/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)

Analysts have been raising their price targets for McDonald's Corp. (MCD) stock after its recent stellar earnings report. However, MCD has been on a tear over the last month. One conservative play is to sell short put options with one-month expiry.

MCD closed at $327.58 on Friday, Feb. 13, down from its peak of $332.08 on Feb. 12 after the Feb. 11 earnings release. But, it's up 9.2% from a $299.86 trough on Jan. 5 and a later dip to $302.84 on Jan. 20. Can it keep rising? This article will review MCD's value and its potential upside.

Strong FCF, Albeit Lower FCF Margins

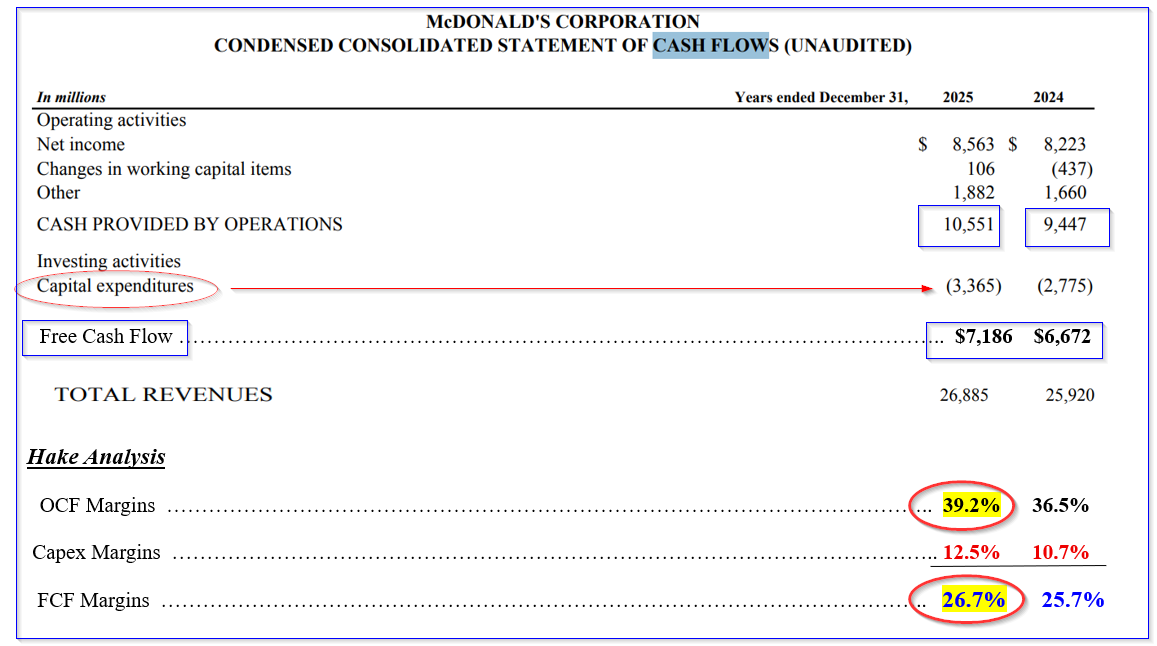

The most important part of McDonald's earnings report is its operating cash flow (OCF) and free cash flow (FCF), and related OCF and FCF margins (i.e., percent of revenue).

This is seen in the table below from Microsoft's cash flow statement, including my analysis. It shows that McDonald's OCF and FCF margins rose in 2025, despite higher capex spending.

For example, operating cash flow rose to 39.2% of revenue from 36.5%, a +7.4% gain, after revenue increased just 3.7% to $26.9 billion over 2024. That's double the revenue gain.

That means McDonald's is becoming more efficient, squeezing out more cash from its operations as sales rise.

That is a sign of strong operating leverage. So, as revenue rises next year, expect to see an even higher OCF margin.

Moreover, this allowed the company to spend even more on capex, as a percent of revenue. Capex rose to 12.5% of sales from 10.7%. But, even after that increase, free cash flow (FCF), as a percent of sales, rose to 26.7% from 25.7%.

That allows the company to expand, invest, and yet still generate higher FCF. This will lead to a higher price target. Here's why.

Revised FCF Projection

I discussed MCD's pre-earnings valuation in a Jan. 16 Barchart article, “McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings,” as well as prior Dec. 17, 2025, and Nov. 7, 2025, articles.

