Valued at a market cap of $114.9 billion, New York-based KKR & Co. Inc. (KKR) is a leading global investment firm that manages alternative asset classes, including private equity, credit, real assets, and insurance solutions. Founded in 1976, the firm invests across the full capital structure and throughout the economic cycle, leveraging deep industry expertise and a long-term, value-oriented approach.

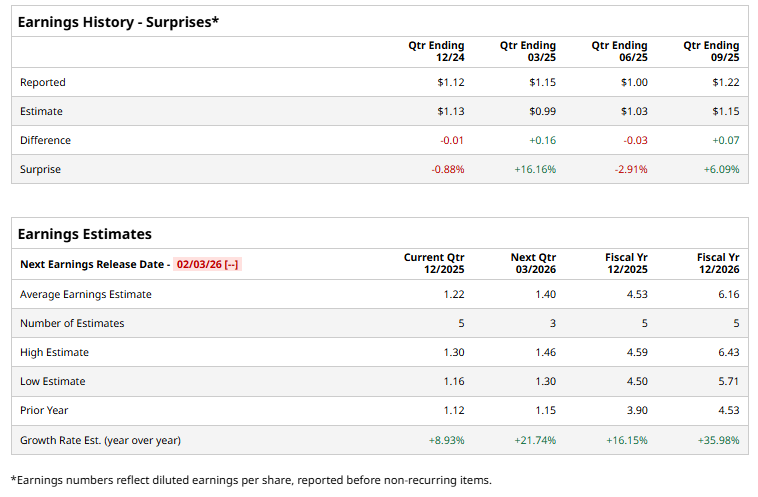

KKR is scheduled to announce its fiscal Q4 earnings before the markets open on Thursday, February 5. Prior to the event, analysts expect this private equity giant to report a profit of $1.22 per share, up 8.9% from $1.12 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in two of the last four quarters, while missing on other two occasions.

For FY2025, analysts expect KKR to report a profit of $4.53 per share, up 16.2% from $3.90 per share in fiscal 2024. Its EPS is expected to further grow 36% year-over-year to $6.16 in fiscal 2026.

KKR has declined 9.9% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 16.2% return and the Financial Select Sector SPDR Fund’s (XLF) 15.4% uptick over the same time frame.

On Dec. 8, KKR provided €300 million in whole loan financing to back EPISO 6, a fund managed by Tristan Capital Partners’ acquisition of easyHotel and support the budget hotel operator’s expansion and capital investment across Europe. The loan is secured by a diversified portfolio of 48 hotels comprising around 4,700 rooms across multiple European markets, underscoring KKR’s confidence in the resilience and growth prospects of the affordable hospitality segment. Following the announcement, KKR shares rose 4.3% in the subsequent trading session.

Wall Street analysts are highly optimistic about KKR’s stock, with a "Strong Buy" rating overall. Among 20 analysts covering the stock, 16 recommend "Strong Buy," one indicate "Moderate Buy," and three suggest "Hold.” The mean price target for KKR is $156.84, indicating a 15.5% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)