/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

There is no doubt that 2025 has been a year for technology stocks. While segments including quantum computing and silicon photonics were in the limelight, it’s artificial intelligence stocks that stole the show.

With the markets still in the early days of 2026, it’s a good time for some portfolio rejigging. It wouldn’t be surprising if artificial intelligence continues to dominate headlines and remains among the top value creators through 2026.

To put things into perspective, an April 2025 projection expects the global AI market to hit $4.8 trillion by 2033. Further, a recent study indicates that the AI Agents market is expected to grow at a CAGR of 43.3% annually through 2030. These numbers point to ample headroom for value creation from AI companies.

To screen the top three AI stocks for 2026, I have used the analyst ratings as per Barchart as the benchmark. The results don’t surprise, with Nvidia (NVDA), Amazon (AMZN), and Microsoft (MSFT) grabbing the top three positions.

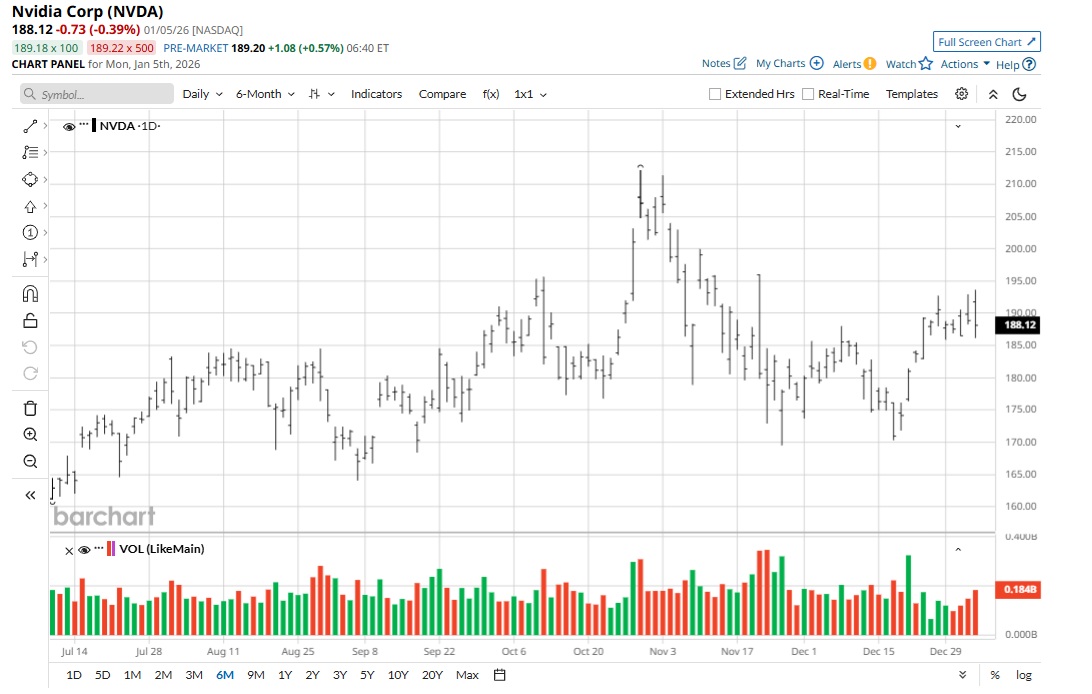

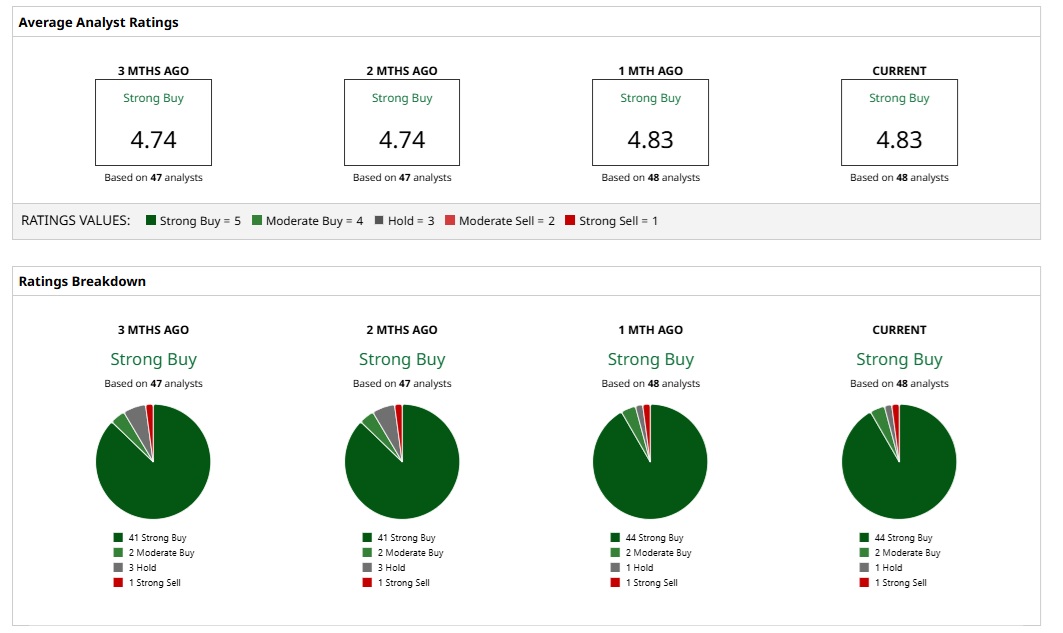

Artificial Intelligence Stock #1: Nvidia (NVDA)

Headquartered in Santa Clara, Nvidia is an accelerated computing infrastructure company that commands a market valuation of $4.6 trillion. The company’s graphical processing units have been powering the next era of computing with applications across industries.

NVDA stock has witnessed a healthy rally of 26% in the past 52 weeks. This rally has been backed by strong fundamental developments in terms of top-line growth and cash flow upside.

From a valuation perspective, NVDA stock trades at a forward price-earnings ratio of 42.1. However, valuations remain attractive, and this point is underscored by the fact that the stock trades at a price-earnings-to-growth ratio of 0.91.

For Q3 2026, Nvidia reported revenue growth of 62% on a year-on-year (YoY) basis to $57 billion. Further, for the first nine months of the year, operating cash flows were robust at $66.5 billion. This provides ample flexibility to invest in innovation and shareholder value creation. The company has also provided a strong outlook for Q4, which is likely to support the bullish momentum.

