(ZWH26) (ZWN26) (KEN26) (WEAT)

“La Niña, wheat prices & bitter cold Russian weather”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- January 7, 2026

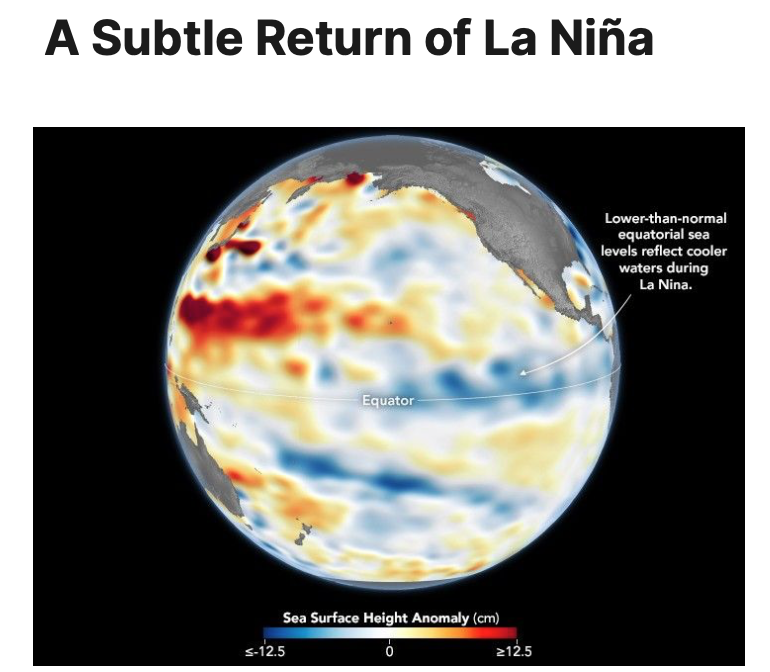

Image Source: NOAA

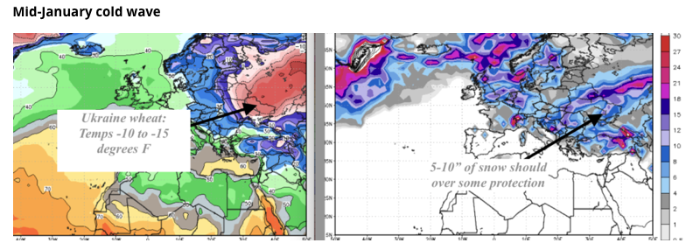

Within the next few weeks, you might hear traders talk about potential freeze damage to the Ukrainian and Russian wheat crops. One of the coldest weather outbreaks in recent years is bound to hit these areas. However, my analysis concludes that AMPLE SNOW COVER should PREVENT the wheat crop from being hurt.

Image Sources: StormVistaWxModels and WeatherWealth Newsletter

While wheat prices can always be oversold, you have heard that same story for many years from other analysts, not from me. I want to see legitimate crop problems and a supply reduction in order to make me grow bull horns out of my head.

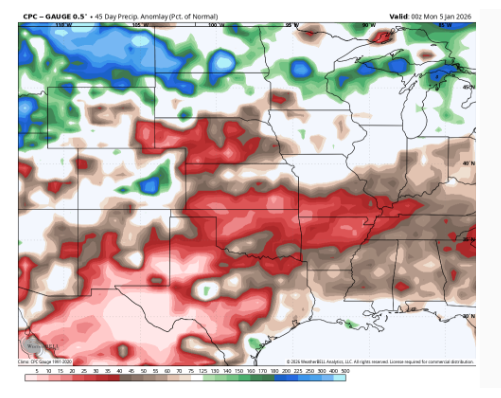

The one crop area I need to watch for my WeatherWealth subscribers (https://www.bestweatherinc.com/new-membership-options) is the southern U.S. Plains, where La Niña has brought dry conditions (red). It is not a market factor now. Wheat has “nine lives” - however, when March and June roll around, a possible bull market in wheat prices could ensue.

