/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Valued at a market cap of $53.2 billion, Ford Motor Company (F) develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles. The Dearborn, Michigan-based company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

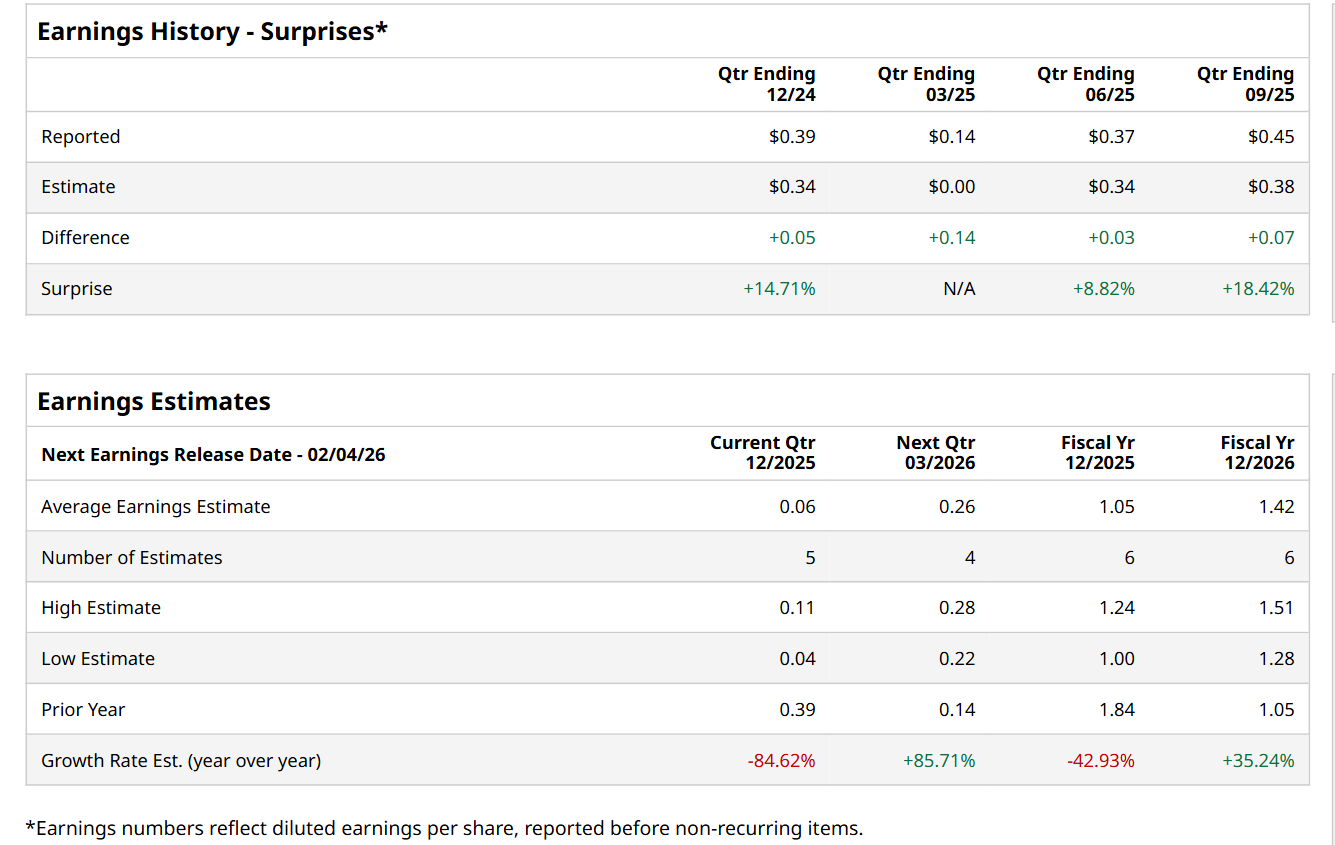

Before this event, analysts expect this auto manufacturer to report a profit of $0.06 per share, down 84.6% from $0.39 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.45 per share in the previous quarter exceeded the forecasted figure by a notable margin of 18.4%.

For the current fiscal year, ending in December, analysts expect F to report a profit of $1.05 per share, down 42.9% from $1.84 per share in fiscal 2024. Nonetheless, its EPS is expected to grow 35.2% year-over-year to $1.42 in fiscal 2026.

