/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Not many companies can say they’re actually winning the artificial intelligence (AI) race quite like Palantir Technologies (PLTR), which is making a relatively strong case. Sure, investors can’t seem to agree on the stock, and a lot of that hesitation comes down to its eye-popping valuation. But it’s getting more difficult to ignore the strength of the business. Palantir has leaned hard into generative AI, especially after rolling out its Artificial Intelligence Platform (AIP) in 2023, which opened the door to wider use across both enterprises and government agencies.

Since then, adoption of AIP has been picking up speed, government spending on Palantir’s software still looks solid, and its profitability is climbing at a pace many bigger software names would love to match. In a market where companies are more cautious about spending on AI, Palantir’s results are starting to speak for themselves. Nevertheless, the stock hasn’t been immune to pressure.

Broader market weakness and those same valuation worries have weighed on shares lately. But a big moment could be coming up soon, with Palantir set to report fiscal 2025 fourth-quarter earnings next month. So, with business momentum quietly strengthening, is it a good time to take a closer look at this AI frontrunner?

About Palantir Stock

Founded in 2003, Denver-based Palantir has transformed itself into a global technology force, earning the trust of governments, militaries, and major enterprises for its powerful intelligence and operational planning platforms. Central to that growth is its Artificial Intelligence Platform (AIP), a next-generation system that embeds generative AI into everyday business workflows, allowing organizations to make smarter decisions faster while improving efficiency.

With growing traction across both public and private sectors, Palantir’s momentum continues to build. As demand for AI-driven solutions rises worldwide, the company looks well-positioned to unlock even greater opportunities in the years ahead. Currently carrying a market capitalization of roughly $399.2 billion, Palantir’s stock has taken a slight breather early in 2026, with shares sliding about 12.19% over the last month. But a short-term dip hardly tells the full story.

Over the past three years, PLTR has delivered jaw-dropping returns, up a staggering 1891.3%, and didn’t slow down in 2025, finishing the year up 112%. That performance dwarfed the broader market, with the S&P 500 Index’s ($SPX) 16% gain in 2025 looking modest by comparison. Even with recent pullbacks, Palantir’s long-term trajectory remains nothing short of remarkable.

For investors still on the sidelines, the biggest hurdle with Palantir isn’t the story. It’s the price tag. The stock trades at a steep premium, currently priced at 213.48 times forward earnings and 100.97 times sales. That stands in sharp contrast to sector medians of roughly 25.4 times forward earnings and just 3.6 times sales, a difference that’s impossible to overlook. Valuations at these levels inevitably spark “bubble” talk, and for some investors, that alone is enough reason to stay away, even after the stock’s stunning run over the past few years.

Palantir Posts Strong Q3 Earnings and Lifts Outlook

While valuation concerns are real, growth-focused investors may still be willing to pay up if Palantir’s expansion pace continues to back it up, and recent numbers suggest that growth is anything but slowing. In its fiscal 2025 third-quarter earnings report, released in November, Palantir posted impressive gains across nearly every key metric. The company once again beat Wall Street expectations and delivered strong guidance, with management pointing to rising adoption of its AI software platform as a major growth driver.

Quarterly revenue jumped 63% year-over-year (YOY) to $1.18 billion, marking the second consecutive quarter above the $1 billion milestone and coming in ahead of the $1.09 billion consensus estimate. U.S. revenue climbed 77% YOY to $883 million. Breaking that down further, U.S. commercial revenue skyrocketed 121% YOY to $397 million, while government revenue rose 52% annually to $486 million.

Government business, particularly from military agencies, continues to play a key role in Palantir’s rise. Additionally, the company closed a record $2.76 billion in total contract value (TCV) during the quarter, up 151% YOY. Notably, TCV from U.S. commercial deals more than quadrupled to $1.31 billion, and total customer count increased 45% YOY. The bottom line showed equally strong momentum. Net income more than tripled to a record $475.6 million, or $0.18 per share, compared with $143.5 million, or $0.06 per share, a year earlier.

CEO Alex C. Karp emphasized that the company is now generating more profit in a single quarter than it did in revenue not long ago, a striking sign of how far the business has scaled. On an adjusted basis, earnings per share reached $0.21, easily beating the $0.17 estimate. Palantir also ended the quarter with $6.4 billion in cash, cash equivalents, and short-term U.S. Treasury securities.

Together, the numbers show why, despite valuation debates, Palantir continues to command serious attention from growth investors. Yet, with such blockbuster Q3 results, attention now shifts to the company’s fiscal 2025 fourth-quarter and full-year results, scheduled for release after the market closes on Monday, Feb. 2.

