President Donald Trump’s decision to prevent Nvidia (NVDA) from exporting its most advanced chips to China may significantly undermine the tech giant’s shares. Disclosed by the president during an interview that aired on Nov. 2, the move was reportedly supported by several of his top advisers. Trump announced the policy after he elected not to raise the subject of the sale of Nvidia’s advanced Blackwell AI chips to China during talks that he held with Chinese President Xi Jinping on Oct. 30.

In combination with other, significant challenges that NVDA is facing, this development has caused the risk-reward ratio of NVDA stock to become unfavorable. As a result, investors should consider selling the shares at this point.

About Nvidia Stock

The runaway leader of the rapidly growing AI chip market, Nvidia’s market capitalization has soared to $5 trillion, making it one of the most successful companies globally. Among its biggest customers are hyperscalers, including Alphabet (GOOG), Microsoft (MSFT), and Meta (META). Additionally, NVDA is partnering with OpenAI. Fueled by the huge demand for its chips, Nvidia’s revenue has tripled since 2023, and the chipmaker generated over $46 billion of revenue in its fiscal second quarter, which ended in July.

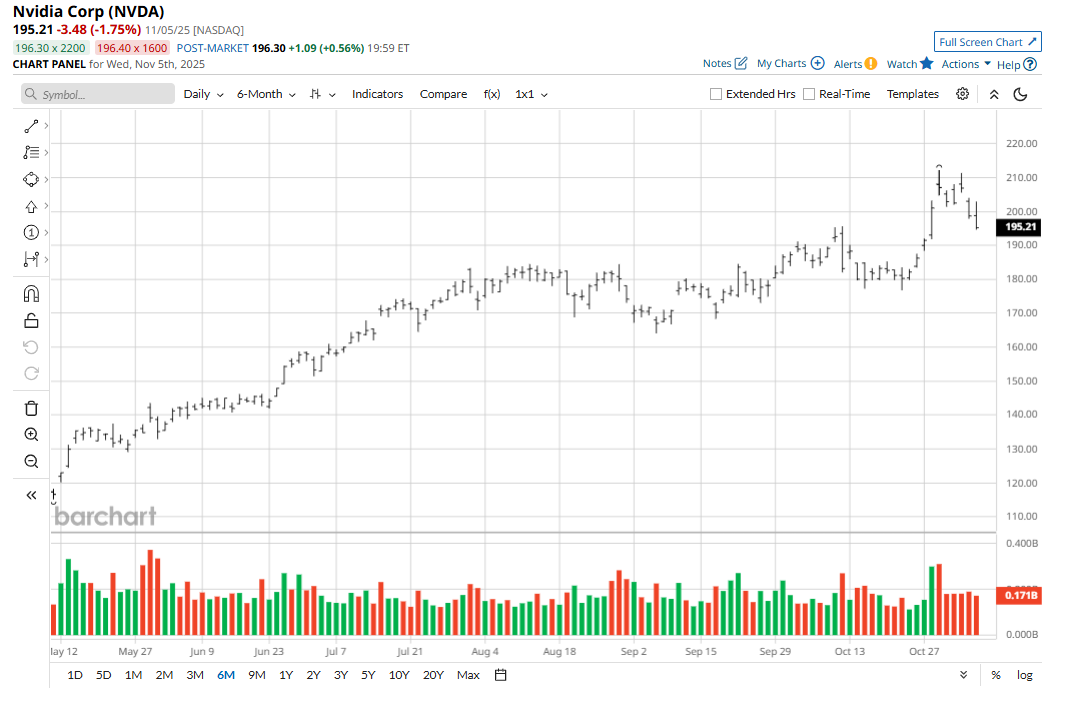

So far in 2025, NVDA stock has gained 48%, significantly outpacing the S&P 500 Index ($SPX). However, in the three months that ended on Nov. 3, the shares had advanced just 10.7%. Moreover, the company’s forward price-earnings ratio of 48 times is certainly not low, while its market capitalization is huge.

Trump’s Move on China Exports Could Be a Negative Catalyst for NVDA Stock

During the president’s interview with CBS’ 60 Minutes, he said, “We will let [China] deal with Nvidia but not in terms of the most advanced [chips]. The most advanced, we will not let anybody have them other than the United States.”

Last month, NVDA CEO Jensen Huang confirmed that Nvidia had already ceased selling its advanced AI accelerators to China in the wake of U.S. export controls. However, many investors might have retained some hope that Trump would ease those restrictions. Consequently, the Street’s enthusiasm for NVDA may wane in the coming weeks and months.

Perhaps the latter trend is already beginning, as the shares fell 5.7% in the five trading days that ended on Nov. 5.

And with several of Trump’s key advisors, including Secretary of State Marco Rubio, Commerce Secretary Howard Lutnick, and U.S. Trade Representative Jamieson Greer, backing his stand, the president is unlikely to reverse course.

Other Threats Facing NVDA Stock

The chipmaker is facing increased competition on many fronts. In 2026, another giant chip maker, Advanced Micro Devices (AMD), is due to launch new GPUs, known as the MI450 series, that are expected to provide meaningful competition for NVDA’s most advanced AI chips. And in a warning sign for NVDA, OpenAI has already agreed to utilize 6 gigawatts of AMD’s offerings over a number of years, with the deal due to kick off in the second half of 2026. AMD has estimated that its new offerings may produce $100 billion of revenue within several years.

Another major competitor is Broadcom (AVGO), whose revenue from AI chips now represents a majority of its semiconductor revenue. What’s more, AVGO announced a $10 billion deal, due to launch in 2026, for its custom AI chips, and it’s partnering with OpenAI on chip development.

And a number of NVDA’s other major companies, including Amazon (AMZN) and Meta, are developing their own AI chips.

An additional problem for Nvidia is Wall Street’s growing doubts about the size of the AI market and the sustainability of the valuations of AI stocks.

Key Takeaways

While Nvidia certainly has many positive catalysts, including the continued, strong growth of AI and its impressive customer base, the firm is facing multiple, powerful threats. Additionally, its valuation is certainly not low. Therefore, it may be a good idea to sell the shares and look for other names with better risk-reward ratios.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)