/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

The global artificial intelligence market is expected to grow from $260 billion in 2025 to over $1.2 trillion by 2030, a roughly fourfold jump as more companies adopt machine learning and natural language processing. With that AI spending ramping up, data analytics leader Palantir Technologies (PLTR) just posted what CEO Alex Karp called “indisputably the best results” he has seen in tech in the last decade.

The company reported fourth-quarter revenue of $1.407 billion, up 70% year-over-year (YoY), helped by 137% growth in its U.S. commercial segment. Adjusted operating income came in at $798 million, with a 57% margin, beating analyst estimates by nearly 14%. Those results pushed analysts to take a more positive view, with HSBC moving Palantir from “Hold” to “Buy” and raising its price target to $205, in line with other firms that have turned more constructive on the stock.

With shares up more than 11.5% in pre-market trading after the release, 2% in early morning trading, and Wall Street warming up to PLTR after years of lukewarm ratings, does the stock’s premium valuation still leave room for upside, or are investors paying too much for growth that’s already priced in? Let’s find out.

Inside Palantir’s Blowout Q4

Palantir Technologies sells enterprise software that helps organizations pull their data together and use AI in day-to-day work, mainly through products like Foundry and Gotham, with its AIP layer becoming a bigger part of the story.

In the market, the stock is up 21% over the past 52 weeks, even as it’s down 24% year-to-date (YTD), which shows how quickly sentiment can shift around this name.

The valuation is already steep. Palantir’s forward P/E is about 198.73x versus roughly 23.43x for the sector.

Still, Q4 2025 gave bulls plenty of hard data to lean on. Revenue jumped 70% year-over-year (YoY) to $1.407 billion, led by the U.S.: U.S. revenue rose 93% to $1.076 billion, with U.S. commercial up 137% to $507 million and U.S. government up 66% to $570 million. Deal activity also stayed strong: 180 deals above $1 million, 84 deals above $5 million, and 61 deals above $10 million.

Profitability stood out too: GAAP operating income was $575 million for a 41% margin, adjusted operating income was $798 million for a 57% margin, GAAP net income was $609 million for a 43% margin, and operating cash flow was $777 million for a 55% margin, with adjusted free cash flow of $791 million for a 56% margin. For full-year 2025, revenue grew 56% to $4.475 billion, with U.S. revenue up 75% to $3.320 billion, including U.S. commercial up 109% to $1.465 billion and U.S. government up 55% to $1.855 billion.

Can Palantir’s AI Engine Sustain This Growth?

Palantir’s growth story right now is closely tied to how much its AI platforms are being used in real, day-to-day work. Innodata being chosen to supply high-quality training data and data engineering for Palantir’s AI-powered rodeo modernization is a clear example: thousands of hours of rodeo video are being labeled so computer vision models can spot animals, riders, and skeleton joints, then automatically calculate and display performance metrics for bull riding, bronc riding, bareback riding, and barrel racing. It is detailed, industry-specific work that can make Palantir’s software tougher to replace once customers rely on it.

On the industrial side, HD Hyundai’s expanded, group-wide partnership shows what broader rollout looks like. Foundry and AIP are now being used across HD Hyundai Oilbank, shipbuilding, and construction equipment, acting as the orchestration layer for connected refinery projects, “Future of Shipyard” initiatives, and construction equipment development. The partnership has already produced tangible results in refinery operations, crude oil selection, predictive maintenance, and sensor data analysis, which is the kind of measurable payoff large customers typically want before they commit to bigger and longer contracts.

The Accenture Palantir Business Group pushes that same idea into global enterprise work. Accenture is now a preferred global partner and is bringing more than 2,000 Palantir-skilled professionals, alongside dedicated forward-deployed engineers from Palantir and Accenture FDEs, to help clients move from siloed data to integrated, AI-powered decision-making. With momentum already across government, energy, and oil and gas, the partnership is also targeting healthcare, telecommunications, manufacturing, consumer goods, and financial services, expanding Palantir’s reach without Palantir having to build all of that enterprise delivery capacity on its own.

What the Pros See Ahead for PLTR Stock

Management expects Q1 2026 revenue of $1.532 to $1.536 billion, and for full-year 2026, it’s guiding to $7.182 to $7.198 billion. On earnings, the average estimate is $0.18 for the current quarter, $0.17 for the next quarter, and $0.84 for fiscal 2026. Those stack up against prior-year figures of $0.04, $0.13, and $0.63, respectively, which work out to estimated YoY growth rates of 350%, 30.77%, and 33.33%.

Citigroup’s Tyler Radke upgraded PLTR stock from “Hold” to “Strong Buy” on Jan. 12, raised his price target to $235, and then lifted it again to $260 after the Q4 report. He’s basically betting on a “supercycle” of demand that runs through both commercial and government customers, which lines up with the same post-Q4 optimism that also had HSBC raising its own target.