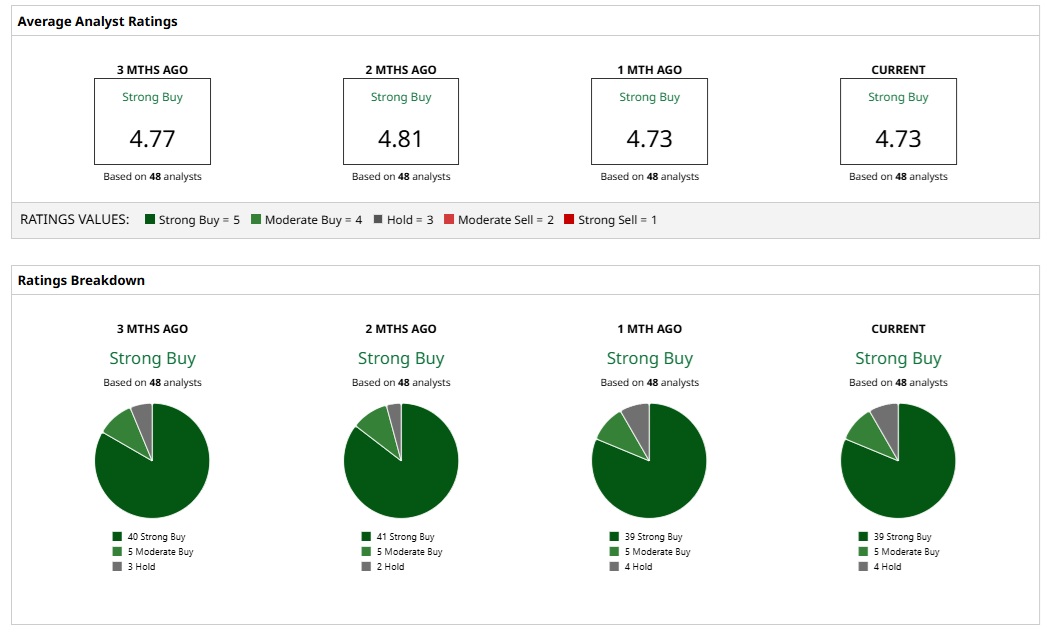

Given the growth momentum and industry tailwinds, it’s not surprising that Nvidia commands a “Strong Buy” rating based on the estimates of 48 analysts. Further, a mean price target of $256 implies an upside potential of 36.1%.

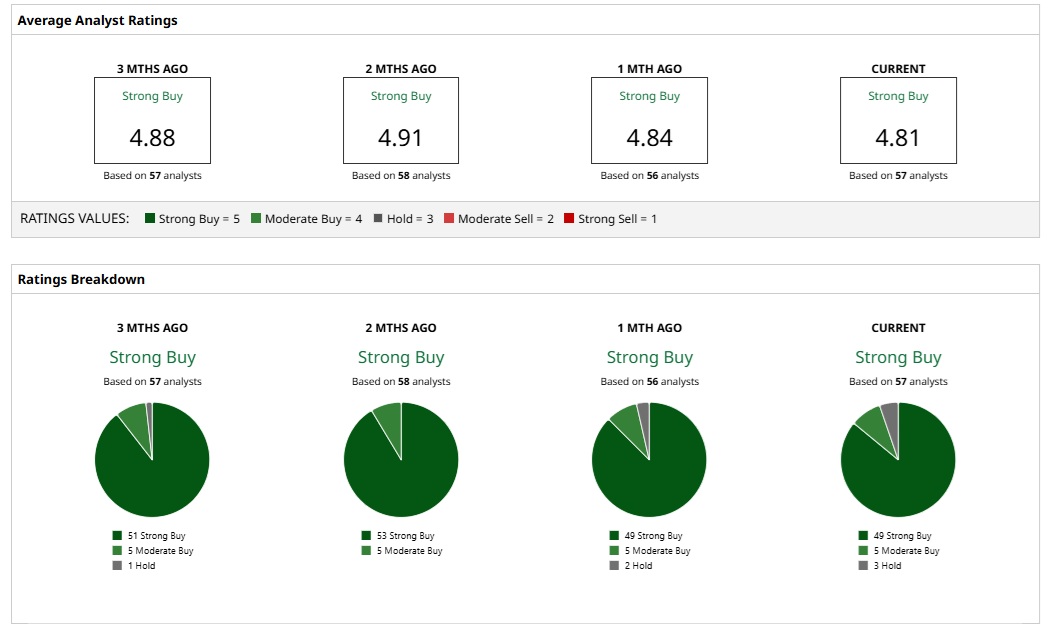

Artificial Intelligence Stock #2: Amazon (AMZN)

Headquartered in Seattle, Amazon is a global force involved in the sale of consumer products, advertising, and subscription services. Additionally, Amazon Web Services (AWS), a provider of an on-demand cloud computing platform, is a subsidiary of Amazon and a key growth driver.

AMZN stock has been in a period of time correction with returns of 2.4% in the past 52 weeks. The sideways movement is a buying opportunity before growth and valuations trigger a rally.

From a valuation perspective, AMZN stock trades at an attractive forward price-earnings multiple of 29.4. It’s therefore not surprising that Amazon is among the top analyst picks.

For Q3 2025, Amazon reported net sales growth of 13% on a YoY basis to $180.2 billion. AWS sales growth was healthier at 20%, to $33 billion. An important point to note is that Amazon is in a period of making big capital investments. For the first nine months of 2025, capital investments have been $92.3 billion. It’s likely that FY25 investments will be $125 billion, and FY26 investments are likely to be higher. The company’s investment in AI-focused infrastructure is likely to translate into growth acceleration.

