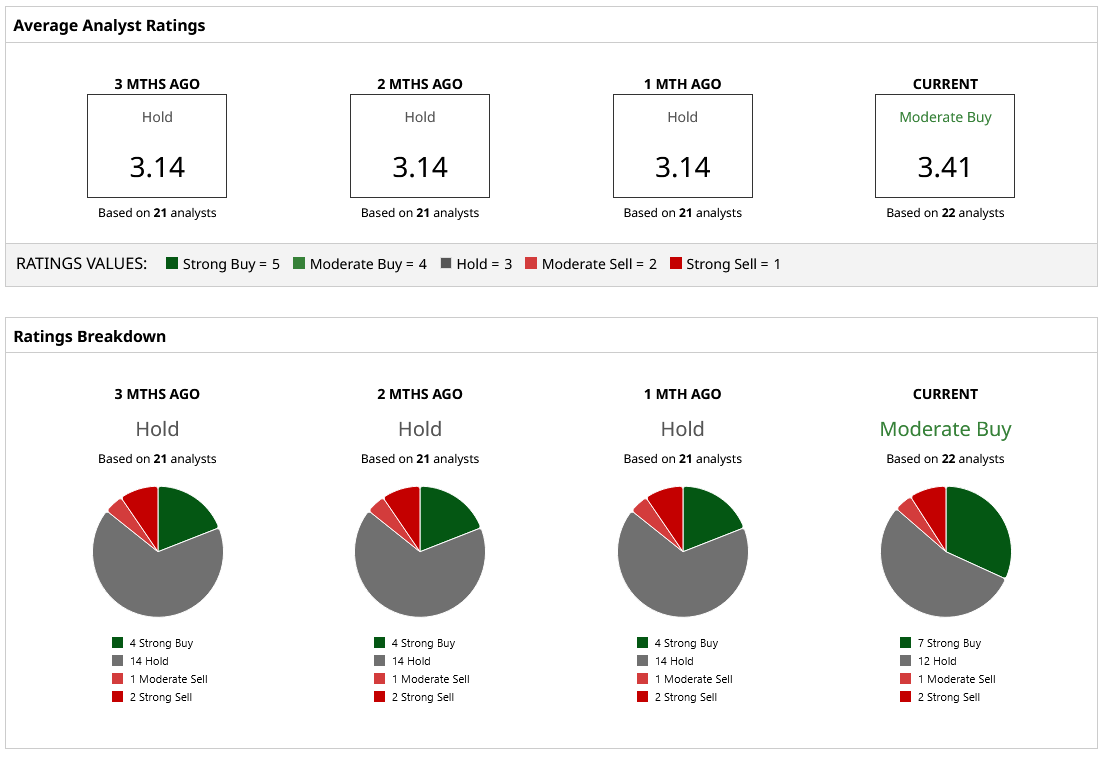

Like any stock that posts record gains, Palantir has its fair share of “Hold” ratings. Most analysts are playing it safe and respecting the extreme valuation that PLTR stock currently enjoys. Out of 22 Wall Street analysts that cover the stock, seven call it a “Strong Buy,” 12 have a “Hold” rating, one analyst has a “Moderate Sell,” and two have a “Strong Sell” rating. Overall, Palantir has a “Moderate Buy” consensus rating.

The median analyst target price of $195.58 only offers 10% potential upside from current levels but is quite realistic. However, if the earnings on Feb. 2 come in strong, the highest target price of $255 may be achievable.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)