/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Palantir’s (PLTR) fourth-quarter earnings report may have marked a turning point for the stock after several months of underperformance. The company delivered stronger-than-expected financial results and offered an optimistic outlook, boosting investor confidence. Following the release, Palantir shares surged more than 11.5% in pre-market trading, reflecting the market’s positive reaction.

One of the most notable takeaways from the quarter was the continued acceleration in revenue growth. Palantir posted the largest quarterly revenue increase since going public, highlighting strong demand across its business. At the same time, the company also delivered strong profitability, showing that its rapid expansion is being matched with improving margins.

The key growth catalyst behind its soaring revenue and expanding profit margins is the heightened demand for its Artificial Intelligence Platform (AIP). As AIP continues to drive existing customer expansions and help acquire new customers, Palantir remains well-positioned to deliver solid growth in 2026, which could support its share price.

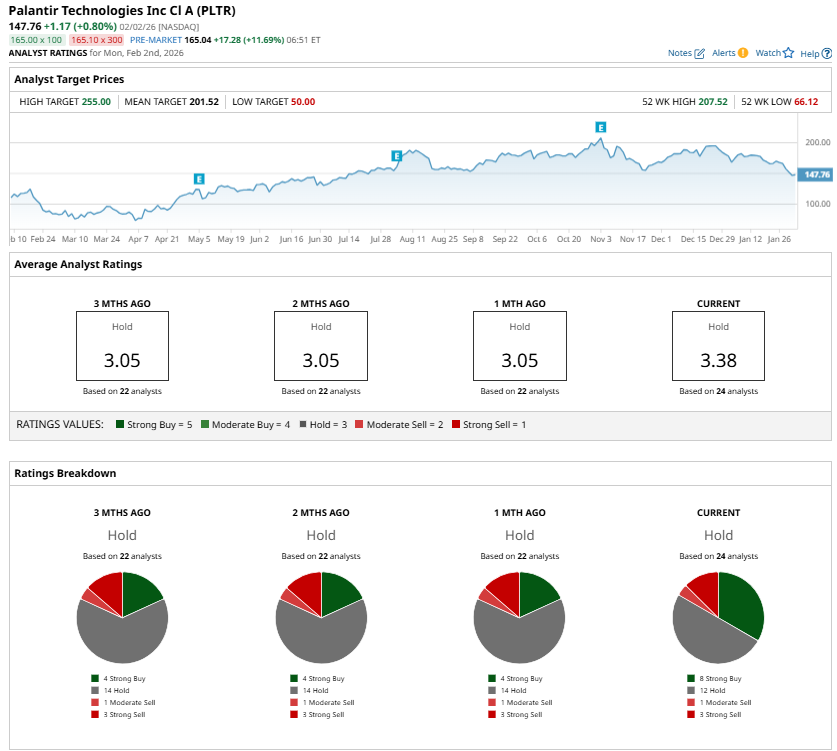

Thanks to solid momentum in its business, at least one Wall Street analyst expects PLTR stock to hit $255 in 2026, the highest price target on the Street. Based on Palantir’s recent closing price of $147.76, reaching that target would represent an upside potential of about 73%.

Palantir’s Revenue and Profitability to Soar in 2026

Palantir’s growth trajectory shows no sign of slowing, supported by surging demand across its core U.S. business and accelerating adoption of its AIP.

In the fourth quarter, Palantir’s overall revenue surged 70% year-over-year (YoY), driven by the strength of its U.S. operations. The U.S. business is the company’s dominant growth engine, accounting for 77% of total revenue. That segment expanded 93% YoY and 22% sequentially, marking a major milestone as Palantir surpassed $1 billion in quarterly U.S. revenue for the first time.

Palantir’s U.S. commercial business has been especially impressive, growing 137% YoY in the fourth quarter, while sequential growth reached 28%. Meanwhile, U.S. government business continued its steady expansion, posting 66% YoY growth and a 17% sequential increase.

Beyond revenue acceleration, profitability has expanded significantly. In the fourth quarter, Palantir generated $798 million in adjusted operating income, translating into a 57% operating margin, up from 45% a year earlier. For the full year 2025, adjusted operating income reached $2.3 billion, representing a robust 50% margin and an expansion of 1,100 basis points compared with 2024.

Palantir’s bookings momentum strengthens its growth outlook for 2026. Palantir ended 2025 with its highest-ever quarterly total contract value (TCV) bookings of $4.3 billion, up 138% YoY. Customer growth also remained strong, with total customers rising 34% to 954. Importantly, the company continues to generate more revenue from its largest clients, as trailing 12-month revenue per top-20 customer climbed 45% to $94 million.

Looking ahead, the U.S. commercial segment will support growth in 2026. During 2025, Palantir closed $4.3 billion in U.S. commercial TCV bookings, representing a 161% increase from the prior year and reflecting accelerating demand for AI production use cases. Remaining deal value in this segment surged 145% YoY, while the commercial customer base expanded to 571 clients, up 49% annually.

Management’s guidance reflects confidence in this momentum, projecting U.S. commercial revenue exceeding $3.144 billion in 2026, implying growth of at least 115%.

International operations also provide additional upside. In the fourth quarter, Palantir secured several major long-term renewals with established international customers, supporting growth in remaining performance obligations and adding stability to future revenue streams.

Overall, Palantir delivered 56% revenue growth in 2025, and management is forecasting another strong year ahead. At the midpoint, 2026 revenue guidance stands at $7.19 billion, representing 61% YoY growth despite increasingly challenging comparisons. With profitability and cash flow already scaling rapidly, Palantir enters 2026 with both financial strength and significant momentum in the AI-driven enterprise market.

Will PLTR Stock Hit $255 in 2026?

Palantir is executing well, as reflected in its accelerating top-line growth and expanding margins. Looking ahead, its AIP will continue to attract more customers while also increasing the size and value of new contracts. Moreover, Palantir's shares have recently slumped, easing concerns that the stock was becoming too expensive.

Despite these positives, Wall Street analysts still maintain a “Hold” consensus rating on PLTR stock, reflecting a more cautious outlook. However, if Palantir can sustain impressive growth and continue to improve profitability, investor confidence could strengthen significantly. In that scenario, the stock could hit $255.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)