/Snap-on%2C%20Inc_tool%20truck-by%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

With a market cap of $17.2 billion, Snap-on Incorporated (SNA) is a global leader in manufacturing and marketing tools, equipment, diagnostics, and systems solutions for professional users. The company serves diverse industries, including automotive repair, aviation, aerospace, government, military, construction, and power generation, through its franchise, direct, distributor, and online channels.

Shares of the Kenosha, Wisconsin-based company have outpaced the broader market over the past 52 weeks. SNA stock has soared 17.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.8%. However, shares of the company are down 3.3% on a YTD basis, lagging behind SPX’s 10.1% gain.

Focusing more closely, the tool and diagnostic equipment maker stock has underperformed the Industrial Select Sector SPDR Fund’s (XLI) 18.5% return over the past 52 weeks.

Snap-on shares climbed 7.9% on Jul. 17 after the company reported stronger-than-expected Q2 2025 EPS of $4.72. Revenue came in at $1.2 billion, above forecasts, driven by a 2% increase in the Tools Group and a 3% rise in the Repair Systems & Information Group, reflecting steady demand from auto parts companies and repair shops. Investors also responded positively to signs of resilience in the automotive aftermarket, where higher U.S. road travel and inflationary pressures encouraged consumers to keep older vehicles, boosting Snap-on’s core business.

For the fiscal year ending in December 2025, analysts expect SNA’s EPS to decline 2.7% year-over-year to $18.67. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

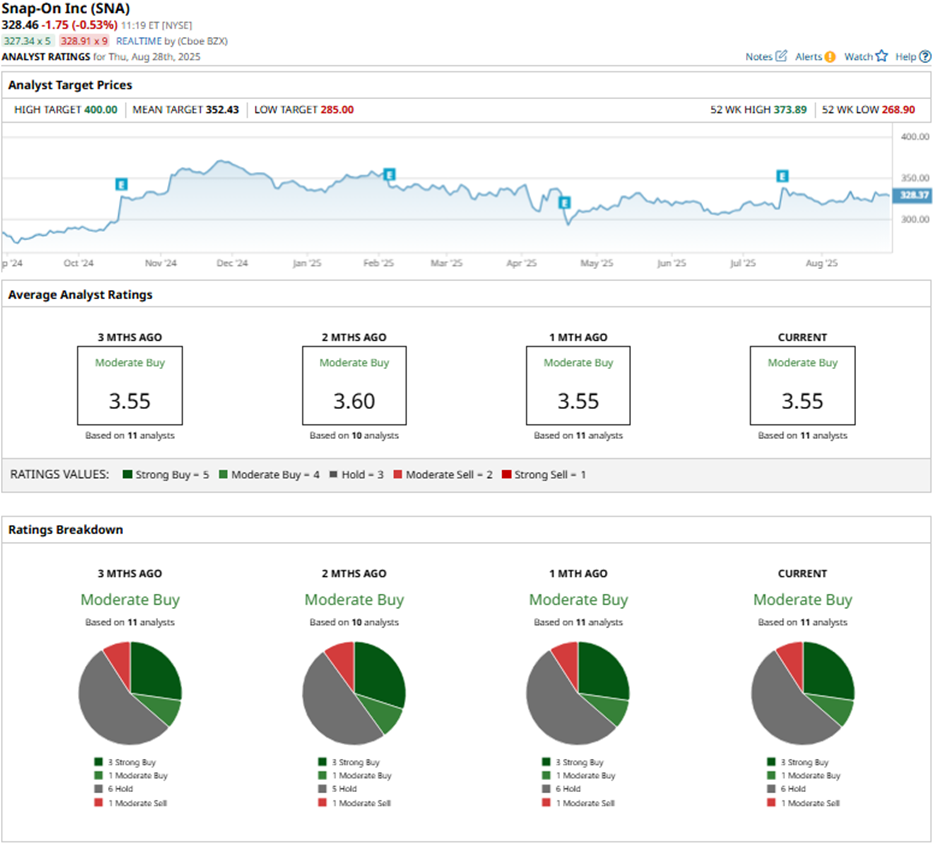

Among the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Moderate Sell.”

On Jul. 18, Baird raised its price target for Snap-on to $347 while keeping a “Neutral” rating.

The mean price target of $352.43 represents a 7.3% premium to SNA’s current price levels. The Street-high price target of $400 suggests a 21.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)