I set a price target (PT) of $371.30 based on its expected $9 billion in FCF in 2026. That would be a 25% increase over 2025. This was based on a 40% OCF margin assumption and $3.2 billion in capex spending.

So, is this realistic? For example, McDonald's Corp has already exceeded that capex level. Let's redo the FCF model based on the recent results.

- Revenue Forecasts. Analysts now project $28.61 billion in revenue for 2026, up from $28.51 billion forecasted in Nov. 2025. Moreover, 2027 forecasts are at $30.26 billion, implying that the next 12 months (NTM) forecast is $28.95 billion (using 3/4s of the 2026 forecast and ¼ of the 2027). That is 7.68% over 2025.

- Operating Cash Flow Margins. Given that OCF margins rose twice the 2025 revenue gain, let's assume that the 39.2% 2025 OCF margin will rise at least 11.5% (i.e., 1.5x the revenue gain): 39.2% x 1.115 = 43.7%. Just to be conservative, let's set it at 42% for the NTM period.

- Capex Spending. McDonald's Corp management said it expects its capex spending to be between $3.7 billion and $3.9 billion this year (see 22.36 minutes into its earnings call). Given that it exceeded this capex guidance in the past, as I projected last month in my Nov. 2025 Barchart article (i.e., it projected $3.2 billion in capex at the high end, but came in at $3.365 billion), and that McDonald's wants to reach 50,000 stores by 2027, let's set the NTM capex estimate at $4.0 billion.

As a result, here is how that works out:

$28.95 billion NTM revenue x 0.42 = $12.159 billion Operating Cash Flow (OCF)

$12.159b OCF - $4.0b capex = $8.159 billion Free Cash Flow (FCF)

That's lower than my prior FCF target. However, it could result in a higher price target (PT). Here's why.

Price Targets for MCD Stock

FCF Yield Metric. In the past, I've used a 3.4% FCF yield metric to value MCD stock, equivalent to a 29.4x multiple of FCF. However, McDonald's stock now has a market cap of $237.6 billion, according to Yahoo! Finance.

That means its $7.2 billion in FCF represented a FCF yield of 3.03%.In other words, if McDonald's Corp paid out 100% of its FCF to shareholders, the stock would have a 3.0% dividend yield.

This is also the same as using a higher 33.33x multiple (i.e., 1/0.03 = 33.33x).

So, multiplying $8.159 billion in NTM FCF x 33.33 = $271.94 billion expected market value.

That is +14.45% higher than the $237.6 billion mkt cap today. So, the price target (PT) is:

$327.58 x 1.1445 = $374.92 per share PT (upside: +14.5%)

That is higher than my prior $371.30 PT, even though the projected FCF is lower. This is because the market is willing to give it a higher FCF multiple.

Historical Dividend Yield PT. Another way to value MCD stock is based on its average 5-year dividend yield. McDonald's has now announced 2 quarterly dividends at a 5% higher rate than last year, at $1.86 per quarter.

So, projecting the next 12 months, assuming a 5% dividend increase, the forward dividend can be forecast as:

$1.86 + $1.86 + $1.95 +$1.95 = $7.62 annual dividend per share (DPS)

Moreover, over the last 5 years, MCD has had an average yield of 2.26% according to Seeking Alpha, 2.21% according to Yahoo! Finance, as well as 2.27% at Morningstar. This averages out at 2.25%. Here is how that works out for a price target:

$7.62 DPS / 0.0225 = $338.57 per share PT (upside +3.35%)

Analysts Surveys. Based on three major analyst surveys tracking analysts, their PTs average $350.00 per share:

Yahoo! Finance …. $340.03 per share PT (37 analysts surveyed)

Barchart ……………. $342.81 PT

AnaChart.com …… $367.16 PT (22 analysts surveyed)

Average PT ………… $350.00 per share PT

That implies upside of 6.84% from Friday's close.

Summary and Conclusion

Based on these three valuation methods, there is still 8.0% upside left in MCD stock, even after its recent rise:

FCF Yield PT …..….. $372.92 per share (+14.5% upside)

Historical DY PT …. $338.57 per share (+3.35%)

Analysts' PTs ………. $350.00 per share (+6.84%)

Average PT ………….. $353.83 PT (+8.0% upside)

However, it could take some time to work out over the next 12 months. That's why I suggest shorting out-of-the-money (OTM) puts in one-month expiry periods.

Last month, I suggested shorting the $295.00 put option contract expiring on Friday, Feb. 20. That is working out so far, and after it closes, I will provide an update on a new play.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)