Looking ahead to Q4, management expects revenue to land between $1.327 billion and $1.331 billion. For the full year 2025, Palantir raised its revenue outlook to a range of $4.396 billion to $4.400 billion. Plus, the company lifted its U.S. commercial revenue guidance to more than $1.433 billion, representing growth of at least 104%.

How Are Analysts Viewing Palantir Stock?

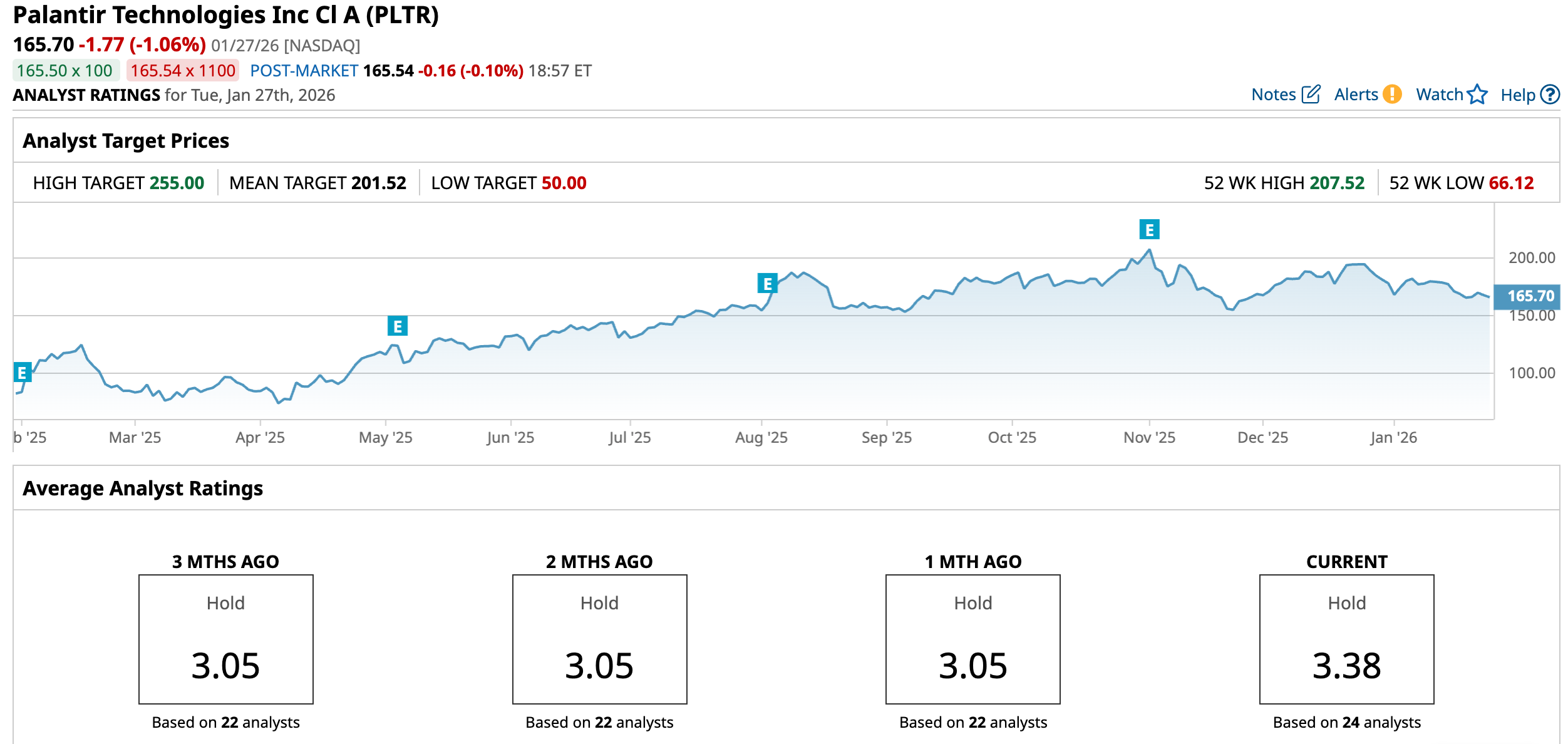

Even with strong fundamentals, Wall Street isn’t fully convinced just yet. Palantir currently carries a consensus “Hold” rating, reflecting a market that’s intrigued but still cautious. Among the 24 analysts covering the stock, eight rate it a “Strong Buy,” 12 remain on the sidelines with a “Hold,” one has issued a “Moderate Sell,” and three are firmly bearish with “Strong Sell” ratings.

Still, the price targets tell a more optimistic story. The average target of $201.52 points to potential upside of about 21.6% from current levels. Meanwhile, the most bullish target on the Street, $255, suggests PLTR could climb as much as 54% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)