/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA) is a multinational automotive and clean energy company that designs and manufactures battery electric vehicles (EVs), energy storage systems, and solar energy solutions, including solar roofs and panels. Its lineup ranges from premium mass-manufactured EVs, supported by its proprietary software enabling autonomous driving, to a well-maintained charging ecosystem that follows the company’s mission towards sustainable energy.

Tesla was founded in 2003 and is headed by billionaire CEO Elon Musk with its headquarters in Austin, Texas. The company is spread across North America, Europe, and Asia.

Tesla Stock Gains Momentum

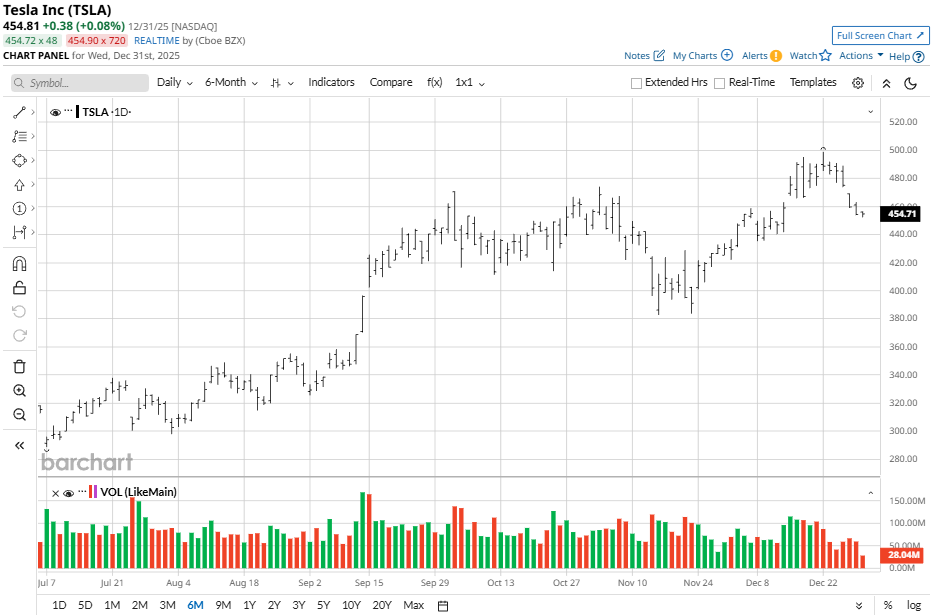

TSLA stock currently trades close to its 52-week high of $498.83, demonstrating strong momentum growth after its dip to a 52-week low recorded in April. Over the past five days, shares are down about 7%, while gaining 6% over the past one month. Over a six-month time frame, the stock has demonstrated a strong return of 43%.

For the past 52 weeks, TSLA is up 19%, modestly outperforming the S&P 500's (SPX) 17% gain amid volatility from delivery cycles and policy shifts. Tesla has shown higher swings than the index but trades below the index’s key moving averages, furthering its strong momentum case.

Tesla Q3 Results

Tesla reported third-quarter 2025 revenue of $28.1 billion, up 12% year-over-year (YOY) and beating analyst consensus of $26.5 billion, driven by record vehicle deliveries of 497,000 units. GAAP EPS was $0.39 and non-GAAP EPS was $0.50, missing estimates of around $0.56 as automotive margins compressed despite the top-line strength.

Automotive revenue rose 27% sequentially with 15.4% margins (excluding credits), while energy storage deployments hit a record 12.5 GWh, boosting overall gross profit to $5 billion and operating income to $1.6 billion. Free cash flow reached a record $4 billion on $6.2 billion operating cash flow, and cash and investments ended at $41.6 billion. Production exceeded 447,000 vehicles, clearing inventory for the delivery surge.

Tesla provided no specific Q4 revenue or EPS guidance but flagged a potential demand slowdown post-U.S. EV tax credit expiry, with focus shifting to energy growth, Full Self-Driving (FSD) software, and 2026 Cybercab/Optimus ramps.