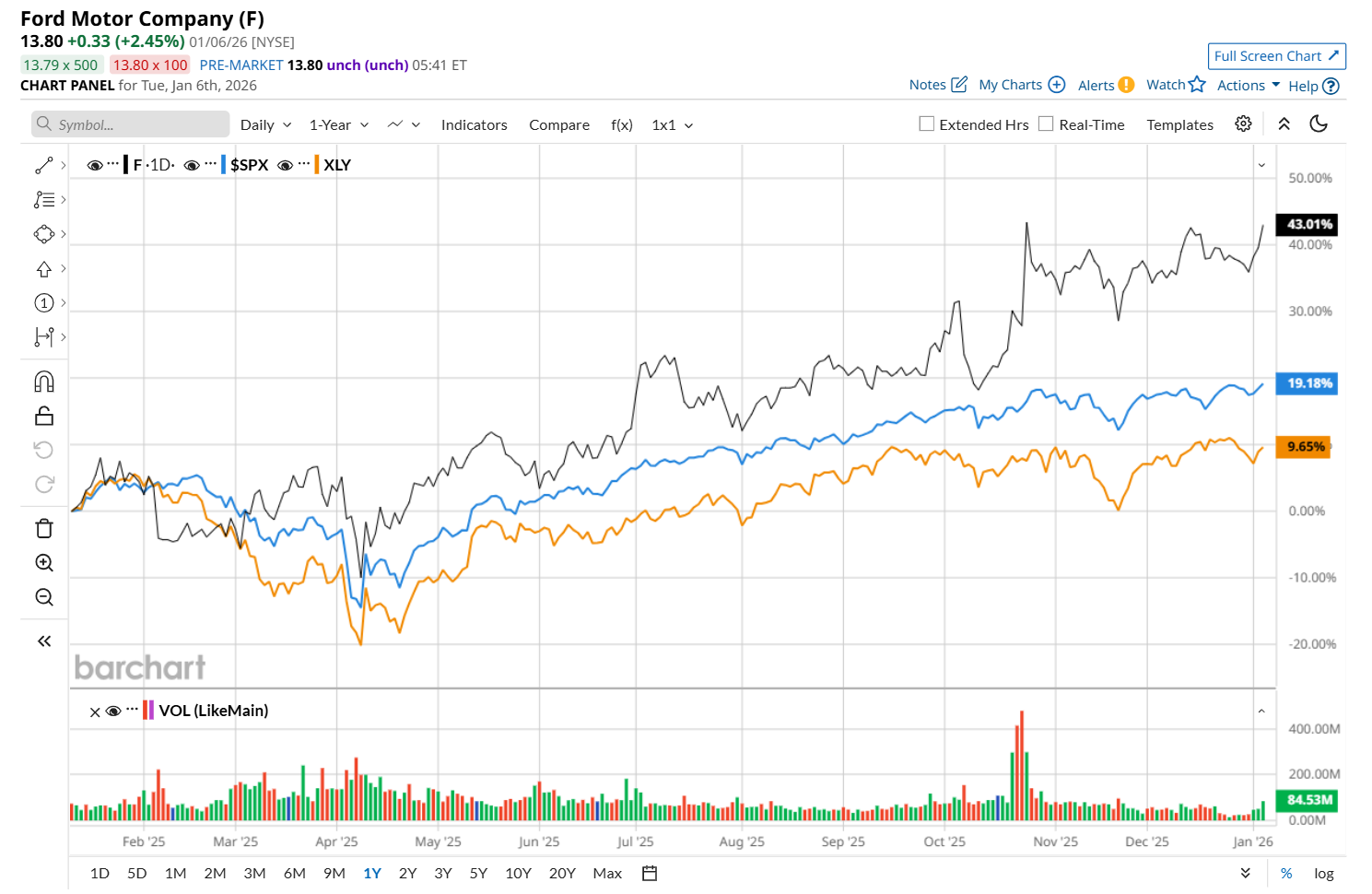

Shares of F have soared 39.1% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.2% return and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.8% uptick over the same time period.

On Jan. 6, shares of Ford Motor rose 2.5% after the company posted strong sales and market-share gains. Ford beat the auto industry for the 10th straight month in December, lifting full-year market share by 0.6 percentage points. Total 2025 sales rose approximately 6% to 2.2 million vehicles, while Q4 sales increased 2.7%, marking its best annual and Q4 performance since 2019.

Momentum was further supported by record hybrid sales, with 228,072 units sold in 2025, up 21.7% year over year, including a record Q4 quarter.

Wall Street analysts are cautious about F’s stock, with a "cautious" rating overall. Among 23 analysts covering the stock, two recommend "Strong Buy," 16 indicate “Hold,” one advises a "Moderate Sell,” and four suggest "Strong Sell.” While the company is trading above its mean price target of $12.39, its Street-high price target of $15 suggests an 8.7% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)