Target Corporation (TGT), headquartered in Minneapolis, Minnesota, is a top-tier American retailer operating nearly 2,000 stores nationwide. The company offers a diverse range of products, including groceries, clothing, home essentials, and electronics. The company has a market capitalization of $40.89 billion.

Target has been facing increased competition from mega-retailers and has undergone a leadership transition. This has put pressure on the company’s stock. Over the past 52 weeks, Target’s stock has declined 39.1%, while it is down 10.2% over the past three months. It had reached a 52-week low of $85.36 in October, but is up 7.7% from that level.

In contrast, the S&P 500 Index ($SPX) has gained 17.5% and 7.9% over the same periods, respectively, which reflects that the stock is underperforming the broader market. The nature of Target’s business classifies it as a consumer defensive stock. Comparing with the Consumer Staples Select Sector SPDR Fund (XLP), we see that, while the ETF is down 6.1% over the past 52 weeks and 5.6% over the past three months, it is still outperforming Target’s stock.

On Aug. 20, Target reported its second-quarter results for fiscal 2025 (the quarter that ended on Aug. 2). The company’s net sales dropped marginally year-over-year (YOY) to $25.21 billion. However, the topline figure surpassed the Wall Street analysts’ estimate of $24.91 billion. Its adjusted EPS also declined by 20.2% annually to $2.05, missing the consensus estimate of $2.09.

Last month, Target announced its plans to cut 1,800 corporate positions to streamline decision-making and try to rebuild its customer base. While the company attempts to regain lost ground, it continues to invest in technology to bolster its operations. Ahead of the holiday season, Target launched its accessible self-checkout, designed for guests with disabilities, across stores nationwide. It also partnered with Alloy.ai to strengthen its supply chain.

For the current fiscal year, which ends in January 2026, Wall Street analysts expect Target’s EPS to decline 16.3% YOY to $7.42 on a diluted basis. However, EPS is expected to increase 9.2% annually to $8.10 in the next fiscal year. The company has missed consensus EPS estimates in three of the four trailing quarters. For the third quarter (set to be reported on Nov. 19 before the market opens), its EPS is expected to drop by 3.8% YOY to $1.78.

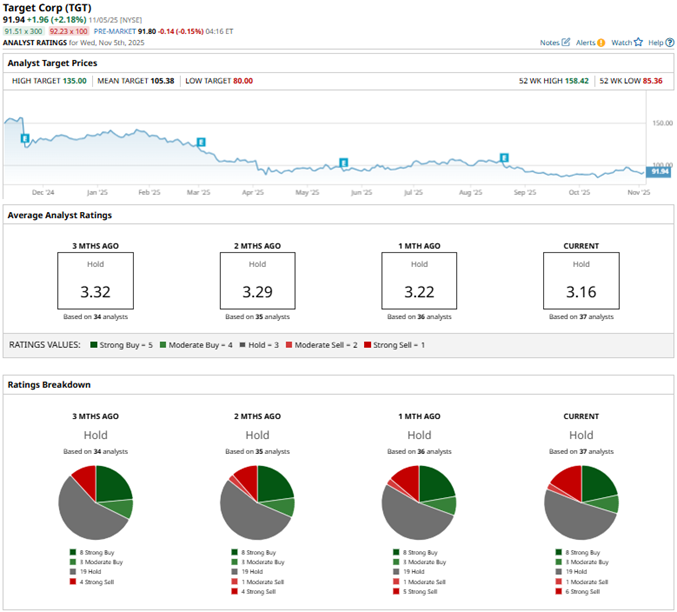

Among the 37 Wall Street analysts covering Target’s stock, the consensus is a “Hold.” That’s based on eight “Strong Buy” ratings, three “Moderate Buys,” 19 “Holds,” one “Moderate Sell,” and six “Strong Sells.” The ratings configuration is more bearish than it was a month ago, with six “Strong Sell” ratings now, up from five previously.

Last month, analysts at BTIG initiated coverage on Target’s stock with a cautious “Neutral” rating. While BTIG analysts recognized the company’s solid brand presence, they also see significant competitive pressures from other retailers, especially the mega names like Walmart, Costco, and Amazon.

Target’s mean price target of $105.38 indicates a 14.6% upside over current market prices. The Street-high price target of $135 implies a potential upside of 46.8%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)