% of normal rainfall last 6 weeks

Image Source: StormVistaWxModels

The world has more than enough wheat, and this follows the third biggest Australian crop in recent memory, too. This could all change by spring in the Northern Hemisphere. Some models are showing an El Niño spring and summer. If so, a bear market in grains would resume. If La Niña persists, wheat prices will bottom.

W h i c h C l i m a t i c E v e n t s c a n c r e a t e t h e g r e a t e s t b u l l m a r k e t s f o r w h e a t ?

La Niña events are most strongly associated with creating the greatest bull markets (significant price increases) for wheat. This is because La Niña conditions often lead to reduced global production, creating supply shocks that drive up prices. However, up until now, La Niña has been quite weak.

Generally, La Niña leads to warmer and drier conditions in the U.S. Plains (a major winter wheat region), Russia, and Argentina, which can severely reduce yields and production. The resulting supply shortages and lower stock-to-use ratios often trigger significant and more persistent price increases in the global market.

W h e n w a s t h e l a s t t r u e b u l l m a r k e t i n w h e a t ?

Image Sources: Barchart.com and markings by WeatherWealth Newsletter

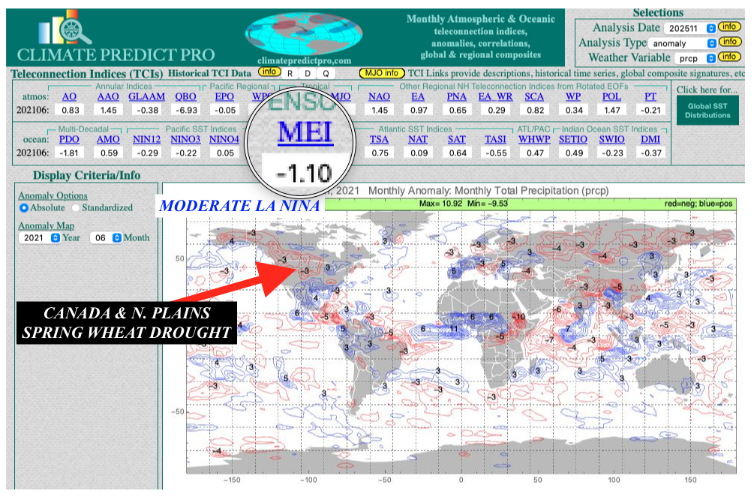

The last significant weather-driven wheat bull markets involved strong rallies in 2010 and 2012, spurred by droughts in major growing regions in Russia. Then, another notable price surge occurred in 2020-2021, driven by drought in the Northern Plains and Canada. In addition, China generated massive buying.

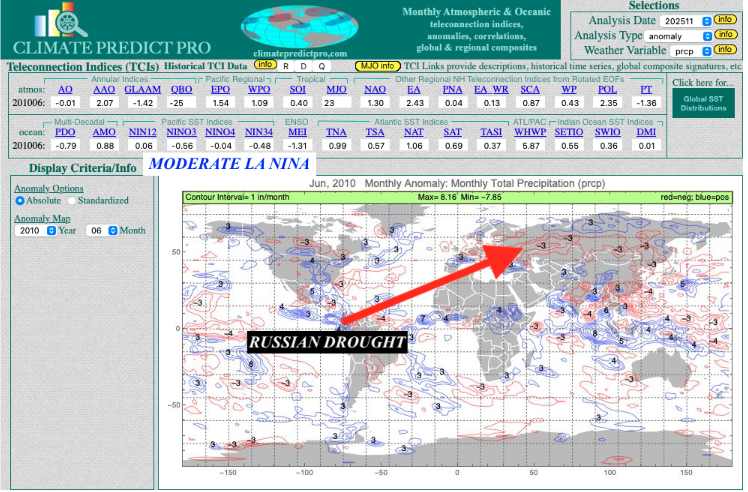

My ClimatePredict program (see image below), used by farmers, commodity traders, and analysts on six continents, illustrates the locations of the La Niña based problem areas during these two cases.

Thanks for Your Interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)