Electric vehicle (EV) giant Tesla (TSLA) is heading toward the end of 2025 on a surprisingly strong footing, despite a year filled with speed bumps. Political noise tied to CEO Elon Musk, a cooling EV market in key regions, and intensifying global competition have all weighed on sentiment at various points. And yet, investor confidence has remained resilient. In fact, TSLA shares are currently trading near record highs as investors continue to look past near-term headwinds and focus squarely on what’s coming next.

That optimism is being fueled by Tesla’s future product platforms, most notably the Cybercab robotaxi and the Optimus humanoid robot, both expected to roll out over the next couple of years. The vision of fully autonomous transportation and artificial intelligence (AI)-driven robotics has reignited excitement around the stock, helping explain why capital continues to pour in. This forward-looking enthusiasm is also why Wedbush Securities analyst Dan Ives believes Tesla’s best days may still lie ahead, despite lingering concerns around the core EV business.

According to Wedbush, Tesla is expected to successfully roll out robotaxi services in more than 30 cities in 2026 while simultaneously ramping up volume production of Cybercabs, moves that would mark the true beginning of the autonomous era for Musk and his company. The firm pegs Tesla’s base-case valuation at $600 per share, with a bullish bull-case target of $800, implying an eye-catching 64.7% upside from current levels. Given these ambitious expectations, TSLA stock clearly warrants a closer look.

About Tesla Stock

Few companies push the boundaries of innovation quite like Tesla. Once viewed primarily as an electric carmaker, the company has rapidly evolved into a full-fledged technology powerhouse, chasing breakthroughs across AI, autonomous driving, robotics, and clean energy. From self-driving robotaxis to factory-ready humanoid robots, Tesla’s ambitions now extend well beyond the road.

With a market capitalization hovering around $1.6 trillion, Tesla commands a prized position within the elite “Magnificent Seven.” While EV remains Tesla’s core business and primary revenue driver, investors are increasingly valuing the company less as an automaker and more as a long-term AI and robotics play, betting that autonomy and humanoid robots could eventually become mega-products capable of eclipsing Tesla’s entire automotive segment.

