AppLovin (APP) is down 13% this afternoon, and the biggest decliner on the Nasdaq-100 Index ($IUXX), as traders are extremely disappointed by the late-Friday news that the stock won’t be added to the S&P 500 Index ($SPX) as part of the latest index rebalancing.

That said, with the shares now down by nearly 18% from their 52-week high, now may be an opportune time to consider buying the dip in APP, with the company’s AI-powered platform and efforts to diversify its audience base seen as key drivers for its future growth prospects.

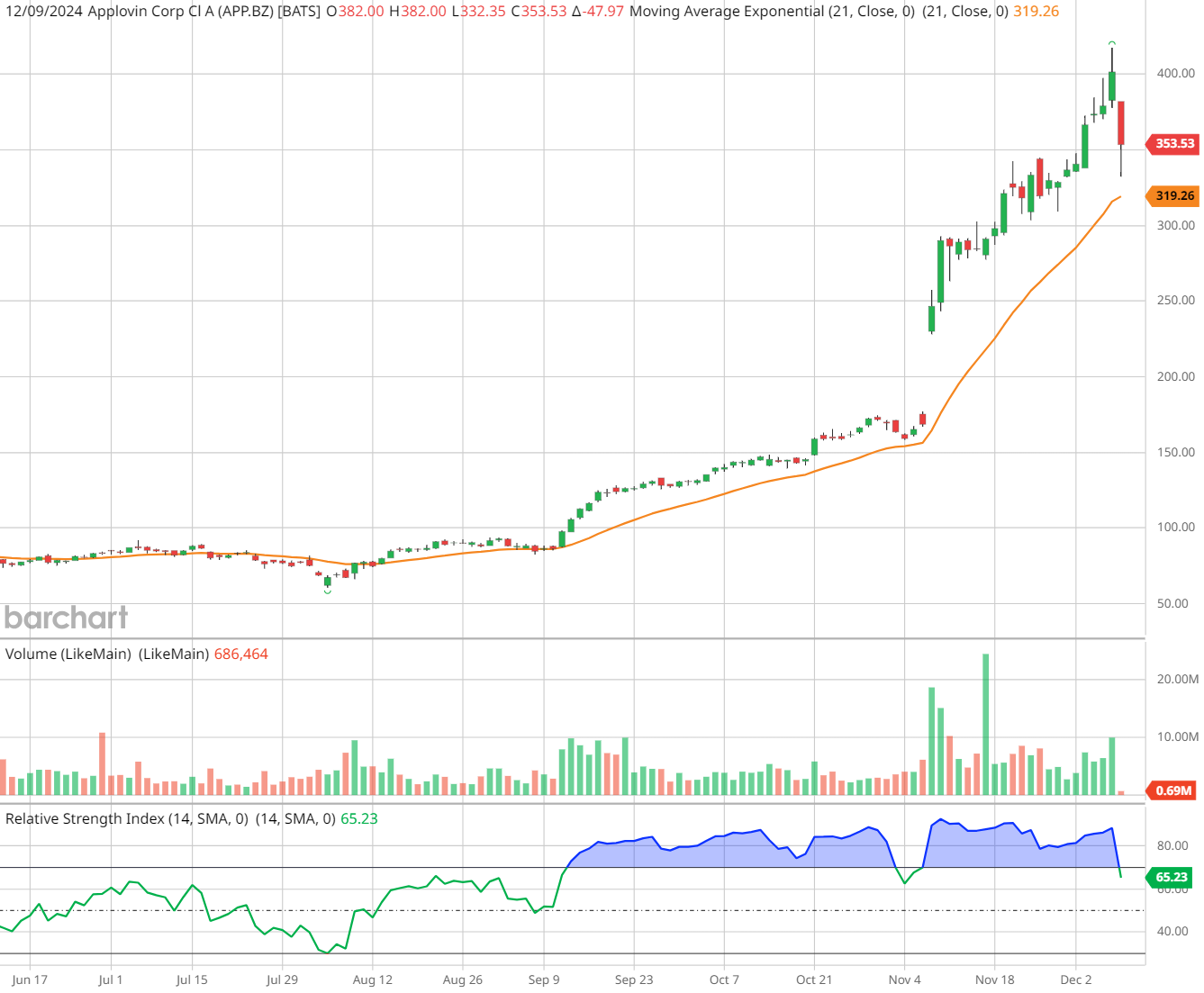

The shares are also working their way out of a short-term overbought status, with the 14-day Relative Strength Index (RSI) now below 70 - though APP still trades well above its 21-day exponential moving average (EMA).

And despite the perceived S&P 500 setback, APP has demonstrated a strong fundamental performance, with impressive revenue and earnings beats, and has provided optimistic guidance for future growth.

Taking a broader view, APP stock has surged by 759.5% year-to-date, supported by the company’s strategic diversification beyond gaming. The share price outperformance has been driven by AppLovin's successful expansion into e-commerce advertising and its ability to leverage data from its mediation platform.

Analysts remain confident in AppLovin's strategic positioning, with several firms recently raising their price targets, reflecting optimism about its potential in the digital advertising sector. The stock is rated “Moderate Buy” overall, and at $353.48, trades at a premium to its average 12-month price target of $272.08. However, the Street-high price target of $480 indicates that APP stock could rise another 35.4% from current levels.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)