/Hubbell%20Inc_%20site%20magnified%20-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $27.8 billion, Shelton, Connecticut-based Hubbell Incorporated (HUBB) is a prominent industrial manufacturer specializing in electrical and utility infrastructure components used across power grids, industrial facilities, and commercial construction. Through its Utility Solutions and Electrical Solutions segments, the company produces mission-critical products, including insulators, connectors, wiring devices, grounding equipment, and harsh-environment enclosures, that support electricity transmission, distribution, and connectivity.

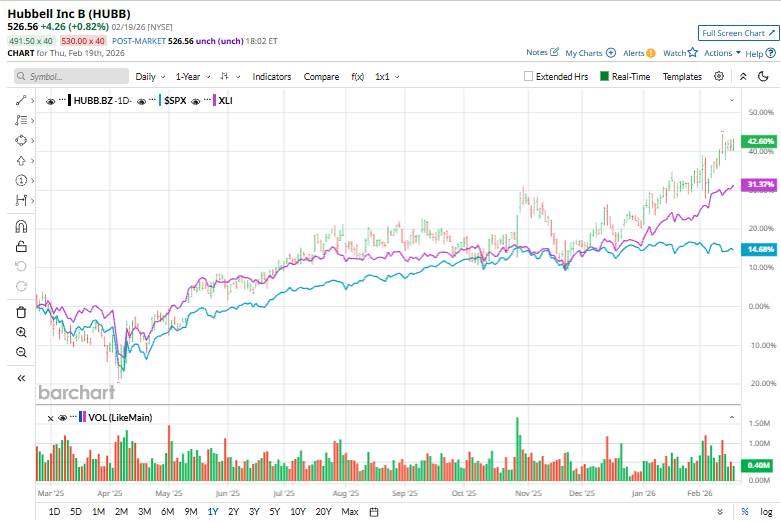

Shares of the company have outpaced the broader market over the past 52 weeks. HUBB stock has surged 34.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.7%. In addition, shares of HUBB are up 18.6% on a YTD basis, compared to SPX’s marginal gain over the same period.

Focusing more closely, shares of the electrical products manufacturer have outperformed the State Street Industrial Select Sector SPDR Fund’s (XLI) 27.1% return over the past 52 weeks and 13.7% rally in 2026.

On Feb. 3, HUBB shares rose 1.7% after the company released its fiscal 2025 fourth-quarter earnings. It posted a revenue growth of 12% year over year to $1.49 billion and an adjusted EPS rise of 15% to $4.73, both slightly ahead of expectations. Growth was broad-based across segments, with Utility Solutions sales up 10% and Electrical Solutions up 14%, driven mainly by organic demand for grid and infrastructure products. Profitability also improved, as adjusted operating profit increased 19% and margins expanded. Management highlighted solid order trends and issued a confident 2026 outlook for continued mid-single-digit organic growth and further earnings gains, reinforcing momentum in electrification and utility-spending end markets.

For the fiscal year ending in December 2026, analysts expect HUBB’s adjusted EPS to grow 8.7% year-over-year to $19.79. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

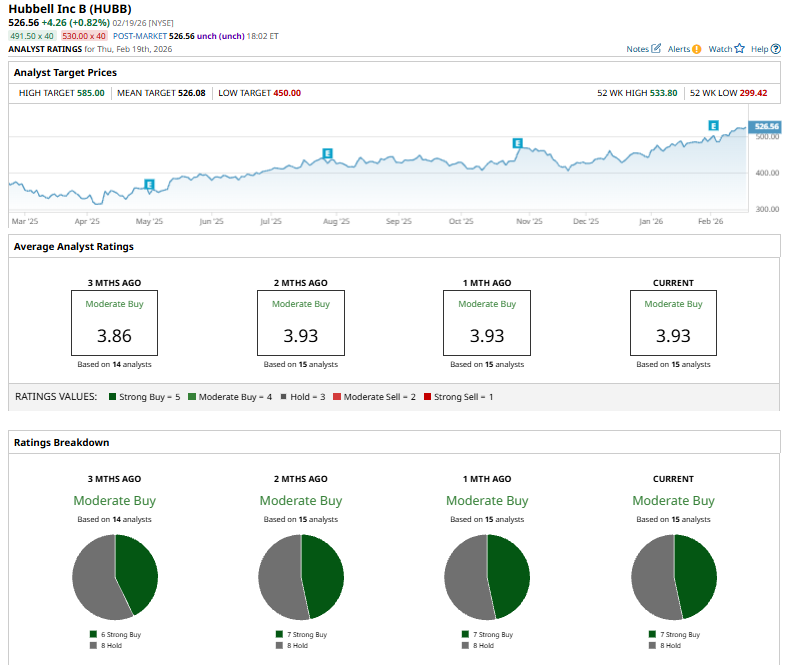

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings and eight “Holds.”

This configuration is slightly bullish than three months ago, with six “Strong Buy” ratings on the stock.

On Feb. 4, JPMorgan analyst Stephen Tusa struck a more constructive tone on Hubbell, lifting his price target to $532 from $478, an 11% bump, while keeping a “Neutral” rating on the shares. The upward revision signals growing confidence in Hubbell’s earnings trajectory and end-market strength.

While the stock currently trades above mean price target of $526.08, the Street-high price target of $585 suggests a 11.1% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)