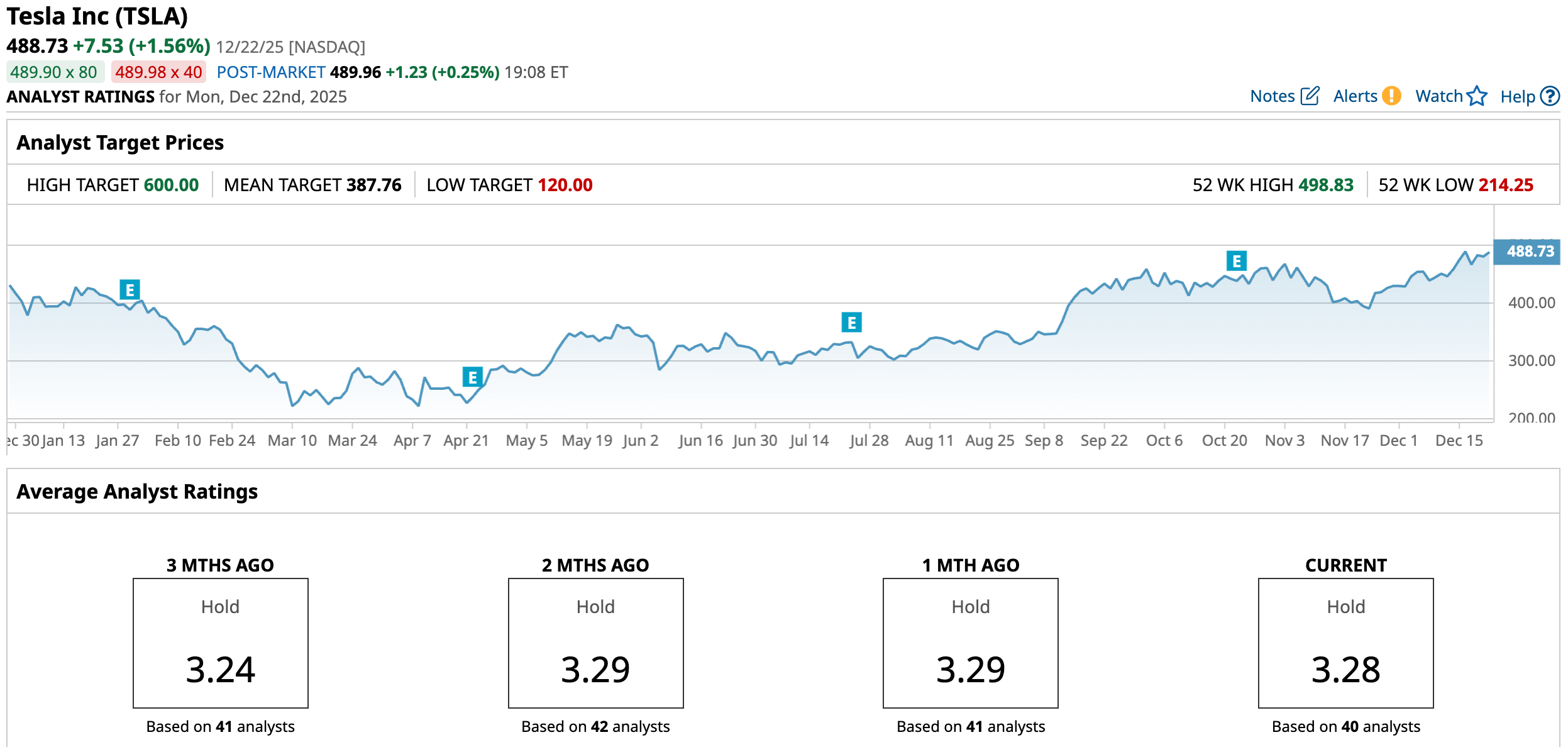

Even after facing several bumps earlier this year, that confidence has translated into strong performance, with TSLA shares up 21% in 2025. And momentum has only intensified in recent months. Tesla stock has surged an eye-catching 51.7% over the past six months, dramatically outpacing the broader S&P 500 Index's ($SPX) 15.26% gain over the same period. TSLA is now trading just 1.3% below its 52-week high of $495.28, which it reached on Dec. 17, underscoring how aggressively investors have been chasing the stock’s next chapter.

A Closer Look Inside Tesla’s Q3 Earnings

Tesla’s fiscal 2025 third-quarter earnings report, released in late October, delivered a mixed but undeniably compelling snapshot of the company’s trajectory. Revenue stole the spotlight, jumping 12% year-over-year (YOY) to $28.1 billion and comfortably topping Wall Street’s $26.6 billion estimate. Notably, this marked Tesla’s first quarter of revenue growth compared with 2024. A last-minute surge in U.S. demand, driven by buyers rushing to lock in the now-expired $7,500 EV tax credit, played a key role in lifting results.

That late-quarter buying frenzy helped Tesla’s core automotive business regain momentum, with segment revenue rising 6% YOY to $21.2 billion. Still, the clear standout once again was Tesla’s energy division. Energy-storage revenue soared 44% to $3.4 billion, fueled by accelerating adoption of the company’s advanced battery solutions. With repeated quarters of double-digit growth, this segment has firmly established itself as one of Tesla’s most resilient and fastest-growing businesses.

Beneath those strong top line numbers, however, profitability painted a more cautious picture. Ongoing price cuts aimed at staying competitive in an increasingly crowded global EV market continued to pressure margins. Gross margin slipped to 18%, down from 19.8% a year earlier, while operating margin fell sharply by 501 basis points to 5.8%. Adjusted EPS declined 31% YOY to $0.50, coming in about 10.5% below analyst expectations and underscoring the cost of defending market share.

Looking ahead, Tesla appears firmly focused on execution as it prepares to roll out some of its most ambitious projects. The company is targeting 2026 for “volume production” of several major launches, including the long-awaited Cybercab robotaxi, its heavy-duty Semi truck, and the next-generation Megapack 3 energy-storage platform.

At the same time, Tesla is pressing forward with one of its most futuristic bets, the Optimus humanoid robot. With the first manufacturing lines now ramping up, Tesla’s long-discussed evolution from EV maker to AI and robotics powerhouse may finally be shifting from vision to commercial reality.

