With a market cap of $23.6 billion, ON Semiconductor Corporation (ON) is a global provider of intelligent sensing and power solutions, serving customers across regions including Hong Kong, Singapore, the United Kingdom, the United States, and other international markets. It operates through three segments: Power Solutions Group, Analog and Mixed-Signal Group, and Intelligent Sensing Group.

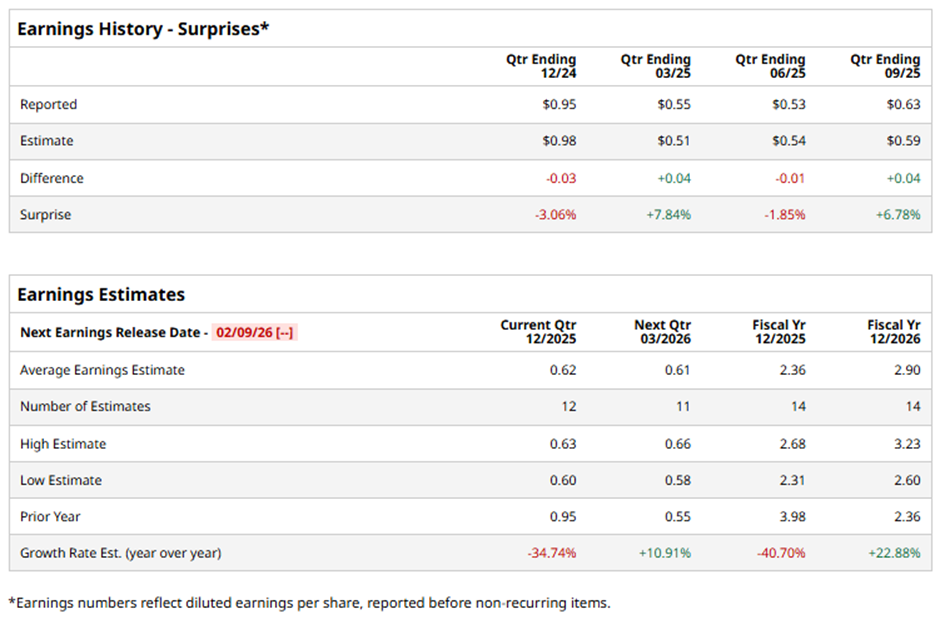

The Scottsdale, Arizona-based company is expected to release its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast ON to post an adjusted EPS of $0.62, down 34.7% from $0.95 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in two of the last four quarterly reports while missing on two other occasions.

For fiscal 2025, analysts predict the chipmaker to report adjusted EPS of $2.36, a decrease of 40.7% from $3.98 in fiscal 2024. However, adjusted EPS is anticipated to grow 22.9% year-over-year to $2.90 in fiscal 2026.

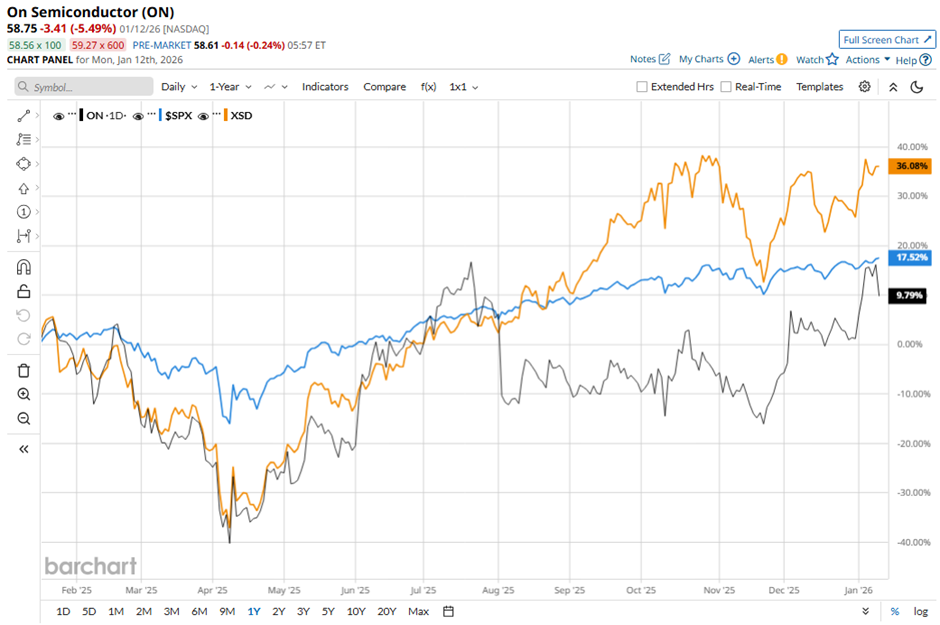

Shares of ON Semiconductor have risen 8.9% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 19.7% gain and the State Street SPDR S&P Semiconductor ETF's (XSD) 39.2% increase over the same period.

Shares of ON Semiconductor recovered marginally on Nov. 3 after the company reported Q3 2025 results that exceeded expectations, including revenue of $1.55 billion and adjusted EPS of $0.63. The rebound was also supported by strong demand for its power management chips used in AI data centers, driven by the ongoing artificial intelligence boom. Additionally, the company’s Q4 revenue guidance of $1.48 billion to $1.58 billion and adjusted EPS outlook of $0.57 to $0.67 were largely in line with market expectations, reassuring investors.

Analysts' consensus view on ON stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 33 analysts covering the stock, 12 suggest a "Strong Buy," two advise "Moderate Buy," 18 recommend a "Hold," and one gives a "Strong Sell" rating. The average analyst price target for ON Semiconductor is $60.28, suggesting a potential upside of 2.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.