Tyson Foods, Inc. (TSN), based in Springdale, Arkansas, operates a global protein empire through its Beef, Pork, Chicken, and Prepared Foods segments. It processes cattle, hogs, and chickens into fresh, frozen, and value-added products, managing iconic brands like Tyson, Jimmy Dean, Hillshire Farm, and Ball Park.

The company holds a market capitalization of around $20.4 billion, which firmly places it in the “large-cap” category, as companies valued above $10 billion earn that distinction. This scale underscores Tyson’s size, influence, and dominance, strengthening its ability to market its products across retail, foodservice, and industrial customers.

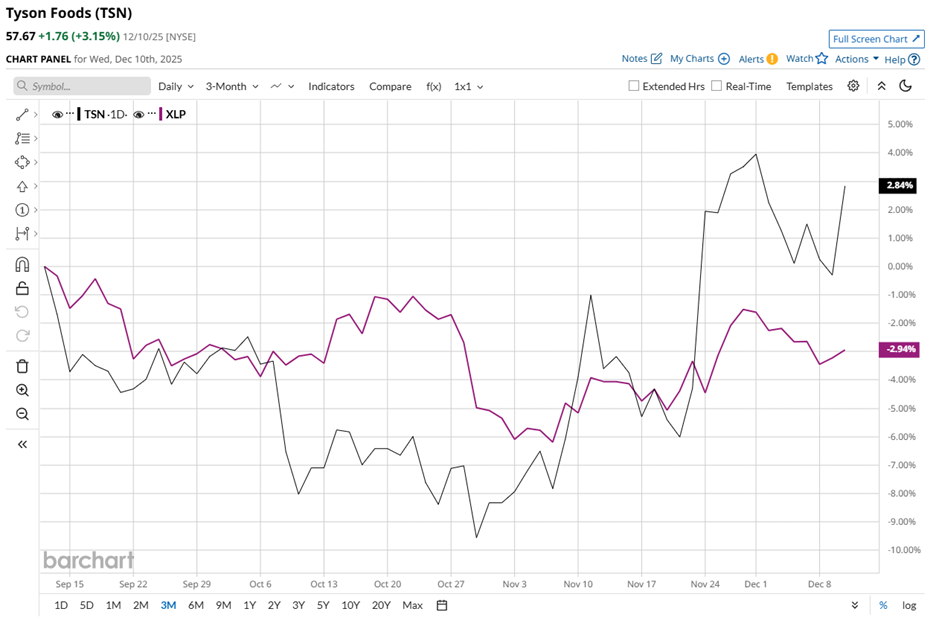

Tyson's shares currently trade about 10.4% below their April high of $64.36, yet the stock has gained nearly 4.1% over the past three months, outperforming the 2.2% plunge in the State Street Consumer Staples Select Sector SPDR ETF (XLP).

Over the past 52 weeks, TSN stock has plunged 7.6%, while year-to-date (YTD), it remains only marginally positive, highlighting a gradual but directionally positive recovery. Meanwhile, XLP has plummeted 5.4% over the same 52-week period and declined marginally YTD.

Technical strength also remains sound. Since late Nov, TSN has traded above its 50-day moving average of $53.86 and its 200-day moving average of $56.27, breaking below these levels only briefly in Dec before regaining pace.

On Nov. 21, Tyson Foods announced network adjustments to streamline its beef operations and enhance long-term efficiency by shutting down its Lexington, Nebraska, facility and converting Amarillo, Texas, to a single, full-capacity shift, while increasing production at other plants to optimize volumes across the network.

The market reacted positively as TSN stock rose 1.8% on the announcement and then gained 6.5% on Nov. 24, as investors interpreted the Lexington closure as a strategic move to enhance both capacity and margins.

For context, TSN’s rival, Archer-Daniels-Midland Company (ADM), has gained 11.8% over the past 52 weeks and risen 15.2% YTD, indicating that while TSN demonstrates resilience, it has room to catch up with top-performing peers.

Even with recent operational adjustments and a sound technical footing, analysts maintain a measured outlook, signaling cautious optimism regarding the stock’s prospects. TSN is carrying a “Hold” consensus rating from 10 analysts, with a mean price target of $61.20, signaling a premium of 6.1% to current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Server%20racks%20by%20dotshock%20via%20Shutterstock.jpg)