Wall Street’s Latest Take on Tesla Stock

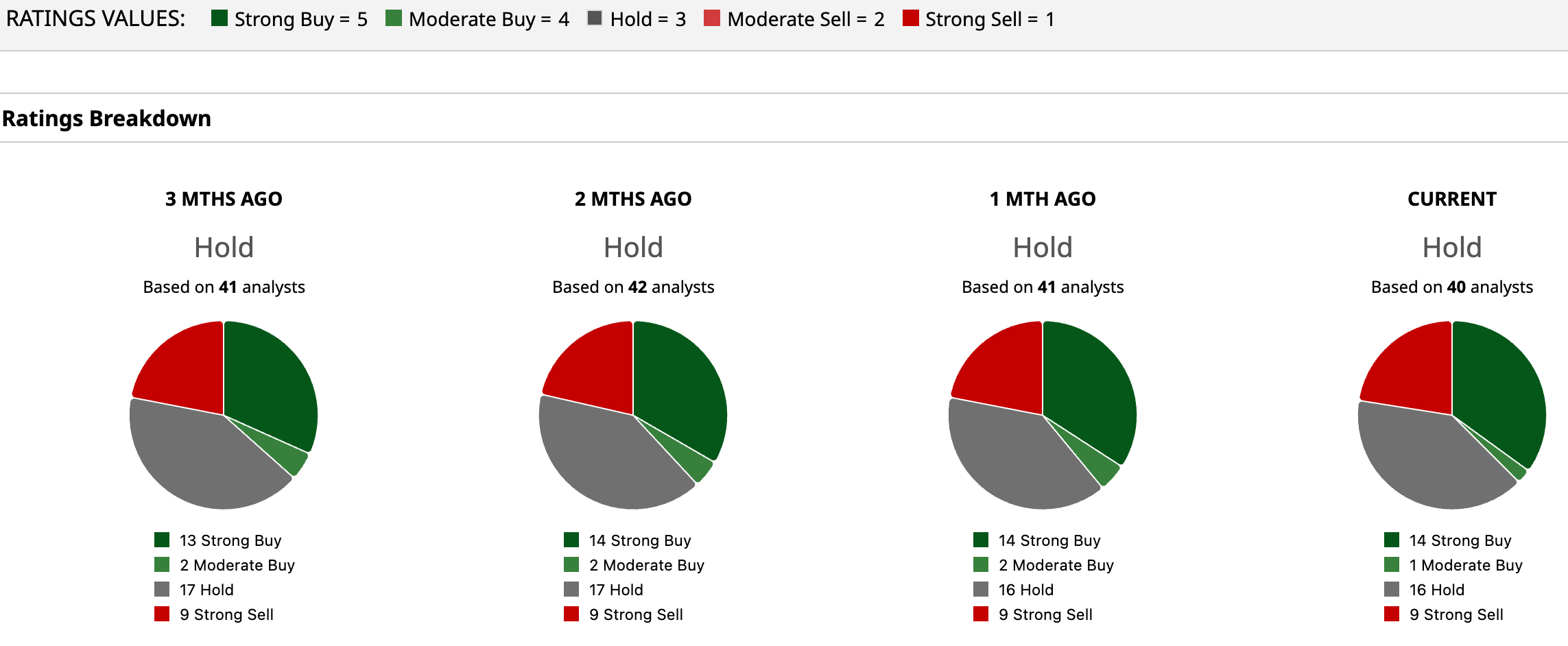

Wall Street remains sharply divided on where Tesla goes next. The stock currently carries a consensus “Hold” rating, reflecting just how polarized analyst views have become. Of the 40 analysts covering TSLA, 14 see a “Strong Buy,” one rates it a “Moderate Buy,” 16 are staying neutral with a “Hold,” and nine have turned outright bearish with a “Strong Sell.”

Even so, the upside argument isn’t off the table. Tesla is already trading above its average price target of $387.76, but that hasn’t stopped the bulls. Wedbush’s base-case price target of $600 implies the stock could still rally another 22.8% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)