Dan Ives Bullish on Tesla

Tesla tops Wedbush's artificial intelligence (AI) plays for 2026 beyond Nvidia (NVDA), with analysts forecasting a path to a $2 trillion market cap soon and potentially $3 trillion by year-end 2026 in their bull case, fueled by FSD adoption, Cybercab rollout, and robotics acceleration. "The AI valuation will start to get unlocked," Wedbush analyst Dan Ives noted, highlighting autonomous tech as Tesla's "golden goose."

Microsoft (MSFT) ranks first overall for the Wedbush analyst, with Azure's AI inflection in fiscal 2026 driving CIO spending. Meanwhile, Palantir (PLTR) is eyeing $1 trillion status via government and commercial wins. CrowdStrike (CRWD) will also benefit as cybersecurity's AI derivative, while Apple (AAPL) could add $75 to $100 per share from its 2.4 billion iOS devices under CEO Tim Cook through 2027.

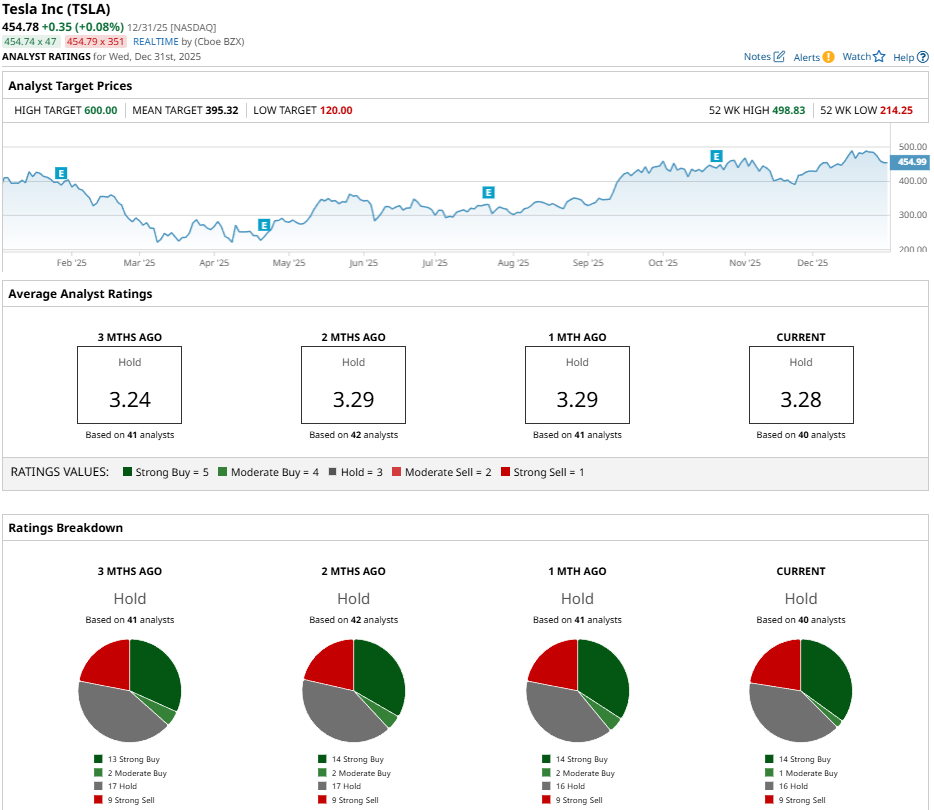

How Does Wall Street Rate TSLA Stock?

Analysts currently rate TSLA stock as a consensus “Hold” with a mean price target of $395.32, reflecting potential downside of 12% from current prices.

Tesla has been rated by 40 analysts, receiving 14 “Strong Buy” ratings, one “Moderate Buy” rating, 16 “Hold” ratings, and nine “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)