With a market cap of $38.5 billion. The Estée Lauder Companies Inc. (EL) is a global prestige beauty leader with a diversified portfolio spanning skincare, makeup, fragrance, and haircare. Founded in 1946 and headquarters in New York City, the company owns and manages a collection of iconic brands, including Estée Lauder, MAC, Clinique, La Mer, Bobbi Brown, and Jo Malone London, which are sold across department stores, specialty retailers, travel retail, and digital channels worldwide.

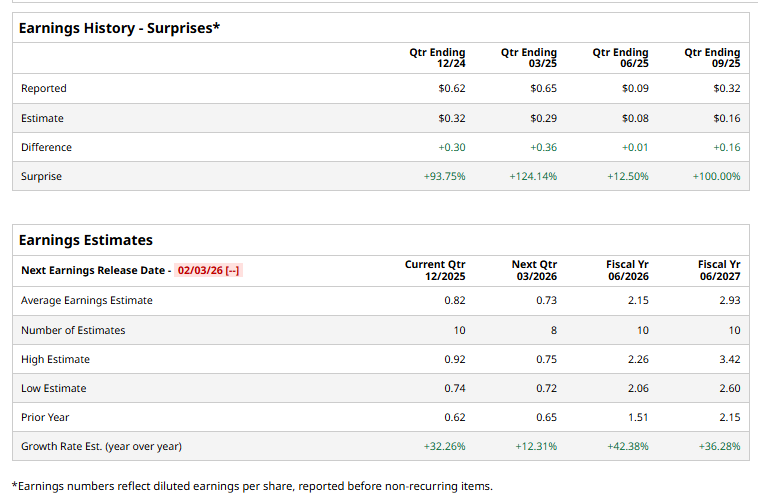

Estée Lauder is set to release its second-quarter earnings soon. Ahead of this event, analysts expect this cosmetics giant to report a profit of $0.82 per share, up 32.3% from the year-ago quarter value of $0.62. Additionally, the company has consistently beaten Wall Street’s earnings estimates in each of the last four quarters.

For fiscal 2026, analysts expect Estée Lauder to report a profit of $2.15 per share, up 42.4% from $1.51 in fiscal 2025. Also, its EPS is expected to rise 36.3% year over year to $2.93 in FY2027.

EL stock has surged 47.6% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 16.2% surge and the Consumer Staples Select Sector SPDR Fund’s (XLP) marginal decline over the same time frame.

On Jan. 5, shares of The Estée Lauder Companies rose more than 3% after Raymond James Financial, Inc. (RJF) upgraded the stock to “Strong Buy” from “Market Perform” and assigned a price target of $130. The upgrade reflects increased confidence in the company’s earnings recovery prospects, supported by anticipated improvements in demand trends, brand momentum across its prestige portfolio, and progress on operational and cost-efficiency initiatives.

Wall Street analysts are moderately bullish about EL stock, with a “Moderate Buy” rating overall. Among 24 analysts covering the stock, seven recommend a “Strong Buy,” one indicates a “Moderate Buy,” 15 suggest a “Hold,” and one gives a “Strong Sell” rating. EL stock currently trades above its mean price target of $103.23.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)