Therefore, even with AMZN stock remaining sideways, the stock has a “Strong Buy” rating based on the consensus estimate of 57 analysts. Further, a mean price target of $295 implies an upside potential of 26.6%.

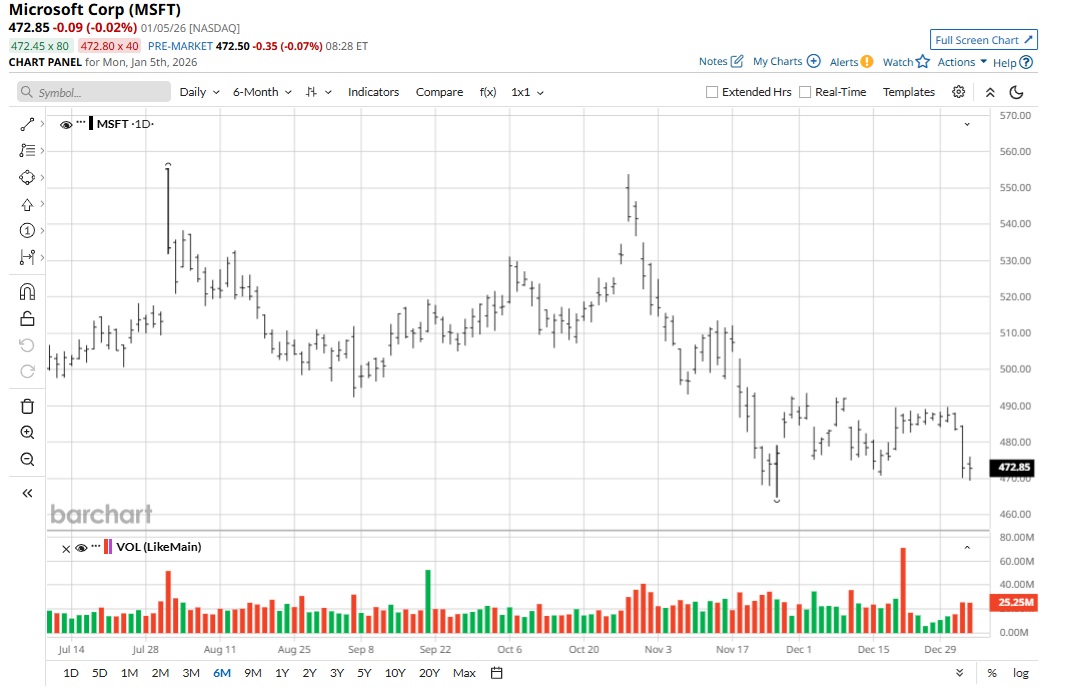

Artificial Intelligence Stock #3: Microsoft (MSFT)

Microsoft, headquartered in Redmond, is another technology giant that provides software, services, devices, and solutions globally. The company has made significant inroads in the AI business with offerings that include Copilot, Azure AI Search, Azure Machine Learning, and others.

Amidst volatility, MSFT stock has trended higher by 10.5% in the past 52 weeks. The relatively muted price action provides an opportunity to buy.

The buy thesis for MSFT stock is underscored by the point that the forward price-earnings ratio is attractive at 30.5. Currently, for comparison, the S&P 500 ($SPX) trades at a PE multiple of 31.2. Additionally, with sustained growth, it’s likely that the annualized (forward) dividend payout of $3.64 will continue to swell.

For Q1 2026, Microsoft reported strong numbers with revenue growth of 18% on a YoY basis to $77.7 billion. The growth drivers were Microsoft Cloud and AI. To put things into perspective, Azure and Cloud services revenue increased by 40% on a YoY basis. Microsoft also returned $10.7 billion to shareholders in the form of dividends and share repurchases. With robust cash flows, it’s likely that value creation will be sustained, coupled with investment in R&D.

Based on the rating of 48 analysts, MSFT stock is a consensus “Strong Buy.” Further, a mean price target of $472.9 implies an upside potential of 33.2%.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)