Truist’s Arvind Ramnani started coverage in January 2026 with a “Buy” rating and a $223 target, arguing Palantir’s scale, operating discipline, and key role in AI adoption can justify the stock even with valuation concerns. He also noted Palantir has outpaced many software peers, pointing to U.S. government revenue rising 50% YoY for two straight quarters and commercial growth accelerating to 73%.

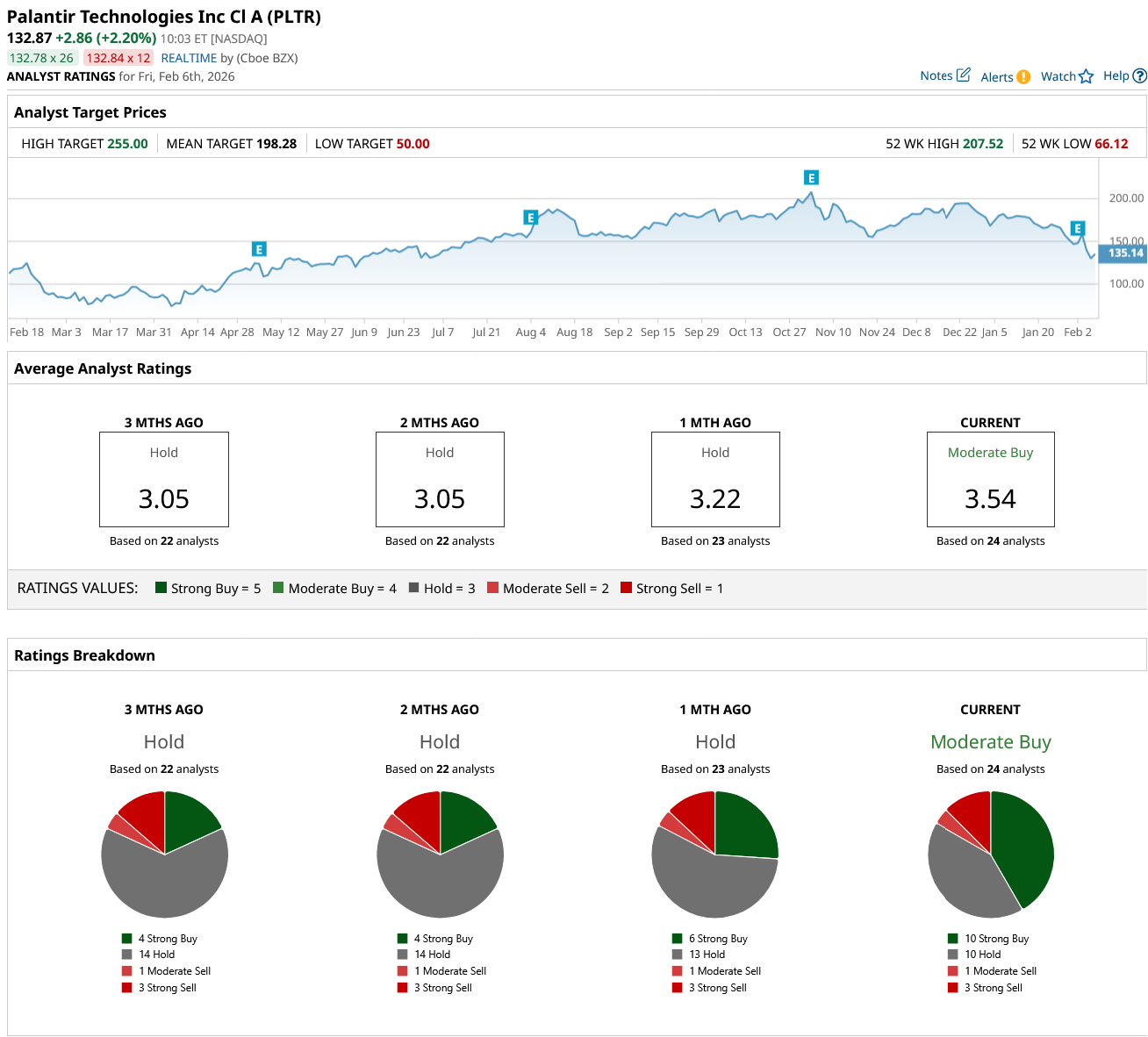

Zooming out, all 24 analysts surveyed rate PLTR stock a consensus “Moderate Buy,” with a mean price target of $198.28, which implies about 49% upside from the current $132.87.

Conclusion

Palantir’s Q4 has clearly pulled Wall Street off the fence, but “is it a buy here?” really comes down to your tolerance for paying up for growth. The company is executing at a level that justifies renewed enthusiasm, and between the guidance, the AI deal pipeline, and a 51% implied upside from the Street’s mean target, odds favor the stock grinding higher over the next 12 to 18 months rather than meaningfully resetting lower. That said, the current multiple bakes in a lot of that promise already, so from here, pullbacks and consolidation phases look more likely than a straight line up, making PLTR better suited for growth investors who can sit through volatility than for valuation purists hunting for a cheap entry.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)